The Options Trading and Investing service provides perspective on high quality setups and option trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. I review current portfolio performance and adjustments made this past week on the GDX and IBB positions. I discuss the possibility of an adjustment to the USO position early this week. Finally, I compare a Vertical Put Spread and a Put purchase to evaluate which represents a more efficient use of trading capital.

Please refer to our education video HERE for more information in the option strategies used in this post.

A summary of the plan for the week is summarized in the video below. The entries and cost basis will be highlighted on this post and on our private twitter feed.

Portfolio was up $257 for the past week. The best open position is short USO (oil) with a $507 profit. We will likely hedge that position on Monday as Stan thinks we should see a move higher for a few days.

As has been the case for weeks now, EEM continues to be the biggest drag on performance but the structure of the position is good and no adjustment is needed. We are just waiting for the move lower to really kick in.

No change to the pending positions in SLV and AMZN discussed 2 weeks ago. Still waiting for the right entry point.

I sold another 4 of the GDX Sep 28 calls leaving the position long just 2 calls (originally the position was long 10 calls) and still short 10 Jun 30 calls. I’ll explain that coming up.

If you have watched Stan’s weekend update video that he posted yesterday you can see that the SPX and RUT may be close to providing us with good trade location for a sizable move lower into summer. However, a few more days of price action should give him a better feel for whether the market moves to new highs first so I’ll continue to wait for his confirmation of a move lower before initiating a short position.

Both option trades this week were overlays of existing positions. It isn’t necessary to establish positions on new underlying instruments in order to continue to build the option portfolio. There is a risk of making an option portfolio difficult to manage it there are an excessive number of underlying instruments.

All new trades will be posted on private Twitter feed.

Below is the current IBB risk profile after the 4-21 adjustment. I bought a Sep15 IBB 250 put for 4.30 and sold 3 Sep15 IBB 220 puts for 1.60 each. That means I established a 1×3 Put Ratio Spread for a $.50 credit ($50 for the 1 lot). Because I collected $50 to initiate the position I actually reduced my upside risk in the existing position by $50. By selling the 220 puts I establish that as the target price where the position will make it’s maximum profit as of Sep 15th. That aligns with Stan’s chart analysis for IBB. The position will have positive Theta on the move lower and the current price is right at the breakeven price so even if IBB doesn’t make 220 by Sep the position can show a nice profit.

Below is what is remaining of the original GDX position. If you remember, that was a bullish position consisting of a short vertical put spread and a long call diagonal spread. I closed the put spread on 4-7 for a $220 profit and now have sold 8 of the 10 long Sep 28 calls for a $148 profit. In total, the portfolio has realized a $368 profit from the bullish position and, as shown below in the risk profile, could potentially see up to $700 in additional profits. We can only lose $25 if GDX goes lower as Stan is projecting it to. The risk/reward is such that it makes no sense to completely close the position at this point. There is still a total of $120 of premium in the short Jun 30 calls so I would only close them if I needed the margin relief which the portfolio does not need at this point.

Below is the new GDX position. This is a Ratio Diagonal Spread. Is that even a thing? Why would I choose this particular strategy? My primary goal in building an options portfolio is to acquire assets (long options). My secondary goal is to create liabilities against those assets (by selling options) to reduce their cost basis and create positive Theta for the portfolio. So, first step in this trade was to acquire 3 of the Jan2018 GDX 25 Calls because Stan is longer term bullish on GDX. Those cost 2.43 each or $729 for the 3 contracts. However, Stan is quite bearish in the shorter term so I wanted to reduce my cost basis in the assets. I sold 6 of the Jun16 GDX 24 calls for 1.14 each or $684 for the 6 contracts. My total cost for the spread is a net $45. What needs to happen for me to own the 3 Jan2018 calls for that total price of $45? As long as GDX is below 24 as of Jun 16th, those Jun16 calls (the liability) expire worthless and I own the 3 Jan2018 calls (the asset) for the net down price of $15 each. What then? If Stan is still bullish GDX at that point, I will keep the calls but I will most likely sell other upside calls against them to reduce, or more likely, completely eliminate the cost basis giving me ‘free’ assets. It is quite possible that between June 16th and Jan 2018 I will sell multiple expirations of calls that may end up in my owning assets that I have a net credit on It’s nice to be paid to own assets!

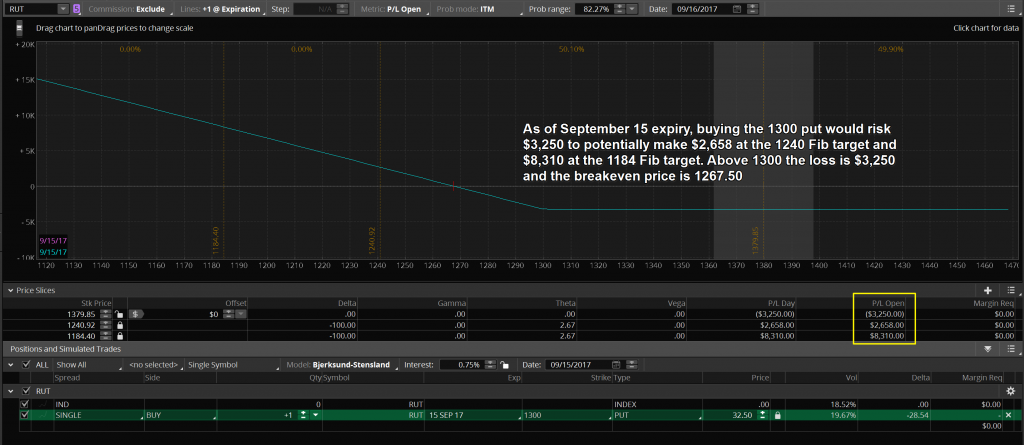

Below is the RUT chart from Stan’s weekend update. As of now, he has likely Fibonacci targets of 1240.92 and 1184.40 by Aug/Sep. How can you profit from those targets using options? There are many different trade structures to utilize for a large move but many option traders still use long puts to capture a large move. My main goal in this options education service is to show option traders and investors that by including the selling of option premium in your strategies you will reduce your cost(risk) and increase your probability of profit.

Buying a RUT Sep 1300 Put. At Friday’s close, that put would cost $32.50 or $3,250 for 1 contract. On the risk profile I show what the profit would be at Stan’s 2 fib targets as of September 15th expiry.

Buying a RUT Sep 1300/1200 Put Vertical Spread. At Friday’s close, that spread would cost $16.90 or $1,690 for a 1 lot. By selling the 1200 put I bring in $15.60 ($1,560) in premium. Because of collecting that premium, I take advantage of positive Theta if the price of RUT declines below 1300. On the risk profile I show what the profit would be at Stan’s 2 fib targets as of September 15th expiry.

Let’s compare the strategy of buying a put versus buying a put spread in the table below. Clearly, reducing cost basis and increasing probability of profit (by raising the breakeven price in this instance) is the better use of trading capital. I added a 3rd row in the strategies table below to compare buying a quantity of 2 of the vertical put spreads or buying 1 put. Look at the difference in potential profits from spending just an extra $130 to buy 2 vertical spreads instead of 1 naked put.

There are many other strategies that I use to reduce cost basis plus I use various adjustments to existing positions where I try to reduce cost basis as much as possible but, for now, I will stop here and let you consider whether it is the best use of your capital to simply buy a put to capture a large expected move lower.

23rd Apr 2017

23rd Apr 2017