The Options Trading and Investing service provides perspective on high quality setups and option trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. Today we review current portfolio performance and a new position established in XRT. I also discuss an additional Ratio Spread in IYR and the evolving position in RUT. Finally, I check back in the AAPL Stock Replacement Strategy to monitor it’s performance.

Please refer to our education video HERE for more information in the option strategies used in this post.

The entries and cost basis of new positions will appear on our private twitter feed during the coming week.

The option portfolio has a total profit of $969 since mid-February inception. The average margin used over that time period has been around $20,000 which gives the portfolio a 20%+ annualized return on margin to date.

The most profitable open position is the short USO (oil) position with a $543 profit. Just below that position in profitability is the RUT Broken Wing Butterfly w/ hedge that finished the week up $525. The remarkable fact about that position is that the total risk is just $260 so the position is currently up over 200% on risk.

Last week I added a new position in XRT which is the retail ETF. The position is a Sep15 Vertical Put Debit Spread that was purchased for a .99 debit.

The worst performers in the portfolio continue to need only a move of 2-3% lower to be profitable and they still have 4 months to expiration so those positions are still a hold. VXX needs a spike in volatility in order to be profitable and there are options expiring in June as part of the position so that may need an adjustment in the next couple of weeks.

All new trades will be posted on the subscriber Twitter feed.

This is the IYR position after the May 3rd trade. $875 of risk if IYR is above 78 @ Sep15 expiry, $2,225 profit if price is between 68 and 73 @ expiry. Profit then begins to decline but position is profitable anywhere between 60.59 and 76.24.

Tweeted this intended trade adjustment on May 1st and actually got filled on May 3rd. Patience pays!!!

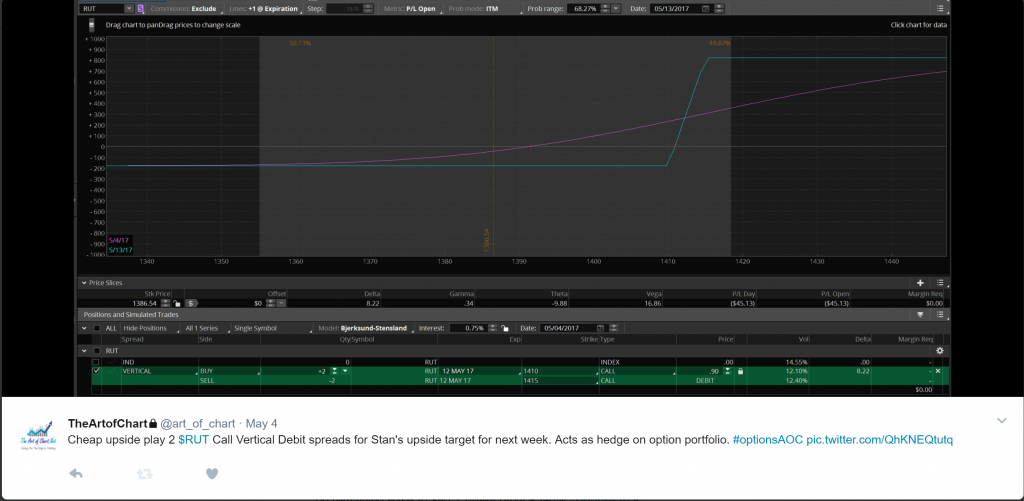

On May 4th I added an inexpensive hedge to the RUT position as well as hedged the overall portfolio slightly by buying a 2 lot Vertical Call Debit Spread. The spread cost $.90 and could potentially be worth $5.00 if RUT is above 1415 on May12 expiry. I am risking $180 to potentially make a profit of $820. This is also a portfolio hedge because I am short multiple positions that generally are highly correlated with the RUT.

Here is the current RUT position. The current profit is $525. If RUT finishes this week in the 1415 to 1420 range the position will be up $1,100 to $1,200. The worst outcome would have RUT finishing the week at 1410 which would leave the position with just a $200 profit. I will monitor this position closely early in the week and see what Stan thinks about the upside in RUT.

The portfolio’s long term Stock Replacement Strategy. This position was established with AAPL at 139.79 with the thought that AAPL was getting close to a turn. AAPL is now close to $10 higher in price so how is the position doing? It is currently down $187 so is the position in trouble? First, the position gets shorter in Deltas as the price of the stock moves higher because if AAPL is above 158.32 @ expiry the position will not be profitable. I am essentially synthetically short approx. 78 shares of AAPL currently. How much lower do I need the stock to go to make a profit? Zero. In fact, is AAPL is at this price level @ Jan2018 expiry I will have a $3,230 profit which would be a 65% return on margin for a 11 month position (71% annualized return). This is unlike any position where you just bought an option because time will repair all of the short term losses of $187 plus add another $3,230 of profit. Nobody like a short term loser but it is much easier holding a position like this than needing a large move up or down to repair a losing position!

07th May 2017

07th May 2017