The Options Trading and Investing service provides perspective on high quality setups and option trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. This week we review current positions and plan for a portfolio hedge, Apple and Natural Gas.

Please refer to our education video HERE for more information in the option strategies used in this post.

A summary of the plan for the week is summarized in the video below. The entries and cost basis will be highlighted on this post on our private twitter feed.

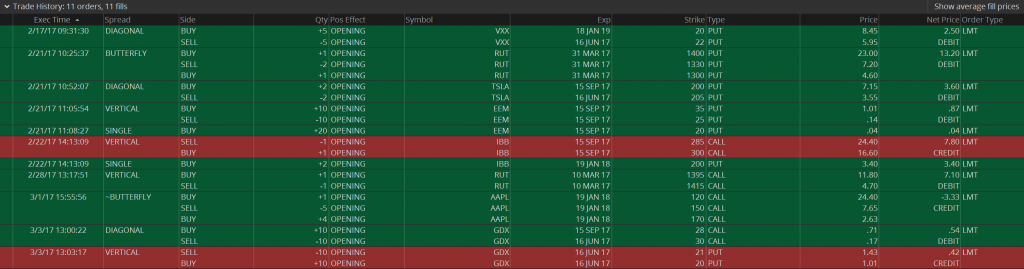

In today’s post we will examine the portfolio’s new positions in GDX and AAPL and potential new positions in IYR and UNG First, let’s take a look at the position statement for the portfolio:

Above is The Art of Chart option portfolio. I use the ‘Paper Money’ $50,000 account in the ThinkorSwim trading platform. Paper Money is a simulated trading account and so the prices at which the trades are opened or closed are based on their proprietary algorithms. That can vary from the actual fill prices. I mirror the trades that I place in the AOC portfolio in my personal portfolio so I know how close the simulated trades are to actual fill prices. Occasionally, a position will fill at a better price in my account and sometimes at a worse price. Overall, so far they have been pretty close.

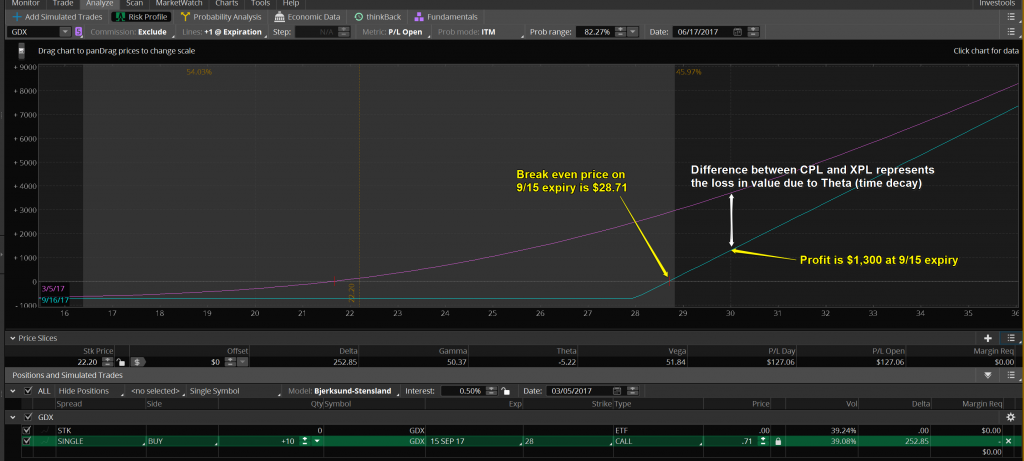

Stan is looking for a large move higher in GDX into a late July cycle high window. Adding a couple month buffer in time I looked at buying the Sep15 28 strike call. At the time that I was evaluating the position on Friday, I could have bought it for $.71 ($710 for a 10 lot). The $.71 of extrinsic value in the option will go to $0 by Sep15, regardless of what price does. That makes the break even price of GDX $28.71 at expiry. Friday’s closing price was $22.20. If the price of GDX hits the target price of $30/share by expiry I would have a $1,300 profit. Below $28/share at expiry and I lose the entire $710.

This is the position I chose to go with instead of buying the calls. I sold a 10 lot of the Jun16 21/20 Put Vertical Credit Spread for a $.42 credit ($420). As long as GDX is above $21/share by Jun16 expiry the full credit is mine to keep. With the current price of GDX $22.20, I actually don’t need GDX to go up in price at all to make the full profit. I also bought the Sep/Jun 28/30 Call Diagonal Spread for $.54 ($540). My net cash outlay for the 2 spreads was just $120 and I have a $1,000 margin requirement. One of the benefits of owning the diagonal spread is from the expected rise in implied volatility (IV) if GDX rallies strongly over the next few months. The current IV of the Sep15 28 calls is 39.08%. That can be expected to rise if GDX rallies because the demand for calls (and puts) often increases in commodity related or precious metal related instruments on expectations of further price increases. IV is simply a reflection of option demand. More demand, higher IV. Higher IV, higher price for the options. The price of the 28 calls would be increasing at the same time the price of the Jun 28 calls (the ones that I am short) will be decreasing because of the option decay.

New AAPL position established on March 1st for a net credit of $3.33. This is the longest duration position in the portfolio as it has a Jan2018 expiry. At expiry, this position will be profitable as long as AAPL is below $158/share giving this position a 82% probability of making a profit. This is the first position in the portfolio where I have to use a stop loss price level because, although this is a defined risk position, the risk exceeds 2.5% – 3.0% of the portfolio value. I will often allow for that higher amount of potential risk on long duration positions as they have more room to move. In this position, as long as the price of AAPL remains below approximately $160/share, the draw down should be less than 2.5% of the portfolio value. If AAPL moves up in price instead of down, that is actually better for the position long term as long as it does so slowly. Since Stan is projecting AAPL to first go lower in price (where there is no possibility of less than a $333 profit) in late summer before rallying into year end, the stop loss level seems relatively unlikely. Every option portfolio that I manage contain some very high probability, longer-duration positions such as this.

Next I am considering a new position in IYR. This position is a 1×2 Put Ratio Spread. In this example, the ratio spread is identical to a Butterfly except that I am not buying the far out of the money (OTM) put as a protective hedge against a very large move to the downside. OTM puts are always relatively expensive due to volatility skew. By not buying the protective put I can own the spread for a better reward/risk ratio over the range of most probable outcomes. This is not a defined risk position because it is net short 1 put. The most important aspect in designing these positions is making sure that the CPL is upward sloping to the left of the risk profile. That is to protect against the entire CPL being displaced lower due to a rise in the implied volatility of the OTM put options in this position. I often consider closing the position if the underlying price is below the peak of the CPL.

On the previous slide, the profit of the position if IYR dropped in price to $68/share today would be about $150. Below you can see that if IYR is at $68 by mid-July then the position’s profit will be more than $500. The difference in those 2 amounts represents Theta. Theta is option decay. When you are a net seller of options you benefit from Theta and when you are a net buyer of options Theta is your cost of owning the options. If, in this example, IYR is at $68/share on 9/15/2017 the profit on the position will be $940. That is almost $800 in Theta at the $68/share price level. Based on the $1,800 margin requirement at that price level, you could make a 44% return on margin just in Theta in less than 7 months. That is equivalent to a 75% annual return on your margin requirement.

Here is the slide of UNG from the 2/26 webinar and blog. At the time, UNG was trading $6.50. As of Friday, 3/3, UNG closed at $6.84. The Call Diagonal Debit Spread is now more expensive to buy and the Put Vertical Credit Spread is less expensive to sell. If UNG pulls back both those spreads will work in favor of establishing the position at better prices. I am still holding off on the position waiting for lower prices which could occur this week. I will have the position staged and ready to go on Stan’s reversal call.

Summary

If you manage a portfolio of options, take a fresh look at your positions. Is time benefiting your positions (positive Theta) or do your positions need a big price move in the underlying instrument to be profitable?

Every option that you own is like a banana. They both are decaying from the moment that you buy them. Some people buy longer duration options as a way to slow down the negative effects of time decay. That is better than buying shorter duration options in terms of time decay but they are essentially buying green bananas instead of yellow ones. They will last a little longer but the problem is they’re still bananas and they are decaying in your option portfolio. Sell something against them!

Profitable options investing involves smart use of Theta and not just speculation of large price moves in a relatively short period of time!

Stan and Jack provide us with actionable price and time targets but that doesn’t mean it is advisable to disregard the benefits of positive Theta. Why wouldn’t you take advantage of both?

Save

05th Mar 2017

05th Mar 2017

What was the Credit for the AAPL trade? I can’t seem to find it.

Edward, the net credit received was $333.

Thanks. Is there anywhere on the web site where the credits are listed for each open trade?

Edward, if you look in the blog post from yesterday you will see that I added the transaction list of all the open positions. It is near the top of the post.

Found it. Thanks

Not opened IYR yet?

Gurunathan, not yet. I would prefer to ‘get short on strength’. All I mean by that is I would prefer to see a bounce in the price of IYR to establish the bearish option position. I will confer with Stan again today to see if he thinks we will get that opportunity later this week.