The Options Trading and Investing service provides perspective on high quality setups and option trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. This week we look to initiate positions in AAPL, RUT and VXX.

Please refer to our education video HERE for more information in the option strategies used in this post.

A summary of the plan for the week is summarized in the video below. The entries and cost basis will be highlighted on this post on our twitter feed. You can follow along HERE.

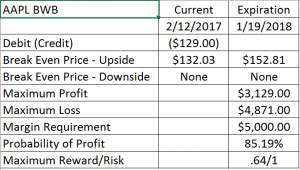

Apple Long Term BWB – Trade Not Initiated Yet, Watch Twitter Feed for Details

Let’s assume that I am long term bullish on Apple stock. I think it could be up another 10% by the end of the year and I would like to profit from that. However, with it’s current price near all time highs and Stan calling for a move lower to below 120 by July, I guess I’ll have to wait to establish a bullish position in July. Or not. One of the great things about option positions is that there is never a bad time to put a position on. I just need to come up with a position that will benefit from a move down to 115-120 by July and then a move higher to around 140-145 by the end of the year. Anything else? Well yeah, I also don’t want undefined risk to either side of the position because I don’t want to tie up too much of my available margin. How hard is it going to be to come up with a position that does all that? As it turns, it’s not hard at all.

Let’s assume that I am long term bullish on Apple stock. I think it could be up another 10% by the end of the year and I would like to profit from that. However, with it’s current price near all time highs and Stan calling for a move lower to below 120 by July, I guess I’ll have to wait to establish a bullish position in July. Or not. One of the great things about option positions is that there is never a bad time to put a position on. I just need to come up with a position that will benefit from a move down to 115-120 by July and then a move higher to around 140-145 by the end of the year. Anything else? Well yeah, I also don’t want undefined risk to either side of the position because I don’t want to tie up too much of my available margin. How hard is it going to be to come up with a position that does all that? As it turns, it’s not hard at all.

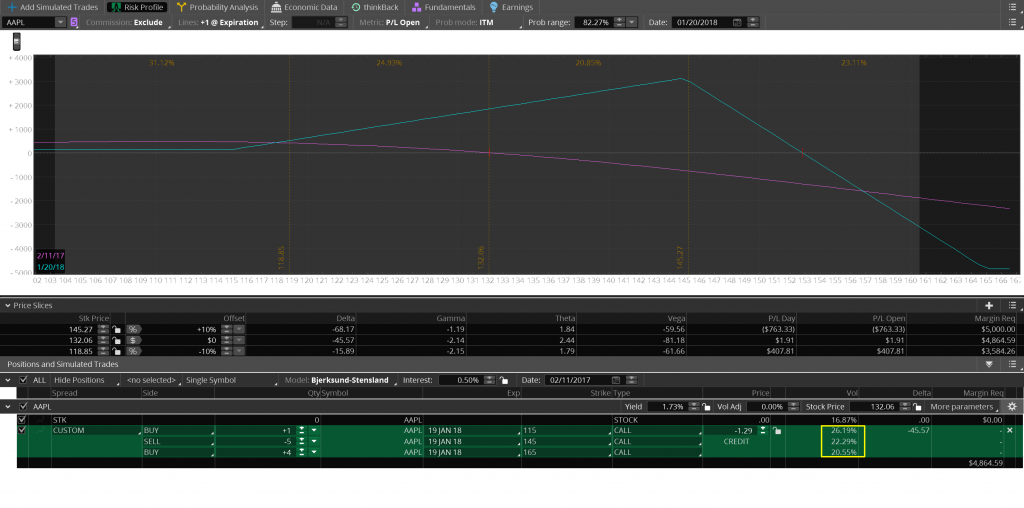

I am first going to set my upside price target as of year end at $145/share since that is a about 10% higher than the current price. I establish that target in the position by selling the Jan2018 145 strike calls. I would then like to buy the 115 strike calls as that is about as low as Stan thinks the price is headed in July. When it turns up again in the second half of the year I want to be long an in the money call to make a nice profit. So that objective is easy to accomplish by using a call ratio spread but unfortunately I can’t use that strategy because I have to define the risk on the spread to avoid using too much margin. That means I then have to go out and buy protective calls to limit the upside risk. I want to collect a credit on the position so that I have no downside risk into July and so this is the risk profile of the position I ended up with:

This is a variation of a Broken Wing Butterfly (BWB) but I had to make a couple adjustments to the position to fulfill all the requirements I had earlier mentioned. Never let it be said that option positions aren’t flexible. A typical Butterfly spread is a 1-2-1 configuration. This BWB is a 1-5-4 structure. Why? Look closely at the risk profile above. You will notice I’ve drawn a yellow box around the implied volatility(IV) of the 3 option legs. You can immediately see how relatively expensive or cheap an option is by looking at IV instead of just price. What is the most relatively expensive option based on IV? That is the 115 call at 26.24%. The second most expensive is the 145 call at 22.32%. The cheapest call is the 165 strike at 20.58%. (The IV on equity put options work just the opposite due to something known as option skew). If I buy fewer of the most expensive calls (115 strike), sell 5 times as many of the second most expensive calls (145 strike) and buy 4 times as many of the cheapest options (165 strike) I can put this position on for a credit which eliminates all risk to the downside. It also pays me if AAPL does nothing but trade in a range over the next year. In fact, as long as AAPL is below $152.81 at Jan2018 expiry this position is profitable.

This is a variation of a Broken Wing Butterfly (BWB) but I had to make a couple adjustments to the position to fulfill all the requirements I had earlier mentioned. Never let it be said that option positions aren’t flexible. A typical Butterfly spread is a 1-2-1 configuration. This BWB is a 1-5-4 structure. Why? Look closely at the risk profile above. You will notice I’ve drawn a yellow box around the implied volatility(IV) of the 3 option legs. You can immediately see how relatively expensive or cheap an option is by looking at IV instead of just price. What is the most relatively expensive option based on IV? That is the 115 call at 26.24%. The second most expensive is the 145 call at 22.32%. The cheapest call is the 165 strike at 20.58%. (The IV on equity put options work just the opposite due to something known as option skew). If I buy fewer of the most expensive calls (115 strike), sell 5 times as many of the second most expensive calls (145 strike) and buy 4 times as many of the cheapest options (165 strike) I can put this position on for a credit which eliminates all risk to the downside. It also pays me if AAPL does nothing but trade in a range over the next year. In fact, as long as AAPL is below $152.81 at Jan2018 expiry this position is profitable.

RUT Short Term BWB – Trade Not Initiated Yet, Watch Twitter Feed for Details

To really understand options you have to be able to deconstruct standard option strategies into their components or you’ll never reach your full potential as an option trader/investor. That is what I am here to help with, after all, this is an option education service. The key to profitability is understanding.

For example, what is a standard Butterfly spread? A Butterfly is nothing more than a vertical credit spread and a vertical debit spread where the long strike options are equidistant from the same shared short strike in the same expiry. A Broken Wing Butterfly(BWB) is just a Butterfly where the the long strike options are not equidistant. For instance, in the RUT BWB below, I show a put vertical debit spread that is $70 wide and a put vertical credit spread that is $30 wide. Both verticals share the 1330 short put. If RUT goes lower in price below the lowest strike price (1300) I can make $70 on the debit spread and lose $30 on the credit spread. That would leave me with a $40 profit except that I had to pay $19 to buy the BWB in the first place. That would leave me with a $21 net profit. On a RUT move to exactly 1330 at expiry and all of the puts except the 1400 strike expires worthless leaving me a 1400 put that would be worth $70 less the original cost of $19 or a $51 profit.

I show 2 other BWB’s on the risk profile above. All I did different was move each spread lower by $10. I wanted you to see how much that reduced the cost of the spread. If you expect a bigger move lower and don’t mind a lower probability of making a profit, you could select either of those 2 choices because you have a greater reward/risk ratio. Remember, in a Butterfly, the smaller the debit you pay, the lower the probability of profit is but the higher the reward/risk is.

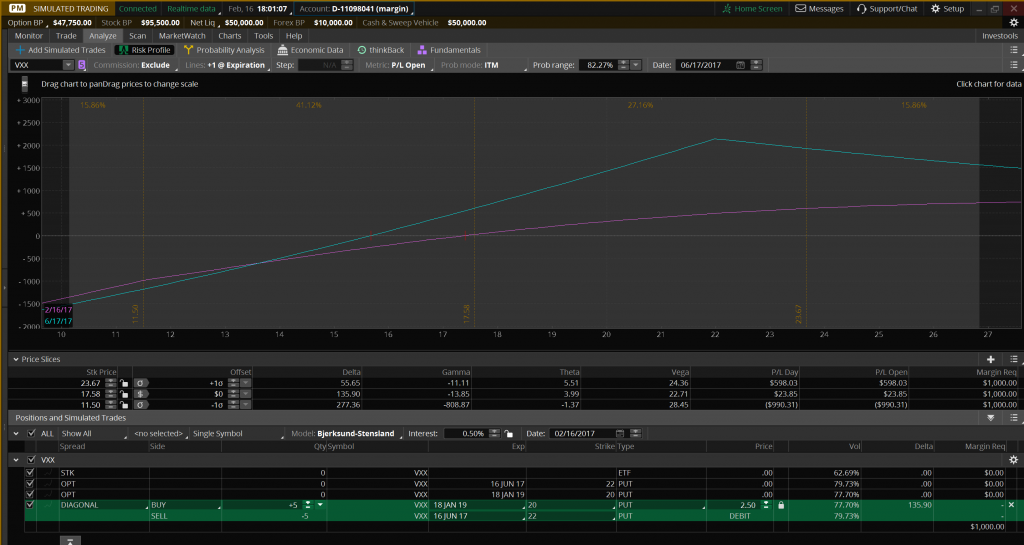

VXX Diagonal Spread – See 2/17 Update Below For Trade Entry

One look at a long term chart in VXX and you can only dream about how much money you could have made had you been short that ETN (exchange traded note) over the past 5+ years. Factoring in numerous reverse splits, the 5 year high price is around 1900 and the current price is below 19. Wow.

The returns from being short VXX over just the past 3 months has been astounding. There is a reason VXX goes consistently lower over time and that is due to the term structure of the VIX futures which is what VXX is based on. You can (and should) familiarize yourself with the instrument if you are considering trading it. Because there is so much profit to be made over time from shorting VXX, getting your hands on shares to borrow is extremely difficult and very expensive to hold as a short position even if you could find some to borrow. Throw on top of that the very real risk of a 20-50% price spike in VXX should the SPX hit a rough patch in the short term and it makes being short out of the question for most investors. Is there another way to profit from VXX’s inevitable path to zero?

Since this is an option post you probably already know that I am going to look at an option play to profit from this situation. This seems like the perfect opportunity for just buying a long term put since we know that over the long term VXX is heading lower. The problem is that it isn’t just us that knows that VXX is going lower over the long term, so does everyone else. That means that the expectation is built into the prices of long term puts in VXX so they are very expensive. If you watched the webinar on option strategies that Stan and I recorded you know that I always try to find a way to reduce or eliminate the cost of buying options by selling other options against the option that I bought. Let’s look at a couple of possibilities of doing that in VXX.

The first step in the process is to consider buying a long term VXX put option to start the position. The longest term options available on VXX are the January 2019 options. With VXX currently at $18.86 I could buy the Jan 2019 puts at the 20 strike for $8.35. I told you they were expensive! If I was to just buy that put I would need VXX to drop in price all the way to $11.65 over the next 709 days just to break even on the position. That is a heavy load to carry. So what can I sell to reduce the cost of those puts?

First, I take a look to see what Stan is projecting for the price of VXX. He is expecting approximately 23 by mid-March. Following a move lower into April we could see price rise to 25+ by July. I would look to sell some shorter term in the money(ITM) VXX puts because not only are the long term puts expensive but so are the short term ones as well, especially the ITM ones. For instance, I could sell some Mar31 23 puts and some June2017 25 strike puts and use the premium I collect to pay for part or all of the cost of the long puts. This would create a Diagonal Spread where I am short Mar31 and Jun2017 puts and long the Jan2019 20 puts for a greatly reduced price. So what do I need to happen to realize a profit in this position? If VXX rises to 23 or above by March 31st expiry, the quantity of 5 Mar short puts will expire worthless and I will be left being short only 2 of the June 25 puts while owning a quantity of 7 of the Jan2019 20 strike puts in VXX for a total cost basis of $2.09 per share. Then, if VXX drops in price late March into early April my long puts will go up in value more than I will lose on the short puts. When Stan projects that the next leg up in VXX into July is beginning, I will likely sell additional June 25 puts to cover the rest of the cost (and then some) of the original long Jan2019 puts. At that point I would have 3 possibilities. (1) I could sell the Jan2019 puts for much more than their net cost and be out of the trade with a nice profit. (2) I could close part of my position with the goal of using the profits from the part that I closed to reduce my cost basis of the remaining position even more. (3) I could keep all of the Jan2019 puts and continue to sell other shorter term puts against that position out into the future. For instance, after the June puts have expired or been closed out I could then sell additional puts month after month for the next 18 months to keep bringing in premium. Ultimately I would like to own Jan2019 puts in VXX that I actually purchased for a net credit. Other than in options, where can you go to get paid to buy something you want to own?

Now, eventually VXX is going to $0. Barclay’s will obviously reverse split the ETN before that happens but relative to the purchase of the Jan2019 20 puts, the value of VXX will literally approach $0 at some point in the future. So, if I did nothing else with those puts other than let them sit in my option portfolio until Jan 2019, they could be worth an amount approaching $15-$20/share. That of course depends on how the market performs between now and January 2019 but, other than short term spikes, VXX is heading lower.

Below is the risk profile of the VXX Diagonal spread from my ThinkorSwim platform. The distance between the purple current profit/loss line and the blue expiration profit/loss line is all Theta or time value. Getting paid just for the passage of time is good, wouldn’t you agree? Let me know if you have any questions on how to interpret a risk profile. I will be using risk profiles just like this in the future so I want to make sure everybody understands how to read it. Post any comments or questions below.

2/17/2017 Update: Got filled on the VXX Put Diagonal spread below for a $2.50 debit.

2/16/2017 Update: I will be looking to establish the VXX Put Diagonal spread tomorrow. Because VXX has dropped into the 17 handle I decided to slide the short puts down to the 22 strike in June. I will be buying the Jan2019 20 strike puts and selling the Jun16 22 strike puts and I would like to pay $2.50 for the spread. Based on a $50,000 option portfolio I will be buying a 5 lot (5 contracts each) for a total of $1,250. The margin requirement is $1,000.

All materials on this site are for EDUCATIONAL PURPOSES ONLY. None of the material present here on this website, subscriptions or associated emails are trading recommendations of any kind.

There is substantial risk of loss of capital when trading and/or investing. None of the material shown here is intended as recommendations for placing trades or investments. There is no warrant as to the completeness or accuracy of the materials presented. Any statement or opinion made on this website and associated materials are subject to change without notice. We do not guarantee any specific outcome or profit.

No compensation from anyone specific to the opinions expressed here has been received. Past performance is not indicative of future results.

Before acting on any information presented on this website, subscriptions or associated emails, you should consider if it is suitable to your specific circumstances and we strongly suggest you seeking advice from your investment adviser.

12th Feb 2017

12th Feb 2017

2/13 Update: Both RUT and AAPL moved higher today by <1% while VXX got crushed. If anyone thinks that VXX is basically the same as the VIX, today certainly demonstrates how different they are. Everyday VXX sells about 3% of it's front month VIX futures and buys the back month. Because of the normal term structure (aka Contango) of VIX futures, the back month futures are more expensive about 80% of the time. So today, even with the VIX up 2%, VXX was down 3%. I am still waiting on Stan to give me the go ahead on entering these positions as he thinks we're not quite there yet. The important lesson to be learned today is, even though I have the option strategy mapped out and ready to go, I saved myself some money by not executing the trades today. Tomorrow is another day…

For options swing trading purposes, do u look for reversal patterns on the hourly chart for trade entry?

Marci, you would treat entries on option swing trading the same as you would futures or equities. Stick to whatever method works best for you. If the hourly chart is most effective for you than by all means utilize it. Myself, I prefer using the ‘SJ’ method. That consists of watching Stan and Jack’s analysis and trading off of their signals! The more important point of swing trading using options instead of futures or equities is that you can utilize defined-risk strategies that can protect you if the underlying doesn’t initially cooperate. In my experience, defined-risk option strategies are far superior to trading non-option strategies in that I don’t use stop loss orders as I have already defined how much I am willing to lose at trade entry. Even if I am wrong about a turning point, sticking with the position often turns profitable after a stop loss would have taken me out of the position at a loss.