Several commodity markets are poised for well-defined up-trends this year. I plan to write about these markets on a bi-weekly basis as the views presented here are more thematic and longer term in nature. Updates to the trading strategies published here will be provided on an ongoing basis.

A quick update on my existing trading strategies which can be reviewed below…….. I managed to close my Gold trade at 1330 which was my target for the final legg so I am out of the position with a great profit. I may be reloading this week. I am also still long Natural Gas and have closed my short calls and puts and still am holding the futures long. I am still holding Corn and Coffee long and also holding short futures on Live Cattle. Please see the past issues of the Commodity Advisory Newsletter for more information on these positions.

Lean Hogs

Lean Hogs has fallen 29% since the high in November which is likely due to the record production of hogs in the US. Pork production has been running 5-7% higher than 2018. The latest December report suggests there may be a slowing of production to only 1-2% higher than last year which in and of itself is a reason for Hogs to bounce off the February lows. Add to the equation the African Swine Fever problem in China which has done massive damage to their domestic pork supply. China is very likely going to be major importer of pork. China has already indicated in the trade talks that they would buy $30 billion in Ag products in 2019. That is up dramatically from the $16 billion in 2018. The situation in China will likely lift global pork values when the tariff situation is finally resolved.

On the daily chart, the current low could produce a reversal this week if we break back up above $57, or we could see a double bottom and then reverse. We are also now at the weekly declining support trend line. Any positive D here is a buy and I want to construct a safe position so that if we see more downside I can hold the position as there is risk in this market and also the deal with China is not yet completed. I want to play the position out into the September time frame since the next major cycle high is in the September 7th time frame.

On the Weekly chart, we have seasonal risk lower which can be seen on the last indicator on the bottom. A seasonal rally may be just a week or two away, so likely with the large decline already in place we should see a reversal pattern soon. If the China tariff issue is resolved, this commodity could see a big upside move.

Trading Strategy

For this week I am watching for a possible lower low and a reversal pattern. I am looking out into the August time frame at $84 calls and also want to sell a June call around 76 or 77 depending on the setup for some downside protection shorter term. I may buy 2 $84 August calls and sell just one June 76 call for a small premium. I would hold the position into target at $84 in August and risk only 200 points on the position from entry. I may modify this strategy based on the setup presented this week.

Wrap Up

This is my fourth newsletter covering some of the better longer term setups in the commodity world. I believe that 2019 should be a great year for trading commodities and China will have a larger than normal influence. For now the Hog market has my attention and I am hunting a new entry. My next newsletter is in two weeks. Trade Well and Trade Smart.

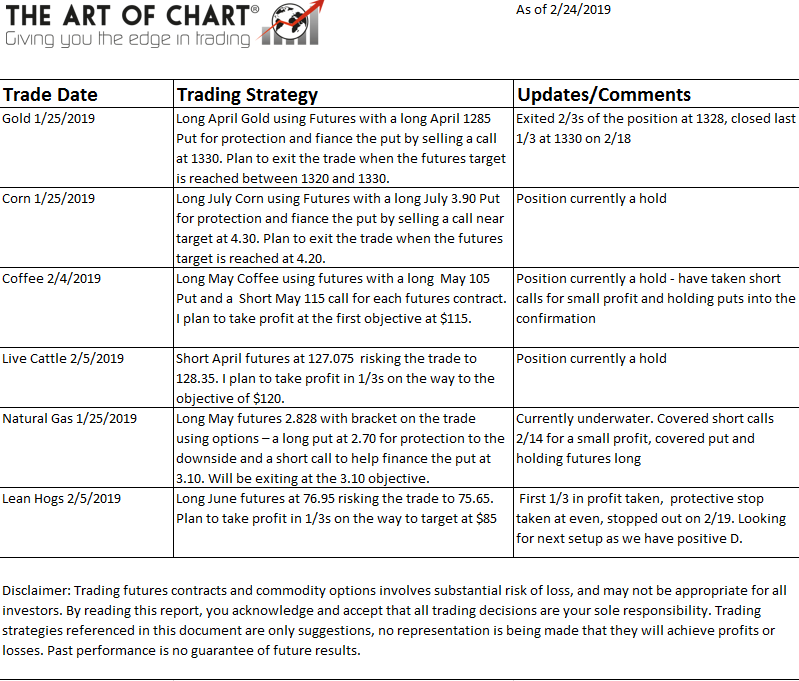

Trading Strategy Review

The trading strategies below represent positions taken by this newsletter and also shorter term positions covered by The Weekly Call. Updates to this newsletter are provided bi-weekly.

Disclaimer: Trading futures contracts and commodity options involves substantial risk of loss, and may not be appropriate for all investors. By reading this report, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced in this document are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.

24th Feb 2019

24th Feb 2019

Comments are closed.