The Weekly Call provides perspective on high-quality setups and trading strategies focused in the Commodity world.. My current performance shows a 430% return since October 2016. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach.

An economic debacle is underway as COVID continues to spread with record daily infections from around the country. The RT.LIVE site that I track is showing a climbing rate of infection for almost all states in the US. With a vaccine announced, I believe a lot of good news is already baked into the indexes and various sectors. Economic activity will fall off in the coming weeks as the virus continues to spread. Without a stimulus, chances are there will be more defaults and small business closures. A stimulus will come next year, and with it continuation lower for the USD and higher prices for commodities in general. Keep an eye on claims and unemployment as these numbers will be impacted by Corona. The election legal challenges and other rhetoric will continue. There is more intentional mis-information on the internet that ever before. Be careful with fact-less garbage which is everywhere. Where are the consequences for the intentional misuse of the internet with intent to do harm? This will continue into the end of this year. The virus and economic activity should be our main concern as the presidential election side show will continue to play out in the background. The USD has hit 94.30 as expected and lower lows have played out. Gold is a buy on pull backs and so are Coffee and Cocoa. Better demand in 2021 for Cocoa; this has big upside potential. Sugar should get hit hard in the next few weeks as there is big production from Brazil, 13.50 is expected. China still in a growth mode and this should continue into next year. Watch for a low in Copper around 2.90 and then a big rally into $3.50+. My track record is posted below under Completed Trades. I have modified the track record to reflect 8 lot trades using the information in this Blog assuming $25,000 per lot as the current portfolio is over $200,000. See some of my completed trade videos below.

The Weekly Call can now be auto-traded on Striker.com. Just call Striker Securities and open an account of at least $25,000 and every trade I make here will be made for you automatically there. I am planning to use the same methodology and risk management approach with the auto-traded account at Striker that I have been using here. If you have a Daily Update or Trader Triple Play membership, there is no subscription fee for the auto-traded account at Striker. For more information, call Striker.com and speak with William at (800) 669-8838. For more information, you can also watch this video from our subscriber Q&A HERE.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

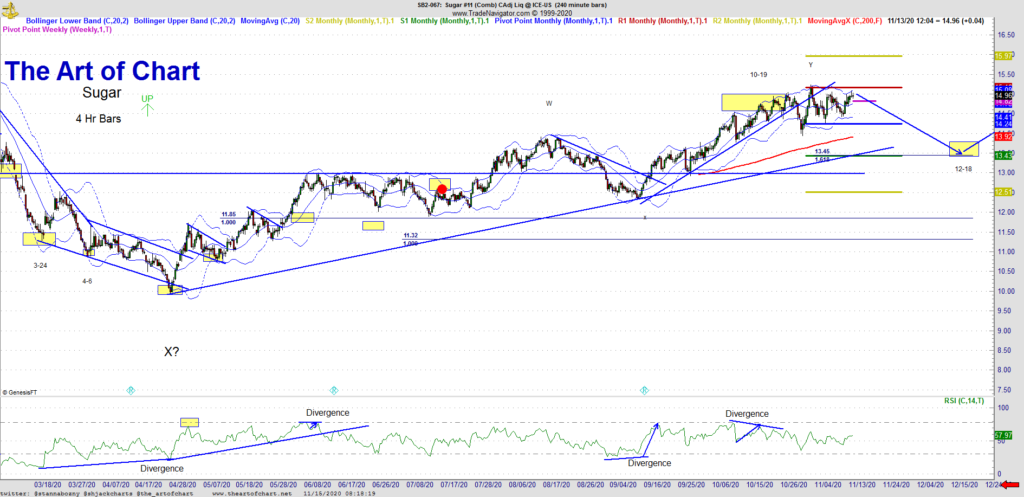

Sugar

7-5 – Sugar made target and has reversed and likely will see $13 next. Looking for this in the next 5-6 trading days. We will see the monthly pivot tested once we have target. After this consolidation, looking for $15 next.

7-12 – Sugar now testing the monthly pivot and the support trend line. It needs a bullish day to follow through and push for $13. Brazil sugar production is up, ethanol production is down which makes for weak price action.

7-19 – Weak price action did develop last week and we have a larger three down into the 100% fib. Likely we should see a retest of the low and a lower low to set up positive

D on RSI. Looking for the next rally into $15 by October.

7-26 – Movement lower last week as expected, still looking for a lower low and a positive D setup on RSI. Still expecting $15 into October. Welcome to the summertime tape.

8-2 – Confirmation of the break out to the upside. Looking for a support test this week, likely the top of W and monthly pivot. Trend line must hold here for the trip up to $15 by October.

8-9 – Nice upside move as expected, looking for trend line support at monthly pivot and higher highs into $15.

8-16 – We are approaching the weekly trend line in Sugar. Once we cross, expect more of a squeeze to the upside. For now a pullback and higher high may get us there. $15 price target is still valid into October.

8-23 – Still expecting the rally in SB, for now pull back as expected into 12.40 or so and next step higher into October and $15 still expected.

8-30 – Nice retracement and close to the support trend line. Looking for the next impulse higher to begin this week. Still targeting $15. Steady as she goes….

9-6 – A break below the trend line and a sign that wave W is in. Likely next course of action is a reversal and higher into $15. RSI is washed out and I need to see 12.50 convert into support to confirm the move higher.

9-13 – Trend line break a clear sign that W is in and now a reversal pattern. Still expecting a rally into $15 and this week we have a setup. We could see a marginal lower low for a stronger setup also. Either way I like Sugar long here.

9-20 – Looks like a break up in Sugar, looking for the $15 target as discussed. Sugar has a lot of ground to cover by the 5th of October, looking for a higher high by then and a negative divergence setup on RSI.

9-26 – Sugar may see a small retest this week and then an expansion higher. A lot depends on the USD here and the dollar is at an inflection point and should turn lower. I am expecting 14.50-15.00 in Sugar in early October, the bull need to perform here. Support trend line must hold.

10-3 – Sugar should continue to rally into the 10-19 window. Still expecting 14.50-15.00 as target. Support trend line must hold and again looking for USD to continue lower which will help commodities.

10-10 – The Sugar rally is coming close to completion. We still have another week of higher prices and I expect to see a negative D setup in the 14.50-15.00 area. As long as the USD continues to be devalued we should continue to see Sugar rally after a retest post October 19th.

10-18 – Great call on Sugar and we should see the new high this week and a strong reversal. Don’t wait around long after the higher high. Trim your position down to just a trailer.

10-25 – Reversal is unconfirmed but looks to be playing out. Watch for a trend line break this week and lower prices. Sugar should reach $13 as target on the pull back. Neg D on RSI is in place.

11-1 – First legg lower appears complete. Looking for a 5-3-5 structure and lower prices to 13.50. USD in a correction also and once it finishes we should see Sugar rally.

11-8 – A large B wave has played out last week and ow I am expecting a 5 down structure into 13.5ish. Watch for the monthly pivot to break to confirm lower lows.

11-15 – Still looking lower and a 5 down for a wave C is expected into Mid-December. Target for the move is still 13.50 and I am waiting patiently. Consolidation can be a triangle but at this point I still see RSI as a wave B.

Coffee

7-5 – Coffee has turned up directly, and we are on the way to $115s. First step is to retest the monthly pivot and it needs to hold. Any break down and we can make a new low. We should see the retest complete this week.

7-12 – Monthly pivot did not hold last week which means we are now seeking a lower low. This will be a stronger setup when seen with positive D on RSI. We should see $93.xx print.

7-19 – Rally on Friday and a three up which could be wave C of a triangle. I am still leaning lower in Coffee and looking for a lower low to set up a long play. This invalidated on a break of the monthly R1.

7-26 – Invalidation with a break of the R1 and we are now in a retracement pattern higher. Looking into August for the high as we need to set up negative D on RSI, once seen, a lower low into Mid-Sept. is expected.

8-2 – Coffee still has another legg up to complete the pattern. Needs a pull back and higher to set up negative D on RSI. Once seen, the lean is lower to retest the low. We can see $95 again.

8-9 – Coffee has reversed, look for a print in the 100-105 and then move to higher highs. Recovery in Brazil and devaluation of the USD should push this commodity higher.

8-16 – Lower lows expected at least into 107 and we can also see 100 before it is all said and done. Coffee should see wave C to 107 this week.

8-23 – The bear flag is likely going to break down and see lower prices. 107 still the focus as next support. I am waiting for a nice long setup as commodities are bullish with the devaluation of the USD.

8-30 – Still tracing the bear flag and Coffee given the crop size and supply is over priced. Looking for a break of the support trend line and lower into 107 by end of September.

9-6 – Coffee is topping out here and a very nice short is setting up. Look for the reversal this week and a minimum retrace into 115. Price is way extended and negative D on RSI is fully set up.

9-13 – It is likely that the turn is in for Coffee. A pull back is needed here into 115-177 or so before the next legg up. Given the devaluation of the USD, I am expecting more devaluation in the future and higher prices in commodities. Look for quality setups Long, this is not ready yet.

9-20 – Target Made on Coffee. Lower low here sets up the next long, turn is setting up. This is a retracement wave and with the devaluation of the Dollar, watch Coffee make new highs into November.

9-27 – As mentioned target made on coffee and looking for a reversal. Likely we see a higher low or a lower low on the next move sown to set up the turn. Convert 115 and we open 145 next. Watch the Real for clues this week with this reversal.

10-3 – Rally has not confirmed yet but likely will on Monday. Looking for the 10-14 window and a retest of the low. It appears to me that 11-2 is the likely low window for Coffee. We will see how it plays out, but resistance at monthly pivot should play out lower.

10-10 – Rally in Coffee is not confirmed and is likely a retracement wave, looking for resistance at 117 or so this week and then a retest of the low. On the retest watch for a possible higher low at 108ish, a lot depends on USD and continued stimulus which will continue to devalue the Dollar.

10-18 – Coffee broke down early and the flag means that we see a lower low into the end of this month. A big rally is coming, watch for the reversal in the next few weeks.

10-25 – Coffee continued lower and now has RSI pos D setup for a rally. I am still leaning lower into 11-02 window and expect a reversal on the next lower low. 102 is the target, waiting on the setup.

11-1 – Coffee about to make a lower low and setup positive D on RSI. Once seen, I am looking for a rally into January. Weekly pivot is currently resistance until proven otherwise.

11-8 – Coffee may have reversed and the tell will be the higher low at around 103.20. Support found there look for a conversion of monthly pivot and higher prices with the next high window in late January.

11-15 – Coffee has turned and we are in buy the dips mode. Look for a retest and a move higher through late January. Support at 108.00 and likely a inverted right shoulder coming this week.

Live Cattle

6-28 – With the spread of COVID, if there is a plant shutdown, we should see price collapse here. Be aware of the risk here. My bias is still higher as we need to convert monthly pivot to see the 105 area next. The lean is still higher.

7-5 – Breaking up and looks like we are heading into the next high window of 8-9. I adjust my timing cycles after a sideways consolidation like what we have seen. It tends to move cycles out, so next high early August is expected – resistance 109 then 115.

7-12 – Follow through this week and no change in forecast…. Looking for 109 target then 115. The support trend line must hold.

7-19 – Follow through this week and steady as she goes. Looking for the 110-112 area next – the support trend line must hold into the next cycle high window into August.

7-26 – Watch for the support trend line to hold, if it does, we see 110-111 into early August. This will end a 5 wave sequence and I am expecting a decent retrace then higher into September.

8-2 – A higher high and a negative D setup on RSI which can still go higher. I am expecting a 110-111 target in about a week. This will end the first sequence up and then a retest is in order before the next rally into the 120s.

8-9 – Still needs a higher high and I am waiting for the final legg with a trailer. We have neg D in place in RSI and a retest is coming. My bias is higher high first then pull back then $120. We could see the pull back directly.

8-16 – Live Cattle is topping out in a 5th wave. Negative D on RSI and looking for a pull back into 103 then the next legg higher into 120. Trend line test is coming.

8-23 – Live Cattle pulling back as expected Currently testing the trend line and looking for a break and conversion to signal the wave X is in progress – 105-103 the target area. Still looking for $120s next.

8-30 – Live Cattle is about ready to turn, lower low as discussed and now looking for a reversal. Positive D on RSI is a sign, as long as that holds we should turn and head towards next target at $120.

9-6 – Live Cattle is about to reverse, positive D on RSI is a clue and I am looking for the next big rally into 120s. With DX being devalued, I am looking for commodities to continue to rally into the end of this year.

9-13 – With the devaluation theme, we should see meats rally. LE is set up for a rally into $118-120, W is in and positive D on RSI. Waiting patiently on the monthly pivot to break and convert which is a confirmation of the change in short term trend.

9-20 – I am still bullish on Cattle, no pun intended. We are out of time for this impulse which means we may see a retest of the support trend line in the next few days. I am still expecting the $120 area into October.

9-27 – I am still bullish n Cattle, ane the high window last week as not very dramatic. I still expect higher into the next window of 10-23 and look for the support trend line to do it’s job. We should continue higher and break W before we see the trend line again as support.

10-3 – So far still expecting a higher high in Live Cattle. Bullish action into 10-28 expected and a price target of $120ish. So far a chop fest higher and looking for the bulls to step in this week and pres prices higher. Support trend line mush hold.

10-10 – Live Cattle may be in a triangle here and we need to watch for a Crazy Ivan move which would be a minor higher high to finish a small 5 wave sequence then a retest before seeing higher prices. Mind your risk here and we should see volatility this week.

10-18 – Live Cattle has seen lower prices and a break of the trend line and the Crazy Ivan move. Watch for support and higher. A reversal is close to setting up on a minor lower low. Target is $115.

10-25 – Live Cattle is now setup and has pos D in RSI – looking for a confirmation of the turn on a break and conversion of weekly pivot at 105.225. Next high window is 11-15, a conversion of 111 is required to open the higher high.

11-1 – Nice rally as discussed, looking for a small pullback and continuation higher into the middle of November. The falling resistance trend line is now the focus, needs to convert to make target.

11-8 – Live Cattle in a corrective pattern and expecting a retest lower then next rally higher. we have 7-10 days of upside left in the window and Cattle will need to get moooving this week.

11-15 – Nice move on Live Cattle and now we consolidate and see a bit more of a pull back before heading higher into the 11-30 high window. Look for the turn this week and a choppy move higher. A retest of the low is expected after making the $115 target.

Gold

7-5 – Target made on Gold and a reversal as expected. No confirmation yet as we need to break the support trend line next. Targets the 1720-13 area next. This may play out quickly this week.

7-12 – A higher high this week and a reversal is still expected on Gold. We are testing the trend line and weekly pivot, convert and we open monthly pivot. We should see 1745-50 as a retracement area.

7-19 – Retracement pattern should break lower into 82 and then possibly into 45-50. Waiting on the next move and a long setup. I like Gold long into February 2021.

7-26 – The full retrace target was not made, gold has turned and last week completed a 5 up structure with Neg D on RSI. Looking for Gold to retrace into 1900-1910 or so before the next rally which should see 2050. Buy the dips through Feb 2021.

8-2 – Continuation higher and driven mostly by a move lower in the USD. I am still expecting a pull back into 1904ish then more bullish action to the upside. Silver is pulling back and the USD is not in a retracement rally. Gold should pull back and find support and continue higher. Gold rally should continue through February 2021.

8-9 – I have raised the pull back target as the move lower in DX has lifted the price of Gold. Watch 1975 for a buying opportunity then possibly we could see monthly pivot. Stagflation on the horizon, we should see higher highs into 2400s eventually.

8-16 – Nice move last week in Gold and we have made my first price target for the retracement. We should see a lower low or a retest of the low before we see the next rally. A flag has formed and has been broke, lower should play out this week.

8-23 – Nice three back on Gold and now the flag has broken down and a running flat may be putting in a slightly higher low. Watch for a long setup later this week. Powell speaking on Thursday.

8-30 – Gold has broken the trend line and we need to watch for the broken trend line for a rally. But I see DX as getting ready to rally and there is risk here of moving lower directly to 1900. Convert 1954 and we open the lower price target. This decision should be made this week.

9-6 – Gold may be putting in a triangle here, and we can see a move to 1900. DX rally is just a back test and a move lower can stil occur. I am very bullish Gold into February 2021 so continue to buy the dips as 2100 is the next price target.

9-13 – A short term flag is forming on Gold, and with the USD in a rally, we should see a lower low here to $19. Convert monthly pivot and we are open to head higher directly into 2100. Either way, I am bullish metals through February 2021.

9-20 – Compression on Gold and a number of gold stocks. A move is about to occur. Ideal pattern is a move lower first to 1900 then the break out to the upside into 2100. I am now looking for a high into the end of November.

9-27 – As mentioned last week, a move was about to occur and it did. We are now at target and about to make a decision. Either a marginal lower low and a reversal or just a move straight up. DX is in it’s target area so a turn should be seen this week. When 1950 converts we open 2100 next as target.

10-3 – Gold continues to go higher and we should see a retest this week and higher highs. Watch the USD as it has reversed also. USD is driving the gold bus at this point so expecting it to continue lower and Gold should continue to rally into 2100.

10-10 – Devaluation of the Dollar means higher Gold prices and inflation. Key to the Gold rally continuing is the US government continuing to provide stimulus which means inflation. The Gold rally is depending on the continued push lower on USD. Convert the resistance trend line and we have a confirmation for the move to 2100 into the end of the month.

10-18 – Trend line hugger which does not inspire confidence, but USD heads lower and the US government about to do more stimulus, no change in forecast, looking for the resistance trend line to break and higher into 10-28.

10-25 – Compression is the situation here on Gold and a triangle that should break higher. I have extended the cycle date to the next high window on 11-10 as sideways consolidations push out the date. Waiting on a break of the upper triangle resistance trend-line then a retest of the triangle and a thrust.

11-1 – Compression has broken down and the USD is rallying into 94.30 or so. We can sell make a marginal lower low but this is a buying opportunity on Gold as I am looking for higher prices into February next year.

11-8 – Trend line break last week and we are into the next legg higher into 11-14. Target is 2000-2050 ad a retest back into 1950 or so should follow with higher prices expected into the end of the year.

11-15 – Gold is consolidating in what appears to be a flat. We are in wave C now and likely we see a retest of the low this week. Weekly pivot is resistance until proven otherwise. Once seen, buy Gold as I see higher prices into February and also May of next year.

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog. I am using 8 lots for the Striker trades which is based on this account being $200,000. Each lot for auto trading at Striker requires $25,000 per lot. See the videos below for more information.

Track Record January 2019 thru December 2019 Click Here.

Track Record January 2018 thru December 2018 Click Here.

Track Record October 2016 – December 2017 Click Here.

*** Trading futures contracts and futures options involves substantial risk of loss, and may not be appropriate for all investors. By reading this web site, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced on this web site and associated documents and emails are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

15th Nov 2020

15th Nov 2020