Welcome to this week’s Crypto Market Weekly Outlook, post #346, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Bitcoin (BTCUSD)

Recent Developments:

Bitcoin has remained relatively stable throughout the past week, despite increased volatility across traditional financial markets. The U.S. Federal Reserve’s inflation report and continued uncertainty surrounding interest rate policy have influenced Bitcoin’s sideways movement. Additionally, the global anticipation of Bitcoin ETF approvals, particularly from the U.S. Securities and Exchange Commission (SEC), remains a key driver of market sentiment. The ETF decision delays have caused traders to adopt a cautious approach, keeping Bitcoin within its current range.

Outlook:

Bitcoin will likely remain sensitive to both macroeconomic indicators and the ongoing regulatory developments. If the SEC takes favorable action on Bitcoin ETFs in the coming months, we could see renewed bullish momentum. Until then, Bitcoin’s price movement may remain muted, with risks of a downside correction if there are further delays. Key resistance levels remain closely watched, and breaking through could open the door to retesting previous highs.

Ethereum (ETHUSD)

Recent Developments:

Ethereum continues to face pressure from the broader macroeconomic environment but is finding support through growth in decentralized finance (DeFi) and non-fungible token (NFT) sectors. Last week saw several layer-2 scaling projects, including Optimism and Arbitrum, making headlines as they continue to drive transaction efficiency on the Ethereum network. These advancements in reducing fees and increasing processing speeds have encouraged more developer and investor activity on the network.

Outlook:

Ethereum’s price outlook is closely tied to its ecosystem developments. The success of layer-2 scaling solutions could significantly bolster Ethereum’s network performance, which may attract more institutional interest. Additionally, any regulatory developments around Ethereum ETFs could influence its price trajectory. Traders will closely watch key resistance levels, as breaking through them could lead to a rally toward previous highs.

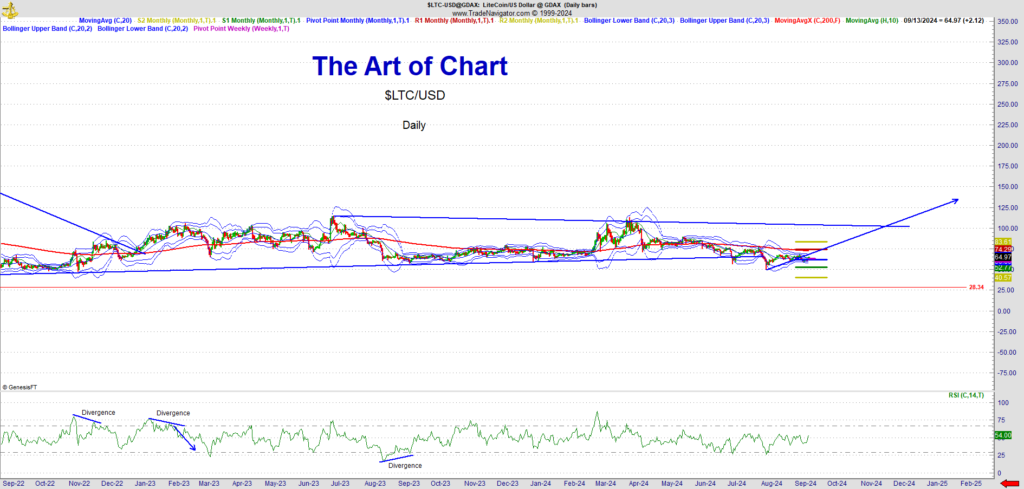

Litecoin (LTCUSD)

Recent Developments:

Litecoin has maintained a relatively low volatility profile compared to other major cryptocurrencies over the last week. The network’s utility for fast transactions and lower fees continues to provide value, but broader market trends, particularly Bitcoin’s performance, have a considerable influence on Litecoin’s price action.

Outlook:

Litecoin is seen as a hedge within the crypto space, with many traders using it for portfolio diversification. Although the coin is approaching key resistance levels, broader market conditions will play a significant role in its potential to break out. If Bitcoin sees significant upward movement, Litecoin could follow suit, but its conservative movement makes it a reliable option for risk-averse traders.

Solana (SOLUSD)

Recent Developments:

Solana continues to build on its reputation as a highly efficient blockchain for DeFi and NFT applications. While the network has seen improvements in transaction speed and cost efficiency, ongoing concerns about network outages and scalability issues have caused some hesitation among investors. However, significant institutional interest and new infrastructure improvements keep Solana in the spotlight.

Outlook:

Solana is likely to remain a strong player in the cryptocurrency ecosystem, especially if it can maintain stability. The network’s focus on resolving past technical issues will be critical in driving further adoption. Traders should keep an eye on Solana’s ability to break key resistance levels, as that could signal a rally toward previous highs. However, caution is warranted due to Solana’s historical volatility during network disruptions.

Regulatory Landscape and Market Sentiment

News from Last Week:

The SEC’s delay in approving Bitcoin ETFs remains a key driver of cautious optimism. The crypto market is anticipating potential approvals that could lead to significant institutional inflows. Additionally, global regulatory discussions, including those from the G20 summit, continue to point towards a more comprehensive regulatory framework for cryptocurrencies. This increased regulatory clarity, while keeping some traders on the sidelines, could serve as a long-term bullish catalyst for the market.

Blockchain Ecosystem Developments

The Ethereum ecosystem continues to benefit from advancements in layer-2 scaling solutions. Both Optimism and Arbitrum have seen increasing adoption, contributing to Ethereum’s capacity to handle higher transaction volumes at lower costs. Solana, too, has seen strides in its infrastructure, positioning itself as a major competitor in the DeFi and NFT spaces.

What to Watch This Week

- Economic Data Releases: Keep an eye on U.S. inflation data and any updates on the Federal Reserve’s interest rate policy, which could affect market sentiment.

- Regulatory News: Watch for further developments from the SEC on Bitcoin ETF approvals and any global regulatory announcements.

- Technological Developments: Ethereum’s layer-2 scaling progress and Solana’s infrastructure upgrades could significantly influence price action in the coming weeks.

The cryptocurrency market remains in a state of cautious optimism, with institutional inflows, regulatory developments, and technological innovations expected to drive trends in the near future. Stay tuned for more updates, and as always, Trade Smart and Trade Safe!

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns. Stay turned for our service that we will be offering to support investors using these advanced tools.

15th Sep 2024

15th Sep 2024