Welcome to this week’s Crypto Market Weekly Outlook, post #356, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview:

The cryptocurrency market has experienced significant developments over the past week, marked by notable price movements and regulatory advancements. Bitcoin (BTC) has surged to unprecedented levels, trading above $99,000, driven by renewed investor optimism and supportive regulatory signals.

Ethereum (ETH) has also seen substantial gains, bolstered by network upgrades and increased adoption in decentralized finance (DeFi) applications.

Key Developments:

- Bitcoin’s Record Highs:

- Price Surge: Bitcoin’s price has reached a historic high, surpassing $99,000, reflecting a 136% increase this year.This surge is attributed to growing investor confidence and expectations of a favorable regulatory environment.

- Regulatory Support: The re-election of President Donald Trump has been accompanied by a shift in his stance toward cryptocurrencies. Previously critical of Bitcoin, President Trump now advocates for a pro-crypto regulatory framework, pledging to maintain the government’s $5 billion stake in cryptocurrencies and promote a strategic Bitcoin stockpile.

- Ethereum’s Continued Growth:

- Network Upgrades: Ethereum’s recent Shanghai upgrade has enhanced the network’s scalability and efficiency, contributing to a nearly 40% rise in ETH’s price, now trading at approximately $3,377.

- DeFi Expansion: The upgrade has facilitated the growth of DeFi platforms, attracting more users and developers to the Ethereum ecosystem.

- Altcoin Performance:

- Solana (SOL): Solana has experienced significant gains, with its price increasing by over 7% in the past week, driven by its high-performance blockchain capabilities and growing developer interest.

- Meme Coins: Tokens like Dogecoin (DOGE) have seen a resurgence, with DOGE’s price surging following the appointment of Elon Musk to a new governmental position focused on efficiency and innovation.

- Regulatory Developments:

- Legislative Prospects: Former SEC Chairman Jay Clayton has indicated that Congress is likely to adopt cryptocurrency legislation during President Trump’s administration, aiming to provide clearer regulatory guidelines for the industry.

- International Movements: Russia has approved a cryptocurrency tax framework, treating digital assets as property and requiring miners to pay taxes on both mining and selling activities.

- Security Incidents:

- Exchange Breach: A major centralized exchange reported a security breach resulting in the loss of a substantial amount of crypto assets. While the exchange has assured users that funds will be covered, the incident has reignited concerns about the safety of assets stored on centralized platforms, potentially driving more interest in decentralized alternatives.

Investor Insights:

- Institutional Interest: The potential approval of a Bitcoin spot ETF by the U.S. Securities and Exchange Commission (SEC) has intensified, fostering optimism among investors. Such an approval could bring a wave of institutional investment and further legitimize Bitcoin in mainstream finance.

- Diversification: Investors are increasingly exploring altcoins and tokens associated with emerging technologies like artificial intelligence (AI) and data processing, seeking growth opportunities beyond major cryptocurrencies.

- Risk Management: Despite the bullish trends, experts advise caution due to the inherent volatility of the crypto market. Maintaining a diversified portfolio and staying informed about regulatory changes are recommended strategies.

The cryptocurrency market is experiencing a dynamic phase, characterized by record-breaking prices and evolving regulatory landscapes. As institutional interest grows and technological advancements continue, the market’s trajectory remains a focal point for investors and stakeholders. Staying informed and adopting prudent investment strategies will be crucial in navigating this rapidly changing environment.

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

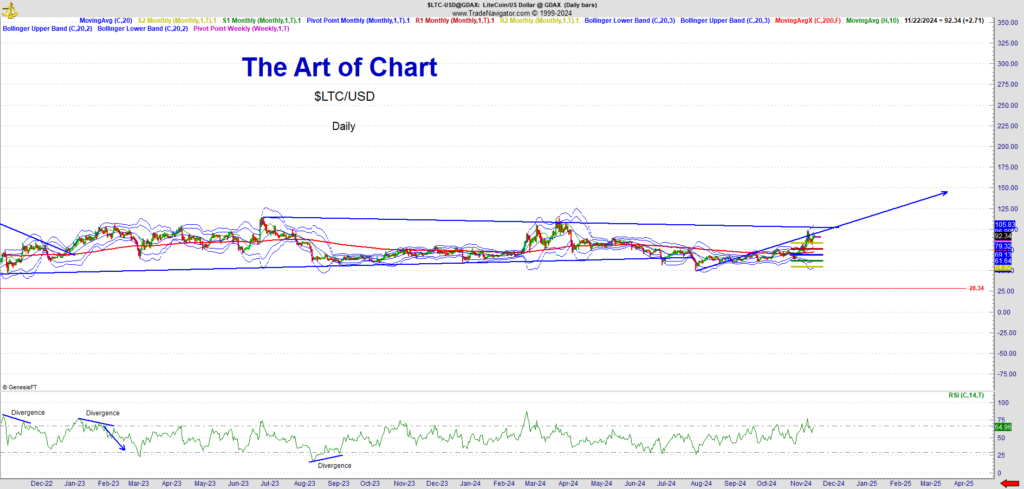

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

24th Nov 2024

24th Nov 2024