Welcome to this week’s edition of The Weekly Call, your trusted source for high-quality commodity setups and trading strategies. Since October 2016, our approach has delivered an impressive 777% return, and we continue to share the insights and methodologies that drive these results with this post #477. This week, we’ll explore the latest market trends, actionable trade setups, and global economic factors influencing commodities like sugar, coffee, live cattle, and gold.

U.S. Markets (Friday, November 7 close)

S&P 500 (SPY): Closed near 6,720, down roughly 1.0% on the day and off for the week as tech valuations came under renewed pressure.

Nasdaq Composite (QQQ): Around 23,050, down ~2.0% on the week, its sharpest weekly decline since April.

Dow Jones Industrial Average (DIA): Approximately 47,000, off slightly but outperforming broader indexes thanks to strength in energy, defense, and industrials.

Global Markets

FTSE 100 (UK): Softer, weighed by banking and commodity sectors.

DAX (Germany): Down as export activity slowed and regional bank stress resurfaced.

Nikkei 225 (Japan): Fell modestly on weak tech demand and global slowdown fears.

Shanghai Composite (China): Slightly lower; policy support expectations remain high but data still signal sluggish domestic growth.

Commodities Snapshot (Friday close)

Gold: Around $4,150/oz, firm as investors sought safety amid equity weakness.

Silver: Near $52.7/oz, holding steady in sympathy with gold.

Copper: Roughly $4.90/lb, marginally lower on slower industrial output data.

Crude Oil (WTI): Approximately $57/barrel, stable despite conflicting signals on global demand.

Natural Gas: Near $3.10/MMBtu, slightly up on seasonal heating demand.

Cryptocurrency Market (Friday close)

Bitcoin (BTC): ≈ $109,500, consolidating above support after mild weekly losses.

Ethereum (ETH): ≈ $3,950, outperforming slightly as Layer-2 growth remains strong.

Solana (SOL): ≈ $195, softer on reduced DeFi inflows.

XRP (XRP): ≈ $2.65, down marginally, trading in a tight band.

BNB (BNB): ≈ $1,080, stable with consistent DEX and staking activity.

Cardano (ADA): ≈ $0.68, unchanged amid low volatility.

Dogecoin (DOGE): ≈ $0.20, flat, reflecting subdued retail participation.

Key Market Drivers

Tech Sector Pullback: Mega-cap and AI-linked names saw profit-taking after earnings, dragging the Nasdaq and risk assets lower.

Consumer Sentiment Slide: U.S. confidence fell sharply, stoking concern that discretionary spending could weaken into year-end.

Safe-Haven Rotation: Gold and the dollar both benefited from risk-off sentiment, while equities and crypto eased slightly.

Fed Policy Uncertainty: Diverging Fed statements muddied expectations for Q1 2026 rate cuts; markets priced in a longer “hold” period.

Crypto Consolidation: Despite a quiet week, BTC and ETH remain well-supported at key technical levels; volatility remains near yearly lows.

Emerging Crypto Projects & Ecosystem News

Digitap (TAP) Presale Growth: The hybrid crypto-payments and Visa-linked app project surpassed $1.3 million in its presale, drawing strong early-stage investor attention.

Yuga Labs Launches “Otherside”: BAYC creator Yuga Labs confirmed its November 12 metaverse rollout, introducing creator-economy tokens and NFT land sales.

Coinbase RWA Expansion: Coinbase launched a beta program for tokenized Treasury and private-market instruments through its Echo acquisition.

Kraken’s U.S. Derivatives Debut: Kraken rolled out CFTC-regulated prediction and event-market contracts, broadening institutional on-ramps.

Uniswap Integrates Solana: The cross-chain upgrade is live, allowing liquidity between EVM and non-EVM environments.

Euro Stablecoin Pilot: European banks moved closer to real-world testing of a MiCAR-compliant EUR stablecoin ahead of its planned 2026 rollout.

Layer-2 Momentum: Arbitrum, Base, and Optimism recorded record throughput for the year, solidifying Ethereum’s scaling dominance.

Outlook for Next Week

Macro Calendar: CPI, PPI, and retail-sales data will dominate headlines, testing whether inflation progress and consumer demand can coexist.

Earnings Wrap-Up: Final corporate results from retailers and financials may offer clues to Q4 spending trends.

Crypto Levels to Watch:

BTC: Support $108k–$109k, resistance $115k–$118k.

ETH: Support $3.8k–$3.9k, resistance $4.3k–$4.5k.

SOL: Support $185, resistance $210–$220.

Market Sentiment: Neutral-to-cautious as traders balance rate-path uncertainty with stabilizing risk appetite.

Volatility Watch: With implied vol near year-to-date lows, breakout risk remains high—any macro surprise or ETF-flow surge could reignite price action.

Focus Areas: Watch for Fed commentary, ETF flow data, and stablecoin supply trends as leading indicators of risk positioning into late November.

Stay tuned as global market conditions continue to evolve, trade smart and trade safe!

As always, stay informed and adjust your strategies based on the evolving market conditions. All trades are posted on our Private Twitter Feed for subscribers and are included in the track record posted below under Completed Trades. I am currently trading 15 lots given the account balance and will adjust as necessary based on market developments.

Trading futures contracts and commodity options involves substantial risk of loss, and may not be appropriate for all investors. Past performance is no guarantee of future results. Please see our Disclaimer for more information.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Sugar

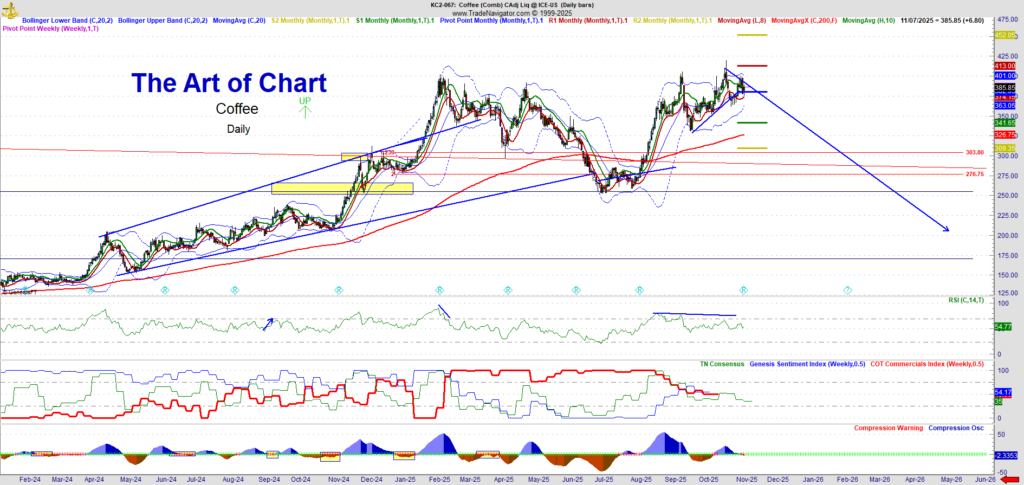

Coffee

Live Cattle

Gold (GC)

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog. I am currently using 15 lots for the Striker trades which is based on this account being over $375,000. Each lot for auto trading at Striker requires $25,000 per lot. See the videos below for more information.

Track Record January 2022 thru December 2022 Click Here.

Track Record January 2021 thru December 2021 Click Here.

Track Record January 2020 thru December 2020 Click Here.

Track Record January 2019 thru December 2019 Click Here.

Track Record January 2018 thru December 2018 Click Here.

Track Record October 2016 – December 2017 Click Here.

*** Trading futures contracts and futures options involves substantial risk of loss, and may not be appropriate for all investors. By reading this web site, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced on this web site and associated documents and emails are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas; we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

09th Nov 2025

09th Nov 2025