The Weekly Call provides perspective on high-quality setups and trading strategies. Our current performance shows a 301% return since October 2016. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach.

Last week entered Bonds, Oil, Gold and Coffee and have been stopped out of Natural Gas as a result of a news announcement. I have re-entered NG short late last week. I have also taken 2/3s profit in my new position in Coffee. See the details below. This week I am focused on re-entries in Sugar and Soy based on the current forecast.

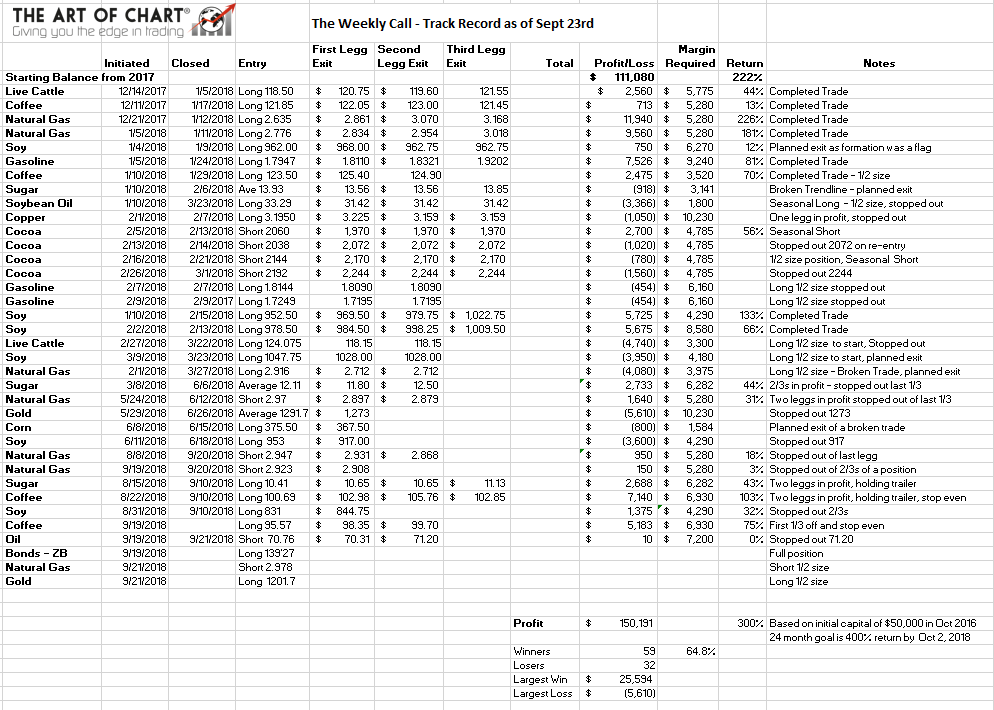

All trades posted here are discussed in our Daily Update Subscription Service and posted on our private Twitter feed. Our track record is posted below under Completed Trades. See some of our completed trade videos below.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Soy – Re-entering the Trade

9-2 – Back from my holiday break and the retest appears to have completed at 828 and we are getting set up for a rally into the 979 area. A conversion of monthly pivot at 862 confirms the rally. I am currently long 1/2 size from 831 with a stop below 826.

9-9 – Still long and waiting for a three up to take off first 1/3 and set stop to even. Likely we see monthly pivot this week. Normally I would wait for a 50% back of the previous swing but in this case respecting the headline minefield in soy so exiting first 1/3 earlier.

9-16 – I was stopped out on ZS last week on the move lower. I am waiting on a clear sign of a reversal pattern before re-entry, we have risk to $800 here so waiting on a confirmation on this turn first.

9-23 – Confirmation of the turn expected this week as we have broken above the trend line. Likely we see 828 hold as support and I am looking to enter for a run higher into the 950s by the end of October. There is still risk to $800.

Sugar – Managing the Trade

9-2 – The 11.68 level did not convert and we have seen a lower low at the monthly S1. At this point we have a candidate low that may be in. Looking for the first three up into 10.89 then the retest. If the retest holds 10.30 then likely the turn is in. If we convert 10:30 then we open 9.68 as a potential lower low. My plan is to exit 2/3s of my current position early this week and wait on the retest to add size.

9-9 – Flag is now complete and I have already exited 2/3 of this position, looking for a retest and support at 10.30-10.40. If support becomes manifest I plan to add size at this level, if not we see a new low.

9-16 – Waiting on the retest to complete, exited the last 1/3 a little early in this trade, waiting to reload lower. Expecting the trend line to break and the monthly pivot to be tested.

9-23 – Still waiting as the three back is not quite done. Expecting a lower low which gets me long again in the 10.20 area. I am currently flat Sugar.

Natural Gas – Entering the Trade

9-2 – The retest completed higher than expected and may be turning over here. Likely a flat has formed here and 2.93 is resistance and am expecting 2.76 next. This week we need to convert back below 2.90 to see continuation lower. I am still holding a short trailer with my stop at even.

9-9 – We have hit first target at 2.76 and now we should see a small retest. 2.82 or 2.86 resistance and lower prices expected into 2.62 likely. Stop still at even and still holding 1/3 in size. Will add size on retest when resistance is seen.

9-16 – So far so good on the decline, we have at least a week left. Only a trailer left on the position and still holding for now. Looking for an exit likely next week. Minimum target $2.70.

9-23 – A busy week for NG. I enter NG short earlier in the week, adding to my existing 1/3 short position. Just before the EIA news announcement, I decided to take a small profit on my new position and placed my stop at even. Price broke higher into a flat and I have been stopped out of my add and my trailer of my original position. Always a good practice to go even stop before EIA. I have re-entered short again at 2.978 and am expecting lowe prices into at least monthly pivot.

Coffee – Entering the Trade

9-2 – Coffee is in the turning process for a seasonal low. I am expecting a rally into 108 then the retest of the low. There is risk here to $98. I am currently carrying just a trailer size position and waiting for the rally into 108.

9-9 – Coffee is still turning and I am still holding 1/3 of a position. Likely a lower low is coming and I plan to add size at that time. Holding the 1/3 in case of an early turn. Target expected is $97.

9-18 – Coffee is still working on a lower low. Took profits this week on the last 1/3 and I currently have no position. I am looking to get long at around $97. Lower low sets up positive D on RSI. Waiting patiently.

9-23 – I got long coffee this week at 95.57 and am off 2/3 of the trade. Originally looking for 101, we may see as high as 105s. Waiting on my last 1/3 with stop even and looking to add size on a pullback into 98. A break of the declining resistance trend line is a positive sign, a retest that holds the trend line as support confirm the turn. Also news of farmers in Brazil lobbying the government about their inability to farm with prices at these levels. Watch the news for more. A government tailwind here would be welcomed!!

Lean Hogs – Entering the Trade

9-2 – A support test is in progress now. The low may be in and we are now three down to the 100% fib. Friday showed us a 5% rally off the low. If we see the low hold from Thursday and see continuation higher, the turn in Lean Hogs in confirmed. Higher prices expected into the October window.

9-9 – Lean Hogs may have found support and likely we see a conversion of the red line – the monthly R1 and if seen the turn is confirmed. Looking for a rally into next window in mid October. I have no position at this time.

9-16 – Lean hogs now confirmed to the upside into the cycle date in October, the next retest is a chance to reload. Price is 50% back the previous swing to you should be out at least 1/3 of your trade and stop even at this point.

9-23 – Lean Hogs near target and is early timing wise. Time and price usually come together in my work so this early is a sign that my price target is low. We may see $62 and the trend line by the cycle date.

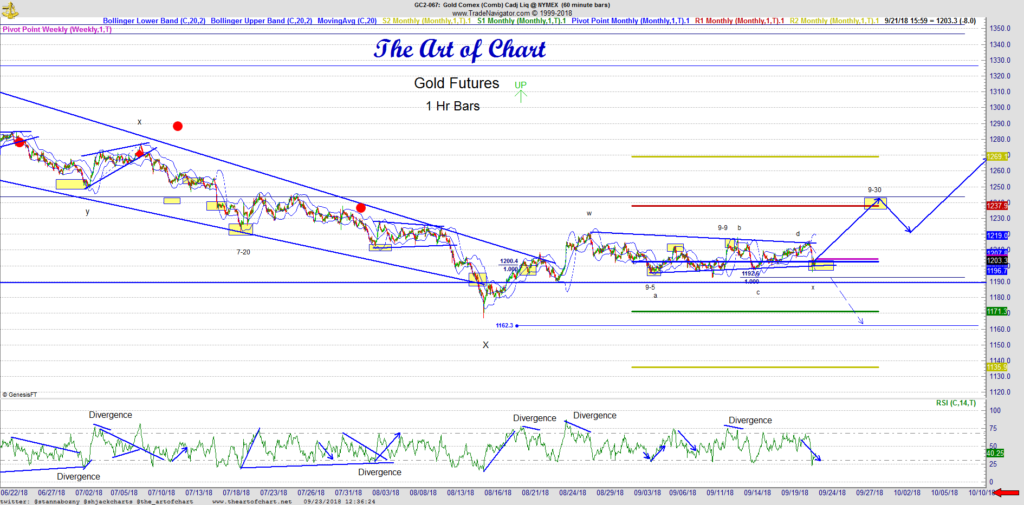

Gold – Entering the Trade

9-2 – We failed to convert the trend line at 40s and have seen continuation lower in Gold into the monthly S1 area. We have a potential candidate low and I am expecting a retest of the low. 1188 is the support area and if this breaks we open 1162. Once support is demonstrated, and we convert monthly pivot, we will have a confirmed turn in Gold and am expecting a rally into November.

9-9 – Looking for the retest this week, and likely support at 1188-85 as discussed. If seen I will be entering long, if not I will be waiting for 1162 as discussed. Looking for a rally in Gold into November based on the USD forecast which is calling for lower prices.

9-16 – Waiting for the retest and now we are in it. 1188-85 is the area for the retest – find support and I am long, break down and I enter on the lower low at 1162. This week should make the decision on Gold and the USD.

9-23 – I have entered Gold long as of Friday at 1201.7. This appears to me to be a clear triangle with a 70% change of breaking up. My stop is below 92s as this would invalidate the triangle and I am looking for a rally this week. The next cycle date in 9-30 to the upside in the 1234 area.

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a $50,000 account limited to a three contract position size. We will increase position size after we generate a 200% return. See the videos below for more information.

Track Record October 2016 – December 2017 Click Here.

*** There is a substantial risk of loss of capital when trading and/or investing. Past performance is no guarantee of future results. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas; we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

22nd Sep 2018

22nd Sep 2018