If I buy a single Aug21 SPY 310/305 Vertical Put Debit spread how many assets do I now own? One of course! Wait, is this a trick question? One, right? The correct answer is five! If that answer didn’t occur to you right away then keep reading because I’m going to reveal one of the most important concepts in successful option trading; cost/risk reduction. Sounds a little boring but it could potentially change your whole way of trading options in the future. Read on if you’d like to learn more!

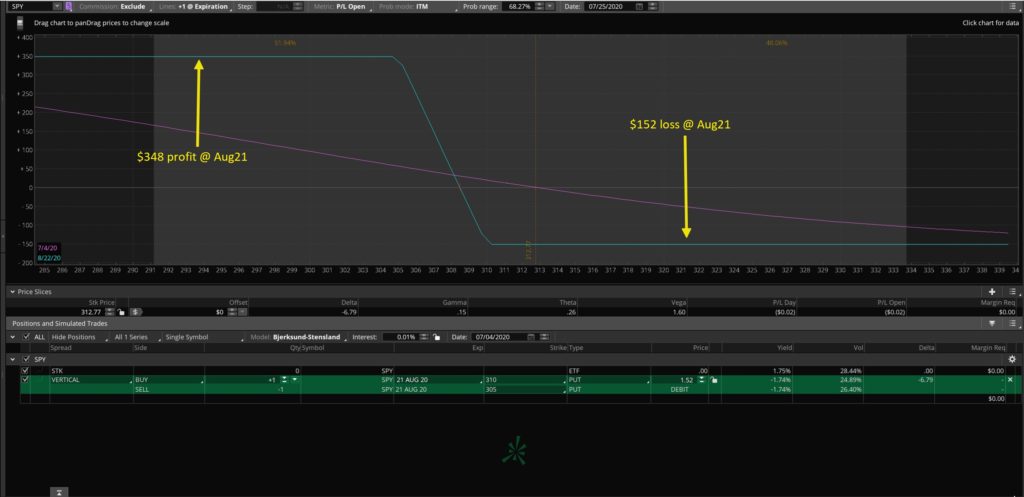

Here is the $5-wide Put Vertical Debit spread that I mentioned. In this spread I’m long the 310 Put and short the 305 Put. That spread would cost $1.52 and have a maximum profit of $348. That is a reward/risk of 2.3/1. So this is just one asset. I still haven’t demonstrated where the five supposed assets are.

When I buy one $5-wide spread that is the same as if I bought five $1-wide spreads, right? So now you see the five assets but this is just semantics isn’t it? Why split it up this way?  Clearly you wouldn’t buy it that way but you could sell it that way! Hmmm…What would be the point in doing that? We have now reached the point in this lesson which can and should forever change the way you view option trading. The point in breaking out the $5-wide position into five separate parts is to highlight the fact that, if price moves lower and the spread becomes profitable, I can begin selling off those five $1-wide spreads to reduce the cost/risk in the position while maintaining the potential for a large gain. And, all the while, increasing the reward/risk ratio on the position. Let’s look at just one example.

Clearly you wouldn’t buy it that way but you could sell it that way! Hmmm…What would be the point in doing that? We have now reached the point in this lesson which can and should forever change the way you view option trading. The point in breaking out the $5-wide position into five separate parts is to highlight the fact that, if price moves lower and the spread becomes profitable, I can begin selling off those five $1-wide spreads to reduce the cost/risk in the position while maintaining the potential for a large gain. And, all the while, increasing the reward/risk ratio on the position. Let’s look at just one example.

Let’s say the SPY goes lower and I’m building a profit in the position. So far so good. What happens almost all of the time? SPY goes back up again and the open profit diminishes or perhaps even turns into a loss. I close the position to limit my loss and then SPY goes lower again and I’m now really pissed about another losing trade. Now, what if I instead had sold one of the five assets that I own. If SPY goes lower the price I can collect for selling the 310/309 Put Vertical Credit spread will rise from the current $.33 credit. If SPY drops to around 305 over the next couple of weeks I could likely sell that spread for around $.52. Then what would the risk profile look like?  I now own one $4-wide spread or four $1-wide spreads. That spread would have a net cost of $1.00 and have a maximum profit of $300. I have reduced the net cost of the position from the original cost of $1.52 to $1.00. That’s a 33% reduction in cost. The maximum profit has also dropped from $3.48 to $3.00 but that’s only a 14% drop. So now the reward/risk is 3/1 instead of 2.3/1. If I wanted to I could have sold two of the assets (310/309 and 309/308) for approximately a $1.00 credit. That would leave my net cost at around $.50 and my maximum potential profit at $250. That would be a reward/risk ratio of 5/1. I think you get where I’m going here, right? I’ll leave the rest of the potential ways that I could reduce cost/risk up to your imagination here. If you’re wondering if it’s possible to remove all cost and even lock-in a profit on a trade the answer is yes. I’m frequently doing just that in the Vega Options service!

I now own one $4-wide spread or four $1-wide spreads. That spread would have a net cost of $1.00 and have a maximum profit of $300. I have reduced the net cost of the position from the original cost of $1.52 to $1.00. That’s a 33% reduction in cost. The maximum profit has also dropped from $3.48 to $3.00 but that’s only a 14% drop. So now the reward/risk is 3/1 instead of 2.3/1. If I wanted to I could have sold two of the assets (310/309 and 309/308) for approximately a $1.00 credit. That would leave my net cost at around $.50 and my maximum potential profit at $250. That would be a reward/risk ratio of 5/1. I think you get where I’m going here, right? I’ll leave the rest of the potential ways that I could reduce cost/risk up to your imagination here. If you’re wondering if it’s possible to remove all cost and even lock-in a profit on a trade the answer is yes. I’m frequently doing just that in the Vega Options service!

Vega Options is an educational service, not a trading service. However, because all of my price action analysis and option trading is done in real-time there is an opportunity for the subscribers to place similar trades from their own account. My job is to simply make available to the subscribers all of the information that I use to make trades. What they choose to do with that information is entirely up to them.

That is all I have for you now. If you are not a subscriber and you would like access to the Vega Options private Twitter feed, you can sign up for a 14 day Free Trial to try out the service. What have you got to lose, it’s free!

CLICK HERE for the Vega Options Free Trial.

Our other services are listed below.

05th Jul 2020

05th Jul 2020