The Options Trading and Investing service provides perspective on high quality setups and option trading strategies. We carefully select these setups due to their quality and profit potential and we report back on results. In the weekend free webinar I review current portfolio performance and I also discuss techniques that I utilize to help reduce risk and, in some instances, lock in profits from previous trades. This week I discuss positions in GDX, EEM and SPX.

Please refer to our education video HERE for more information in the option strategies used in this post.

The entries and cost basis of new positions will appear on our private twitter feed during the coming week.

The best position in the portfolio percentage wise remains the short XRT position with a 45.5% profit. EEM continues to be the biggest under performer.

Below is the list of the closed positions from previous trades. The total profits from all closed positions is $2,382. The open positions need the market to turn lower in order to turn profitable. I took $583 in profits on the short oil (USO) position last week by closing 33 short puts. My intention is to sell more puts in the coming week(s) as oil is projected to head lower once again.

All new trades will be posted on the subscriber private Twitter feed.

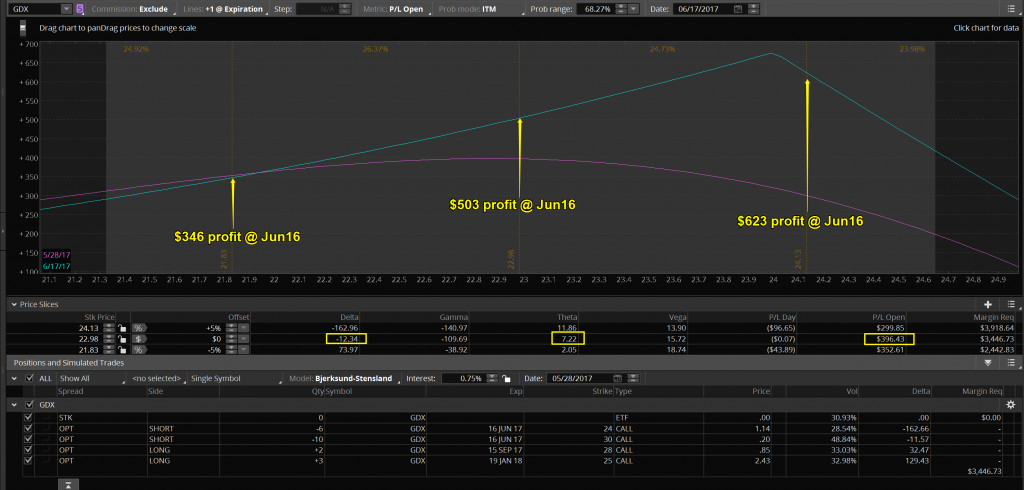

Below is the current position in GDX. This is a ‘workhorse’ position. These are the type of positions that just keep grinding out profits. You don’t see spectacular returns or $200 up or down days but they are very forgiving positions. You can see on the risk profile below the current price plus the 5% plus/minus price slices. Over the next 19 days the position could come close to doubling it’s current profit on an approx. 4% move higher. The position can easily handle about a 4% move lower (or less) without giving back any of it’s current profits. A point of interest here to newer option traders is that while you can see that the position will benefit from a move higher between now and Jun16, the position is actually short 12 Deltas. That just means that the CPL (current profit/loss line) is sloping down to the right (higher price in GDX) but the XPL (expiry profit/loss line) is sloping sharply upward. If Stan was projecting a sharp move higher immediately I would probably lay a Call Vertical Debit Spread on top of this position to benefit from that. Similarly, on a projected sharp move lower I might add a Put Vertical Debit Spread. Either way I would keep this position intact just in case not much of anything happened.

Below is the current position in EEM. Notice the P/L Open. You can see the current open loss of $835 and what that loss would be if the price of EEM were 1% and 2% higher or lower at the current date. This is a short (negative) Delta position so obviously the position would be much better off if EEM were lower by 1% or 2% rather than higher. This position has been hurting the portfolio performance almost since day 1. Having said that however, there still is time as all of the options are in the Sep15 expiry. Is there something I can do in the short term to chip away at the current loss if Stan thinks EEM might drift higher still over the next week?

Below is a 10-lot Put Diagonal Spread. This position would be long almost 200 Deltas and would offer positive Theta in contrast to the negative Theta the current position has. If EEM closes the week at 42, this position should bring in around $230 in profits. Even if EEM is relatively unchanged on the week this will be slightly profitable. If EEM does close at or slightly above 42 by the end of the week the 42 puts will expire worthless and I will own the Aug18 EEM 41.5 puts for the net down cost of $.79. At that time, again if EEM is around 42, I could probably sell the Aug18 EEM 40.5 puts for around $.79. That would mean that I would own the 41.5/40.5 Put Vertical Debit Spread for free. A 10-lot $1 wide vertical spread can be worth $1,000 less the cost of purchase. If the purchase price is $0 then I have no risk and a $1,000 max profit if EEM is below 40.5 at Aug17 expiry. That would completely wipe out the current $835 loss.

Below is what the combined position would look like. Instead of being -182 Deltas this week, the position would now be +15 Deltas for this week only. The position would also be earning positive Theta and would benefit from a drift higher. I would not make this adjustment if I was expecting EEM to move sharply higher or lower this coming week. Sharply lower would profit from the existing position with no adjustment. Sharply higher would need a different adjustment such as adding call vertical debit spreads. Before I actually place an adjusting trade I will find out what Stan is projecting for EEM this week. I already know that he feels quite strongly that EEM is very close to a turn here and should head considerably lower so this adjustment is not needed for anyone who is comfortable waiting it out just a little longer.

Below is a SPX position that I am considering adding to the portfolio as an upside hedge. The relentless grind higher in SPX has stressed the option portfolio as I have been positioned short for quite some time now. However, I have no intention of ‘flipping’ long at this point but I do have to consider limiting the damage to the portfolio should this grind continue awhile longer. I am considering positions with limited downside exposure that will reduce portfolio losses on a move higher in the short term. Possibility #1 is below. This position would risk $205 to the downside which is acceptable based on the profits that I will be accruing in the rest of the portfolio if SPX heads lower immediately. This position will generate a $2,295 profit if SPX is 1% higher than current price at Jun16 expiry. However, if SPX is much higher than that I will have a loss of up to $1,705. This would be a short Delta position on day 1 meaning I would have a short term loss immediately if SPX goes higher. If I am trying to protect a short Delta portfolio this position looks inadequate.

Below is possibility #2 that risks the same $205 amount to the downside but allows more room to the upside. In order to do that I had to push the expiry out by 5 days to Jun21. Here you can see the max profit of $2,295 occurs beyond 1% higher in SPX. The Delta of the position is less short so an immediate move higher in SPX incurs less of a short term loss. Still however, if SPX immediately moves higher and continues the upward grind, this position may also be slightly inadequate.

Below is possibility #3 that risks $15 more than the previous 2 positions. But look at the extra Deltas I have purchased for that $15. Now, if SPX goes higher immediately and then continues it’s upward grind, this position is profitable from day 1. The reward/risk ratio is good but the only way this position pays at Jun9 expiry is if SPX is between 2442 and 2468 which is a relatively narrow range.

As you can see from this slide and the previous 2 slides that they are multiple ways to take advantage of a projected move. There is no right or wrong position and ultimately, you need price to cooperate in order to see big profits. However, the one thing you do absolutely control at trade entry is your risk. Using defined risk positions, such as these, allows you to play a projected move without getting hurt badly. You always want to control risk so you can live to play another day!

28th May 2017

28th May 2017