The first step in my process of initiating a new option position is identifying a promising chart setup. I’ll consider setups on various time frames anywhere from the 65-minute charts all the way up to the monthly charts. My typical trades originate from the daily and weekly charts but I’m always looking for the best opportunities where ever they show up. The purpose of this post is to introduce you to some option strategies so I won’t go in depth as to the details of this setup on the GLD monthly chart but suffice it to say I like this for a bullish trade. The first target higher is 194.45 and my stop would be 169.30. Remember, this is a monthly chart so this is an appropriate setup for a long-term trade. Most of my trades last anywhere from a few days to a few months but any trade initiated from a monthly chart is going to last anywhere from 6 months to 2 years. In building a portfolio of option positions I’ll try to have at least a few of these very long term positions. Let’s take a look at how I can trade this setup.

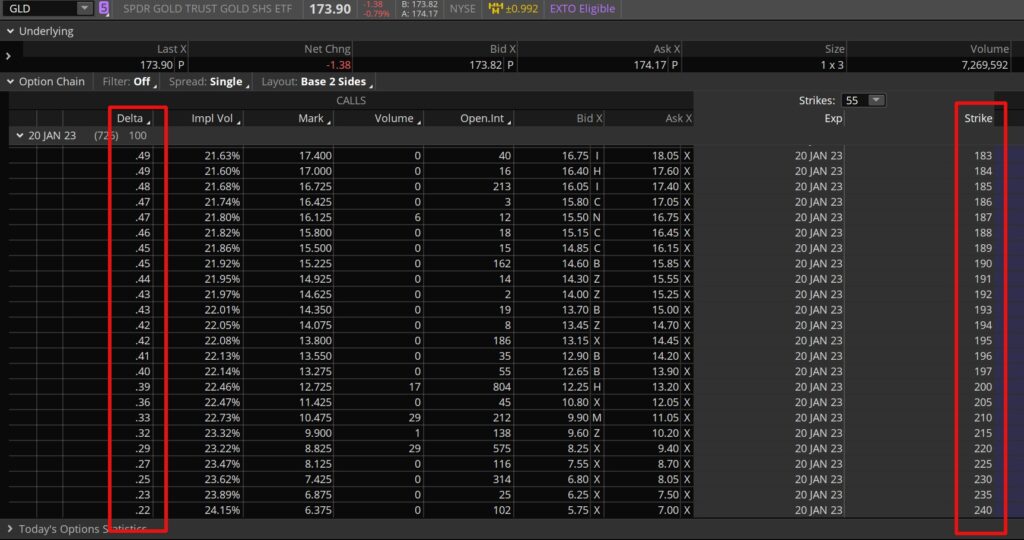

Once I’ve identified a good trade setup from a chart pattern I then move on to selecting the option strategy that I’ll use to structure that trade. There are numerous strategies available to option traders and I discuss most all of the them at various times in the Vega Options service but for purposes of this lesson I’ll start with the most basic trade structure of all, the long Call. Buying a Call acts as basically a less expensive way to simulate owning a stock, ETF or index. In this case, I’m looking to get long (bullish) GLD, the gold ETF. This is the point in the lesson that I’m going to introduce you to one of the option Greeks; Delta. If you aren’t familiar with option Greeks I recommend this explanation of option basics from Investopedia. Think of Delta as describing the directional risk of an option. The Delta of owning 100 shares of GLD (or any stock) is 100. Owning 1 contract of the January 2023 GLD 200 strike Call has a Delta of around 39. So, my ownership of the Jan2023 GLD 200 Call is equivalent to owning 39 shares of the ETF. If I own 100 shares of GLD and the price goes up or down by $1 then I’ll make or lose $100. If the price of GLD goes up or down by $1 but I instead own 1 contract of the 200 strike Calls I’ll make or lose approximately $39. Delta is not fixed! It changes as the price of GLD changes. You can see an option chain below of the various strike prices and the corresponding Deltas those options represent.

Now let’s move onto the trade structures that I’d consider to establish a bullish position in GLD. As mentioned above I could simply initiate a bullish GLD position by buying a Call. Below is the risk profile for a long Jan2023 GLD 200 Call. Simple enough. The defined risk of the position is the same as the cost. The mark price of the Call at the previous trading day’s close was $12.75 or $1,275 per 1 contract. I cannot lose more than that amount. The Delta is around 39 and the Theta is -1.45. Theta is essentially the holding cost of this position right now. I’ll lose approximately $1.45 per day by owning this option. The Theta loss will increase over time and eventually if the price of GLD doesn’t rise above 200 by Jan2023 I’ll lose the entire amount of $1,275. But don’t worry, I have strategies that will reduce that amount over time if the price of GLD rallies in the future. In fact, I’ll show you a way to actually lock-in a profit and still have the potential of making a much larger profit if price continues higher. You have to keep reading if you’d like to learn that strategy!

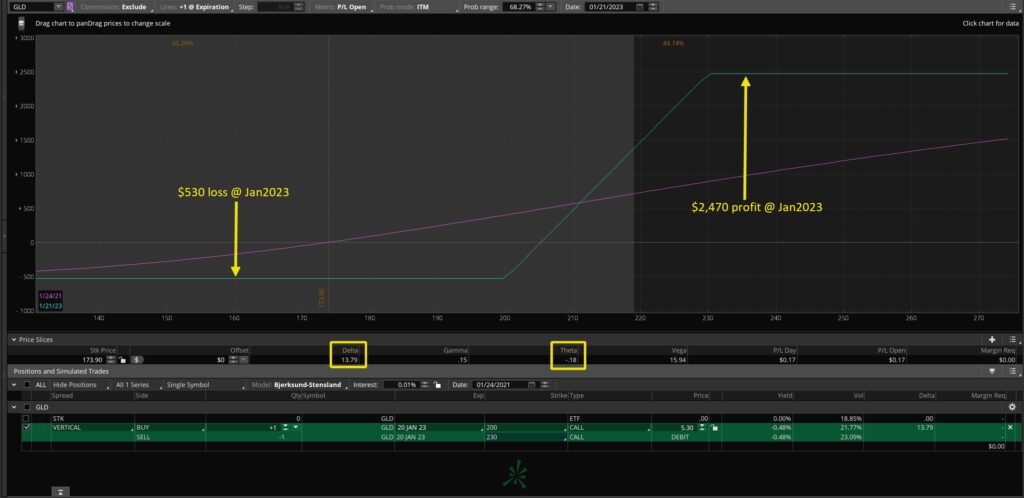

Now, there are ways to reduce the initial cost of establishing a bullish position. Below shows the risk profile of buying a Vertical Call Debit spread instead of just buying a Call. That entails buying a Call and selling a further out-of-the-money (OTM) Call. Below is an example of that strategy by using a $30-wide spread. That reduces the cost of my bullish position from $12.75 to $5.30 and it reduces the Delta risk from 39 to under 14. It also however limits the maximum amount I can make should GLD see price increase to more than $230/share by Jan2023. With reduced risk comes reduced maximum potential profits. That’s always the trade off in options.

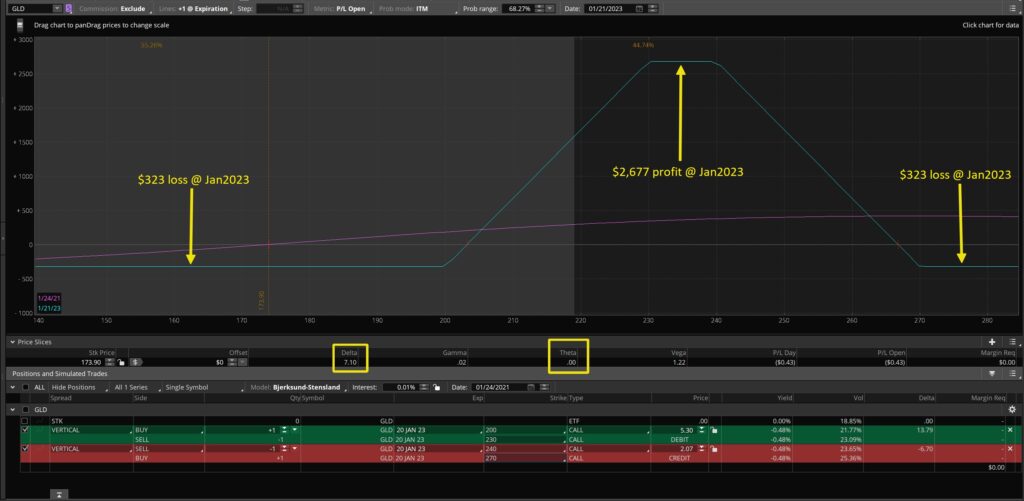

Can I reduce that initial cost even more? Of course! In order to do so however I need to sell off more of the potential upside profit. Below is the risk profile of a Butterfly Call spread. This option strategy would reduce the initial risk from $5.30 with the Vertical spread to just $2.70. The Delta risk has also dropped to less than 6. That means if GLD goes lower instead of higher in price over the next month or so I won’t lose much because I haven’t paid much for the position. Notice however that I’ve sold off all of the potential profits above 257.60 and I can actually lose $2.70 if GLD is above 260 as of Jan 2023. Of course, that’s if the trade isn’t managed along the way. What I mean by that is, if GLD rallies strongly for months and price is moving above the 250-260 area before Jan2023 I’ll likely be able to close the trade for a profit. So I’m not too worried about that $270 loss above 260 for now.

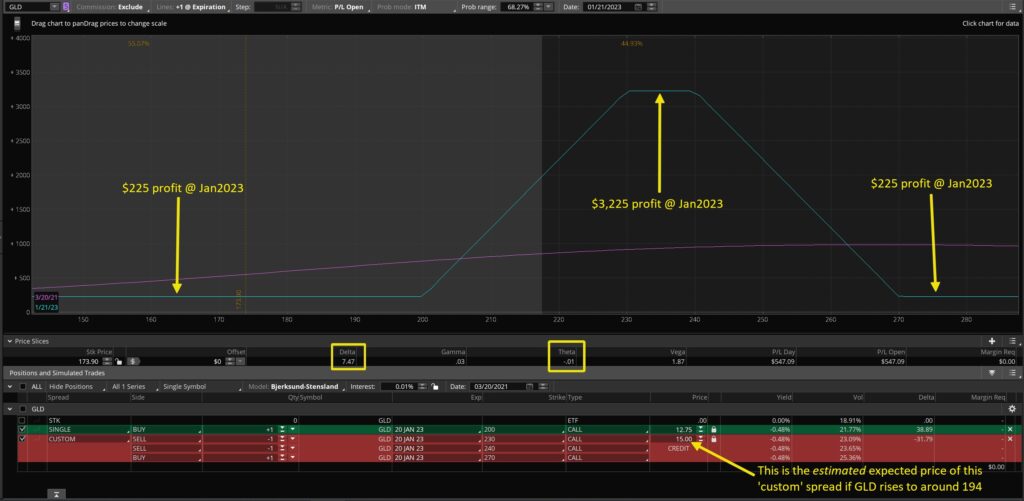

Below is a slight variation on the Butterfly spread that I just explained. This is a Call Condor spread. I’m not going to go in-depth on the difference but you can see that it increases the width of the maximum profit area. That increase in width comes at an increase in the cost of the spread.

Here’s where I’m going to show you a scenario where I could eventually own the Condor spread and have a guaranteed profit locked-in on the position. First, I’m starting off with just the long Call position, not the Vertical Call spread. That was the first risk profile that I showed. My option strategies and trades revolve around my chart analysis which updates constantly due to the price action. I like the current setup for a bullish trade and I’m willing to take the greater initial risk of buying the Calls without hedging that risk right now by selling further OTM options. Let’s just say, theoretically, that the price of GLD rises to my initial target of the previous pivot high at 194.45 within the next few months. If that happened I’d sell the ‘custom’ spread shown on the risk profile below. That custom spread would turn my long Calls into a Condor spread all in one transaction without the intermediate step of owning the Vertical Call spread first. If the price of GLD is near 194 then I’d likely collect around a $15.00 credit for selling the custom spread. Since the cost of the original Calls that I bought was a $12.75 debit then that would mean I’d locked-in a minimum $2.25 profit with a maximum $32.25 profit.

A lot of traders would take their profits and close the long Call position if price reaches the 194 area. And that would be a good trade however those profits would pale in comparison with the maximum potential profit of this position! How many times have you looked at a long-term chart of a stock and said ‘I wished I had hung onto that stock longer instead of selling it’? Once the cost of a position is eliminated or a profit has been locked in it is much easier to hold a long-term position and not be tempted to sell it prematurely. One other consideration. What if I’m able to lock-in the profit as shown above when GLD hits 194 and then price pulls back and then presents another bullish chart setup? I could then initiate a new position to add to the first. Now the potential profits really start to add up!

Vega Options is a options educational service managed by Paul Frey in conjunction with TheArtofChart.net. The service includes access to a private twitter feed and a private blog where option strategies and price action analysis are discussed throughout the trading day.

CLICK HERE for the Vega Options Free Trial.

Our other services are listed below.

24th Jan 2021

24th Jan 2021