The Options Trading and Investing service provides perspective on high quality setups and option trading strategies. We carefully select these setups due to their quality and profit potential and we report back on results. In the weekend free webinar I review current portfolio performance and I also discuss techniques that I utilize to help reduce risk and, in some instances, lock in profits from previous trades. This week I discuss positions in GDX, AAPL, VXX, EEM and XRT.

Please refer to our education video HERE for more information in the option strategies used in this post.

The entries and cost basis of new positions will appear on our private twitter feed during the coming week.

Another good week for the option portfolio as it was up $400 over the previous week and up approx. $1500 over the past 2 weeks. It now has $4,899 in profits on closed positions. It is very common for the open positions to be at a loss in a longer term option portfolio because much of the profits accrue from the passage of time (Theta). As I close out positions it constantly drops the P/L back down on the ‘open’ positions. A good example of that is GDX where the open position shows a $486.50 loss but I have closed (realized) profits of $1,163 since May30. We are well positioned to make additional profits if the market indices move lower into late summer/early fall.

All new trades will be posted on the subscriber private Twitter feed.

Below are 3 images from my tweets to the subscribers from this past week. If you are not a subscriber, consider the 30 day Free Trial.

On Friday 6/16/2017 I closed the Jun16 GDX 22.5 calls for $.01 making my profit for the trade $417 and I am now able to sell more calls against the Jan2018 calls to generate more Theta.

On 3/3/2017 the closing price on GDX was 22.20. This past Friday’s close was 22.06. The price of GDX is just 14 cents lower over that time period and yet the GDX option positions have contributed over $1,500 in realized profits and $1,000 in total profits to the portfolio. How does that happen? Stan has been spot-on in his short-term price and time projections and I have utilized option strategies that have been heavy on Theta so that the positions are profiting from time as much as price direction. I still own 2 assets in GDX, 3 Jan2018 GDX 25 strike calls and 2 Sep15 GDX 28 strike calls. The liabilities against those assets have been closed or have expired so I am now able to sell more calls against them to generate more premium from Theta. Rinse and repeat, over and over.

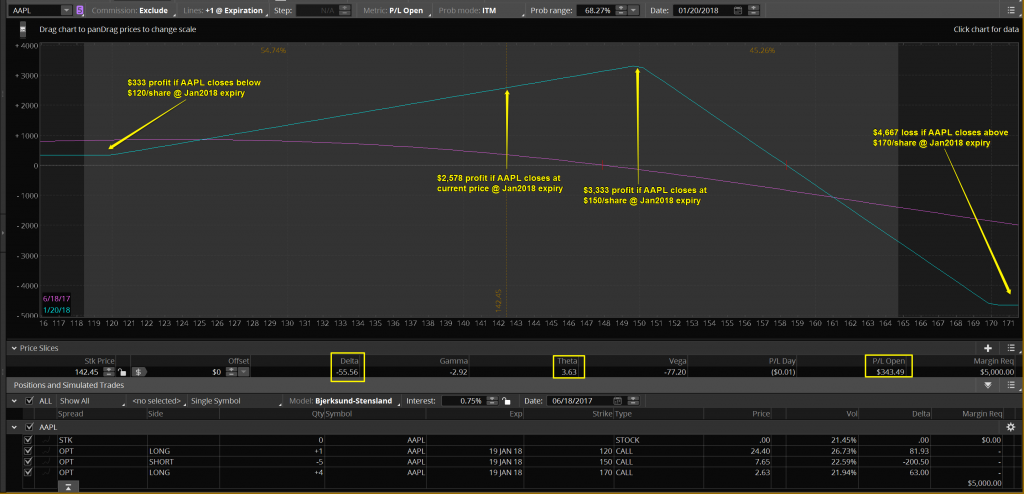

Below is the current position in AAPL. It is a long-term Stock Replacement Strategy that deserves a place in any option portfolio. Why do I call it a stock replacement strategy? What advantages does it have over simply buying the stock? As you can see below, the position is profitable as long as AAPL’s price is below $158.34. There is no risk to the downside. That feature is not available if you purchase the stock. This position doesn’t benefit from a big move higher like owning the stock does. That has been the big advantage to owning the stock over the past year. Will that continue? Stan doesn’t project that to continue in the Big Five Chart Service view of AAPL. If you are not a subscriber consider the 30 day free trial to see where he and Jack think AAPL is headed over the next year. Going forward I will keep an updated comparison of how this strategy has performed in comparison with owning the stock so we can all see how it is working. As of the close on Friday 6/16/2017: The option position I established used up $5,000 of margin. For that amount of margin, I could have instead bought 72 shares of AAPL stock at $139.79 on 3/1/2017. On 6/16/2017, AAPL closed at $142.27/share. If I had bought the stock my profit would be $178.56. The option position currently has a gain of $343.50. That means that the option position has out-performed the stock purchase by $164.94. That is an improvement in performance of $1,083.62 since last week.

Going forward I will keep an updated comparison of how this strategy has performed in comparison with owning the stock so we can all see how it is working. As of the close on Friday 6/16/2017: The option position I established used up $5,000 of margin. For that amount of margin, I could have instead bought 72 shares of AAPL stock at $139.79 on 3/1/2017. On 6/16/2017, AAPL closed at $142.27/share. If I had bought the stock my profit would be $178.56. The option position currently has a gain of $343.50. That means that the option position has out-performed the stock purchase by $164.94. That is an improvement in performance of $1,083.62 since last week.

This was the question I asked on the June 11 webinar when the stock position was out performing the option position by $918.68: If I was allowed to switch positions and take the stock position and the open profit but I had to hold whatever position I owned through Jan2018 expiry, would I make the switch? Not a chance! How about you?

What if the price of AAPL on Jan19, 2018 is the same as the current price, what will the positions be worth? The stock will still maintain a $178.56 gain plus $136.08 in dividends for a total profit of $314.64. The option position will have a total profit of $2,578.

Why longer-term option positions make up the majority of the Art of Chart’s option portfolio.

Consider the AAPL position I just discussed. I established the position when AAPL was trading at $139.79 on 3/1/2017. To be profitable, AAPL could trade higher or lower or unchanged but the area where the position would lose at expiry was above $158.34. The area where the trade would be unprofitable immediately after the position was established was any price higher. In other words, the position was short-term bearish and long-term neutral to bullish. So what happened after I established the position? Of course the stock moved against the position and traded as high as $156.65 on 5/15/2017. Any bearish to neutral short-term (less than 60 days) strategy gets blown up and takes a loss as it expires. With this position I was able to ride out the storm and keep the position which has now turned profitable.

So what about the short-term traders? You can still be a short-term option trader and utilize longer-term option positions. Let’s look at this past week in AAPL with the Jan2018 position that I own in the portfolio. Let’s say I felt AAPL was going to have a bad week and I wanted to take advantage of that. What if I didn’t already own my current position and I initiated it just before the close on Friday, 6/9/2017. So the stock drops by 4.5% but the option position would have had a $600 profit in one week which is a 12% profit on $5,000 margin requirement. If I was a short-term trader I could have closed the position this past Friday and booked the $600 profit. Now, if I knew that AAPL was going lower this past week I could certainly have used a much more profitable short-term strategy instead but the problem is nobody knew what the price of AAPL was going to do last week. Stan likes to say that his good chart patterns play out about 70% of the time which is a huge advantage in trading however no one should take that to mean 100% certainty! I have been trading over 30 years and the current market is as ‘distorted’ as I ever remember. This relentless grind higher has only been seen a few times in recent decades. Art of Chart option trading is about maximizing the range of profitability that you can get with longer-term positions while incorporating Stan and Jack’s price and time targets to reduce the cost basis of entering the positions. This method will produce slower profits but fewer losses and, over time, more consistent profitability with lower trading costs.

I will have some new positions to add or adjust this week and I will notify subscribers through the Twitter feed.

That is all for this week. If you have questions or comments you can post them here on the blog or if you are an Art of Chart subscriber you can post it on the private Twitter feed. If you are not a subscriber you can sign up for a 30 day Free Trial to try out the service. What have you got to lose, it’s free!

18th Jun 2017

18th Jun 2017

Hello,

Any plans to adjust TSLA, IYR or IBB soon? Or waiting for a turn? Any reason why the EEM tweeted this week was not lowered to no credit or a small debit rather from a .05 credit?

Ed

Ed, I often use Ratio Spreads such as I showed in the EEM tweet from this week as a ‘trade repair’ strategy. Obviously the current EEM position can use some help. The reason I am hesitant to add the ratio spread for $0 or even a small debit is because it just adds to the loss in EEM if it continues to move higher. There are 3 possible outcomes in the price of EEM thru Jun30 (the expiry of the ratio spread I was looking at); it can go up, down, or remain unchanged. If I add the position for a debit I lose money in 2 of the 3 outcomes. When you factor in commission costs, even if I put the position on for $0 I lose with 2 of the 3 outcomes. I can ‘force’ a credit by selling more downside puts in the position but then I am at risk if EEM moves sharply and quickly lower. The other way to generate a credit without selling more puts is to extend the duration of the position. If I do that however I risk having EEM move through the expiry profit area of the ratio spread to the downside before the Theta has a chance to push the position into a profit. Ratio spreads are a balancing act where you can get into trouble if you are not careful. The ideal time to enter the position is near the end of the ‘A’ wave of a 3 wave move lower. That is what I am shooting for in EEM. I will look again at the position today to see if I can tweak it to make it work.

As far as IYR and IBB I will look at them also. The TSLA position is un-repairable. There is no point in spending time looking at an ‘adjustment’. I can establish a new position if I think there is a good opportunity there.

Thanks. TSLA probably is not worth looking at until it breaks the 9 ema. Will be interesting to see if it form a double top here.