Welcome to this week’s Crypto Market Weekly Outlook, post #351, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

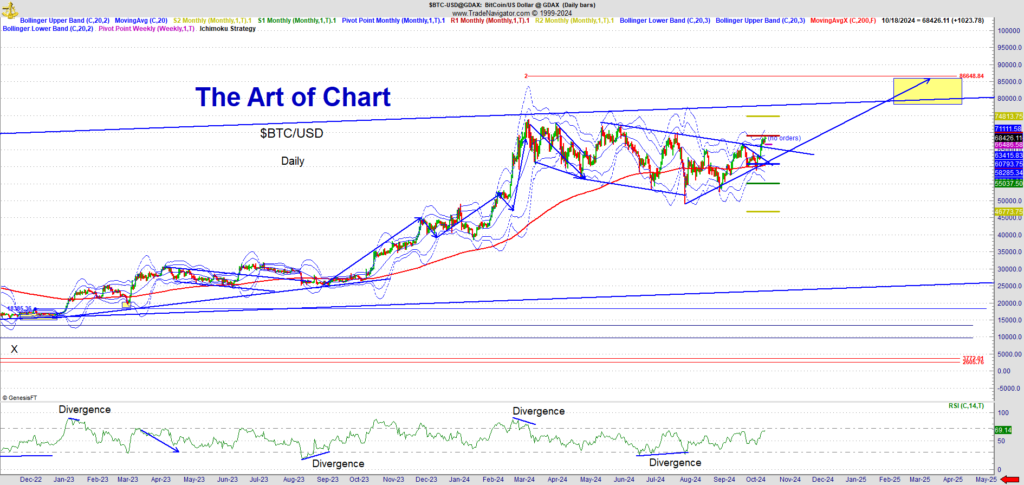

Bitcoin (BTCUSD)

Recent Developments: Bitcoin has experienced steady upward momentum over the past week, trading within a tighter range as market participants awaited regulatory decisions and global economic updates. The approval of a spot Bitcoin ETF by the U.S. Securities and Exchange Commission (SEC) remains the key focus. Speculation is growing that a decision could come soon, which has kept the market optimistic, despite minor dips in price. Global inflation concerns, alongside monetary policy shifts, have also contributed to Bitcoin’s safe-haven appeal. Institutional interest continues to grow as recent data shows increasing BTC accumulation by large holders.

Outlook: If the Bitcoin ETF is approved, we could see substantial upside movement as institutional flows would likely increase. Near-term support sits around key levels, while potential bullish targets lie above $35,000. However, caution is advised if there are further delays in the ETF decision, which could trigger short-term corrections.

Ethereum (ETHUSD)

Recent Developments: Ethereum has been trading in a consolidated range, supported by developments within its DeFi and NFT ecosystems. Layer-2 scaling solutions like Optimism and Arbitrum have continued to drive transaction growth on the network, providing much-needed relief for users facing high gas fees. Regulatory scrutiny has also weighed on Ethereum as the SEC considers potential Ethereum-based ETFs. Despite this, Ethereum remains a key player in the blockchain space, with consistent growth in decentralized finance (DeFi) and decentralized applications (DApps).

Outlook: Ethereum’s future trajectory will depend on how well it can scale and reduce costs for its users. As Ethereum prepares for the next phase of its development, including future updates in its roadmap like Proto-Danksharding, the token could see upside if scalability solutions continue to prove successful. Resistance remains at $1,800, with key support around $1,600.

Solana (SOLUSD)

Recent Developments: Solana has had an eventful week, with increased adoption in both the DeFi and NFT spaces. New Solana-based projects and collaborations, including major partnerships in gaming and decentralized applications, have added to its appeal. Additionally, Solana is seeing higher transaction volumes on its network, partially due to the release of the Solana Saga phone, which aims to integrate mobile Web3 experiences more seamlessly.

Outlook: With rising institutional interest and the blockchain’s growing ecosystem, Solana looks poised for long-term growth. However, network stability issues remain a concern for investors, particularly after last year’s outages. Traders should monitor both Solana’s technical improvements and its partnerships to gauge the token’s potential upward movement. Breaking through resistance at $35 could signal the next leg higher for Solana.

Litecoin (LTCUSD)

Recent Developments: Litecoin has remained relatively stable, with lower volatility compared to other major cryptocurrencies. It continues to be favored for its fast transaction speeds and low fees. As Bitcoin’s price moves, Litecoin often follows suit, though with a lag in both direction and momentum. Litecoin’s upcoming MimbleWimble upgrade is also drawing attention from the privacy coin community, as it will enhance transaction privacy while maintaining regulatory compliance.

Outlook: Litecoin may remain a lower-volatility asset, but significant moves in Bitcoin could trigger spillover effects. Traders watching for opportunities in Litecoin should consider its upcoming technological upgrades, which could improve its use case in privacy-focused transactions. Immediate support lies at $60, while key resistance is seen around $70.

Regulatory Landscape and Market Sentiment

News from Last Week:

- The SEC has once again delayed its decision on approving Bitcoin ETFs, leaving the market in anticipation. This decision comes amid increased pressure from institutional players and rising adoption of cryptocurrencies by traditional finance.

- On the global stage, G20 meetings have hinted at further regulatory clarity for digital assets, particularly stablecoins and decentralized finance (DeFi). Many countries are now coordinating to develop comprehensive frameworks for cryptocurrency adoption while balancing risks related to money laundering and terrorism financing.

Blockchain Ecosystem Developments Ethereum continues to lead the charge in decentralized applications, with Optimism and Arbitrum gaining traction in reducing network congestion. Solana, with its fast transaction speeds, is becoming the go-to blockchain for gaming and NFT projects, despite concerns over previous network outages.

What to Watch This Week

- ETF Developments: Any news on Bitcoin ETF approvals will likely cause substantial market shifts, with the potential for institutional inflows boosting prices across the board.

- U.S. Economic Data: Inflation and jobs data will play a key role in shaping investor sentiment. As macroeconomic conditions fluctuate, cryptocurrencies like Bitcoin and Ethereum may see increased volatility.

- Technological Upgrades: Watch for new developments from Ethereum’s roadmap as well as Solana’s infrastructure improvements, which could drive additional interest in these networks.

The cryptocurrency market remains cautiously optimistic as regulatory clarity and technological advancements are anticipated. Keep an eye on Bitcoin ETF news and stay tuned for more updates in the fast-paced crypto landscape.

Trade Smart and Trade Safe!

As always, the crypto market remains highly sensitive to external factors, including regulatory news and macroeconomic developments. Institutional adoption and technological advancements continue to play a critical role in shaping the future of major assets like Bitcoin, Ethereum, and Solana. Stay tuned for more updates, and trade smart, trade safe!

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

20th Oct 2024

20th Oct 2024