Welcome to this week’s Crypto Market Weekly Outlook, post #375, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview

Major Cryptocurrencies:

Bitcoin (BTC): Trading at $83,843.80, down slightly for the week as macro risk sentiment cools. ETF inflows slowed, but long-term accumulation trends remain intact.

Ethereum (ETH): At $1,816.25, pulling back modestly amid continued growth in staking and Layer-2 adoption.

Solana (SOL): Trading at $122.75, down from last week’s highs, with ecosystem activity holding strong across DeFi and NFTs.

Dogecoin (DOGE): At $0.2262, relatively flat, with meme coin enthusiasm cooling alongside broader market pullback.

Key Developments This Week

1. Risk-Off Sentiment Hits Crypto Alongside Equities

Strong U.S. jobs data and rising bond yields pushed traders into a defensive stance, dragging crypto assets lower to start the week.

Bitcoin saw reduced ETF flows, though long-term holder accumulation remains strong.

Ethereum held relatively firm thanks to on-chain activity and ongoing protocol developments.

2. Layer-2 Ecosystems Continue Expanding

Arbitrum, zkSync, and Base all recorded increases in daily active users and transactions.

New DeFi platforms and cross-chain bridges are making Layer-2s more attractive for both developers and users.

Ethereum gas fees declined slightly, boosting engagement across smaller apps and games.

3. Solana Ecosystem Stays Active Despite Price Dip

Solana continues to host NFT mint events, new GameFi releases, and DEX expansions.

Phantom Wallet reported a rise in mobile activity tied to new user onboarding in Latin America and Southeast Asia.

Developers are emphasizing Solana’s speed and scalability as new DePIN (decentralized physical infrastructure) projects go live.

4. Stablecoins and Regulation Back in the Spotlight

U.S. regulators are reportedly accelerating stablecoin frameworks following bipartisan draft proposals.

Multiple major crypto payment firms are lobbying for clearer guidance on U.S. dollar-pegged tokens.

Tether and Circle both reaffirmed full-reserve status amid renewed scrutiny of audit practices.

Emerging Projects to Watch

EchoFi ($ECHO): A new DeFi protocol integrating on-chain copy trading and smart portfolio mirroring.

YieldRoot ($YROOT): Multi-chain yield optimizer offering cross-chain vaults with auto-harvesting functionality.

BlockMesh ($BMX): Decentralized AI compute marketplace allowing tokenized access to GPU networks.

Solaxy ($SOLX): Green finance initiative on Solana rewarding staking tied to verifiable climate-positive outcomes.

Investor Insights

Bitcoin: Remains in consolidation mode, with price action tied closely to interest rate expectations and ETF demand.

Ethereum: Despite price softness, strong fundamentals in staking, L2 adoption, and dev activity keep ETH attractive long-term.

Solana: Still a top contender in the altcoin space with growing real-world use cases and fast-expanding tooling.

Meme Coins & Speculative Tokens: Risk appetite has cooled slightly, but targeted hype cycles continue to create sharp moves in low caps.

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

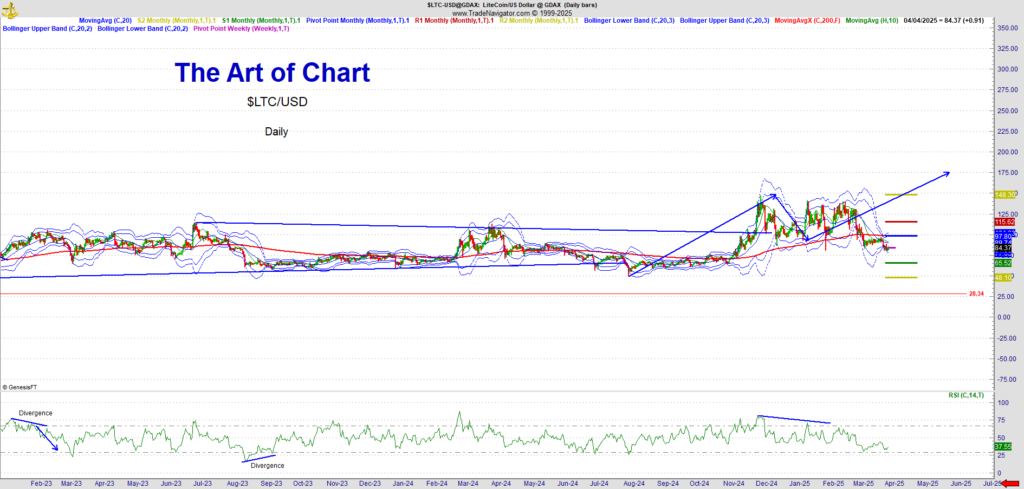

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

06th Apr 2025

06th Apr 2025