The Weekly Call provides perspective on high quality setups and trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. This week we have exited Gold for now and manage our trades in Coffee and Wheat and plan to enter Oil and Cocoa.

Our track record is now posted below under Completed Trades. See some of our completed trade videos below.

Follow along during the week on twitter by following HERE.

30 day FREE trial now offered for Trader Triple Play – Click Here

Gold Trade – Managing the Long

1-1 – Per the Daily Update, we recognized a small day trade long from the weekly pivot last week into the 1165 area. Resistance here and a backtest into the 50 back area, 1143 inflection area, is a setup for a long into the 1180 area. Break below 1138 and a new low is likely. This is not yet the setup for the larger long we are hunting as there is still downside risk to 1111-1105. We are still waiting on the US Dollar to make a new high to confirm a turn.

1-8 – The setup at the inflection area has worked and we tweeted out last week to exit 1/3 of a position at the 50% back area and another 2/3s at the three up at 81s. So far we have a profit of 22 handles. At this point with stops at even, we wait on the backtest to resolve. We are looking to add to our position with support at weekly pivot at 68 if support is demonstrated or if broken at 55’s. We are expecting 1232’s if 55’s remain support. A break and conversion of 1200 confirms the low is in.

1-15 – We have not been able to reload long as there has not been a pull back of any significance yet. So far we are up over 55 handles and recommend that you have a small trailer long remaining. Last week we mentioned on the Daily Update to watch 1210 for resistance which is playing out. We are looking to add back to our position after support is seen at 77s or 65s. A break of 55’s invalidates this trade and invites a full retest. Higher prices still expected into 1232s. a break and conversion of 1200 confirms the low is in.

1-22 – We have not seen enough of a backtest yet to consider adding more to our position. Still possible to see 1193s. Still holding 1/3 long and waiting for target 1231s. If seen with neg D we will punch out long and wait on the backtest to re-enter.

1-29 – We have seen a backtest in a three wave move into the 78 area – weekly pivot will make a decision on Monday – if resistance we see another legg lower to 71s. If weekly pivot is converted to support we see 1245 or so by 2/20. The low window ends by 2/2, We are happy to hold our 1/3 position long for now.

2-5 – Still holding 1/3 of a position and are up over $75 from our entry. We are looking to take profits at the end of this impulse. We are looking for a new high into the high timing window.

2-8 – We tweeted out an exit of our last 1/3 in Gold on Wednesday. This concludes the trade and we exit with over $14,000 in profit. We expect another long entry sometime in early March. Follow along during the week on twitter by following HERE.

Cocoa – Finding the Turn

We were hunting an 18 month cycle low in Cocoa – this is a very volatile commodity and we suggest trading this only if you are experienced in commodities and risk management. There is a likelihood that this low can be the beginning of a change in trend for this commodity.

11-20 – On the Daily chart we have hit our target area of 2383 and expect to find support. There is still downside risk to 2231. We recommend initiating a position on a higher low and expect to take 1/3 off our position at 2531 and set our stop to even. If we are stopped out below the current low we will look to re-enter at a higher low closer to 2231. The cycle low window ends on 11/23.

11-27 – We are still hunting the low and are currently long with a stop below the low. Waiting on 2531 to take off 1/3 and place out stop at even. There is still downside risk to the trendline. If seen, we will be stopped out and will reenter at the trendline below.

12-5 – Nothing has changed, we are still currently long with a stop below the low. Waiting on 2531 to take off 1/3 and place out stop at even. There is still downside risk to the trendline. If seen, we will be stopped out and will reenter at the trendline below. Timing cycles look positive.

12-11 – We were stopped out of our previous trade below the low and have already re-entered the trade at the trendline as mentioned last week. Timing cycles on the cycle chart below look very positive and we are staying the course on the cycle low. Our stop is below the current low.

12-18 – We tweeted on 12/14 to exit the first 1/3 of the long since we were 50% back the first swing while placing stops at even. At this point in the trade, we wait and see what happens at the current higher low. If we are stopped out we will wait for the next long setup. We can see three up to 2368 if we make the turn. This is an inflection point, the next two trading days will decide if this setup worked as planned.

12-25 – Nothing has changed and we are waiting patiently with 1/3 of the trade in profit with our stop to even. Timing cycles are still on our side.

1-1 – We have been stopped out at even with 1/3 of our trade in profit. We are expecting a lower low and a reversal pattern in the next 7 trading days. We expect another setup and a turn between now and 1-12. Watch for a new low and reversal pattern in the 2060-2080 area.

1-8, 1-15 and 1/22 – We are waiting patiently on a better setup which may occur by the end of January. An entry at 2096 or 2073 on positive divergence is a possibility this week or early next week.

1/29 – We have achieved our first target area at 2096 and suggest an entry here with a potential add in the 2073 area. No reversal pattern yet but the low window is ending by 2/2. Take your first 1/3 at 2165 and set your stop to even for a free position.

2/5-2/12 – We entered per the instructions above and took our first 1/3 at the 50 back per our twitter update. We did get stopped out of the remainder of our position on a new low. We are waiting on a reversal pattern and expect to see it in the next week.

Wheat – Found the turn, Managing the Long

We have been tracking Wheat patiently waiting for a reversal pattern. It may arrive this week before 2/7 according to our timing cycles.

1-29 Wheat has been in a downtrend since March of 2008. On the Weekly chart the falling wedge has a chance to break up this year. We have divergence on the weekly and the daily charts. The daily chart has a low window that ends on 2/7 and likely a higher low would form and inverted head and shoulders pattern. On the 4 hour chart, watch for an entry 415 to monthly pivot at 407. Convert monthly pivot into support and we open 475 in the next 3-4 weeks. Take your first 1/3 at 50 back of the last swing and set your stop to even for a free position.

2-5 – We entered per the instructions above at 415 and have taken 1/3 off at the 50 back and our stop is now at even for a no risk position. We will now wait to see if we advance per the chart below to a three up to the 457 area.

2-12 – We are waiting on 457 as the first three up. We expect a 50% back test then a break of the trend line. Cycles show a high window in April. We are holding 2/3s of a position with our stop at even.

Oil – Waiting on the Setup

We have been trading oil short and believe that cycles are now showing a road higher later this week / early next week. This week timing wise shows a turn around 2/7. We have two entries, $51 and $49.21. We will adjust on twitter as we come closer to target. We will be watching for Positive Divergence on a 1 hour basis.

2-5 & 2/12 – So far the setup has not presented itself.

Coffee – Managing the Long.

Another Coffee trade is presenting itself. We are in the low window and have risk to 141.35 and expect an entry this week. We are looking for two different types of entries. First a move to 141.35ish and then a higher low. Either is a good entry depending on your tolerance for risk. The second entry is a conversion of monthly pivot to support at 146.95. Either will work so we will be watching for an entry. Follow along on twitter here to see our entry.

2-12 – We tweeted out the entry last week on Thursday and have taken profit on the first 1/3 of our trade. Our stop is now at even. We are looking for support in the 146.50-147 area and expect to break monthly pivot at 149.30. Cycles are bulling through the end of February.

Have a GREAT trading week!!!

COMPLETED TRADES

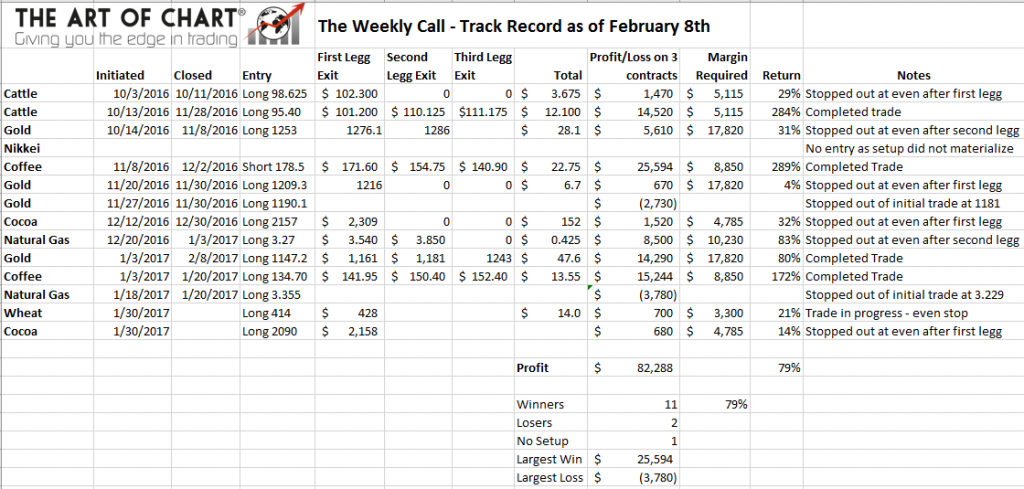

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a three contract position size. See the videos below for more information.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in Live Cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in Coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with Natural Gas, we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the Coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the Gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter Gold in a few weeks after a back test.

12th Feb 2017

12th Feb 2017