The Options Trading and Investing service provides perspective on high quality setups and option trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. We review current portfolio performance and an adjustment made this past week closing part of the GDX position. We discuss managing the VXX and EEM position and review our stock replacement strategy in Apple.

Please refer to our education video HERE for more information in the option strategies used in this post.

A summary of the plan for the week is summarized in the video below. The entries and cost basis will be highlighted on this post and on our private twitter feed.

The option portfolio was up $680 for the past week. The best open position is GDX with a $330 profit. In that position I actually closed 4 of the 10 long calls as I have started to take profits in anticipation of a pullback in price.

VXX has started to perform due to the increase in market volatility over the past 10 days and is now up over 10%.

The Apple Broken Wing Butterfly which expires in Jan 2018 continues to perform well. It is the stock replacement strategy that has no risk to the downside. Since we initiated the position, the price of AAPL is up less then 1% while the position is up 3.6%. At the current stock price, the position will gain more than $2,400 by expiry.

EEM remains the biggest drag on performance so I will review it to see if an adjustment is needed.

We have pending positions in SLV and AMZN waiting for a good entry opportunity.

Also, I am looking to add a good sized short position in RUT after we see an upward retracement of the current move lower. That position will probably be established within the next 2 weeks or so depending on Stan’s chart analysis.

All new trades will be posted on Twitter.

The portfolio had an existing position in GDX which was up almost $300. I didn’t want to close out the position but I did want to ‘scale back’ a bit as Stan thought that GDX was under-performing gold. When a position is less certain directionally I want to reduce the Deltas and increase the Theta. There is always a trade off between Delta and Theta but it is important to remember that Delta’s are very expensive. You want greater Deltas to take advantage of a directional move but during a less directional move Theta will contribute more to your profits. You can see the visual representation of Delta by viewing the purple current profit/loss line (CPL). If that line is has more slope that means the position has a higher exposure to price movement. When the CPL is flatter, price movement is less important and Theta impacts the position more. By selling 4 of the long calls and keeping all 10 of the short calls, I reduced the Delta and increased the Theta. I could sell a few more of the long calls in the coming week(s) if Stan sees a move lower coming and can actually cause the positon to go from bullish to bearish. When you manage an option portfolio you don’t necessarily want to always close out positions if you think the underlying has turned. Taking out most of the Delta risk but keeping some Theta could be beneficial. It also allows you to ‘cover’ a new position that you may initiate. If I add a bearish position and GDX goes higher instead, I could use the existing position to help reduce the loss on a bearish position gone bad.

Below is the current EEM risk profile. The common characteristic of most all of the option portfolio’s positions is positive Theta. That means that the position will profit even if the price of the underlying instrument, EEM in this case, doesn’t move. We are still expecting a large move lower in EEM into late summer but the move has been slow to get started. You can see the position is targeting the $33 price level in EEM by September 15th but we are benefiting from Theta right now as even if EEM doesn’t go lower the position will go from being our biggest draw down currently (-$379) to a $442 profit at expiry. Nobody likes to have a loss on a position but there is a big difference between needing a big directional move to repair your loss and just needing time to pass to resolve the problem!

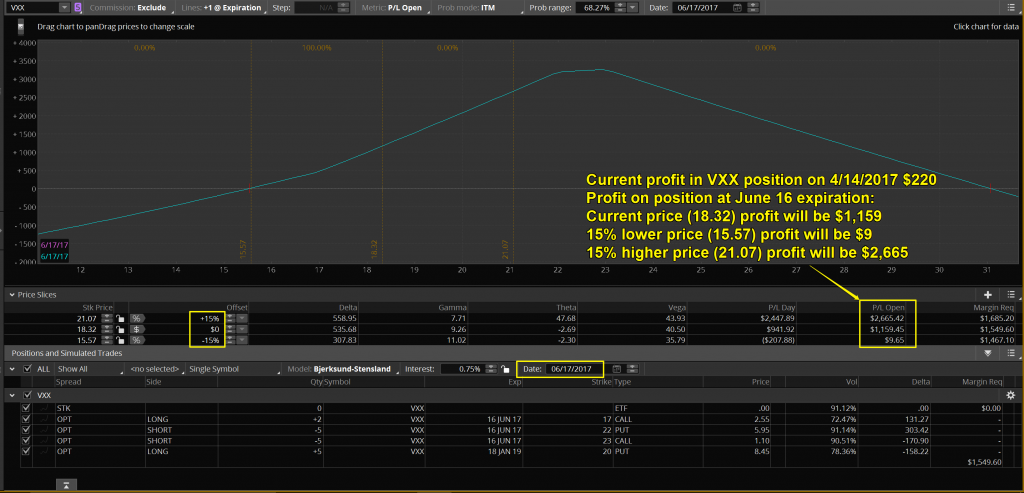

Below is the position in VXX. Current profit $220. Break even prices on the position: 15.50(15% lower) and 31.25(70% higher). Maximum profit at Jun16 expiry is $3,250. Current Theta of $14.52/day which is an average of over $5,000/year. Now the question becomes, can I sell off some more of the upside range? Do I need room for a 70% move to the upside?

The challenge becomes managing the CPL. If the CPL is flat or sloping down to the right and if the price VXX starts to accelerate to the upside, the position will have an accelerating loss because the CPL will be displaced lower on the risk profile. That is because the position is short 5 OTM calls which will get quite expensive if VXX volatility picks up. If Stan expects a drop in volatility later this week I will likely take advantage of that to sell a few more OTM calls with the idea of closing them out again for the move higher in vol into late summer. See updates on the Twitter feed.

Asymmetrical reward/risk. From the current profit of $220, a 15% move lower in price of VXX will cost the position $211 in lost profits. The same size move higher in the price of VXX will add $2,445 to the position’s profit. So, from the current position, I am risking $1 to make $11 on a 15% move. That is the value of Theta. If nothing happens to the price of VXX between now and June expiry, the profit of the position will go from $220 to $1,159. That means the position will earn $939 in Theta. That represents a 60% return on margin over the next 60 days which is an average of 1%/day. That is an annualized rate of return of 365% just in Theta. No price movement needed! However, unlike positions such as Iron Condors where you generally don’t want any price movement, this position is ‘skewed’ to the upside to coincide with Stan’s chart analysis. This is how the option portfolio takes advantage of directional calls from Stan while profiting from the passage of time.

Save

Save

16th Apr 2017

16th Apr 2017