I am currently holding a long-term bullish GOLD (Barrick Gold Corp) position which has a 98% probability of profit. Now I am not a probability trader but I know some of you are so I like to mention it occasionally. I arrived at this position by buying (25) Jan2021 GOLD 20 Calls on 11/18 and selling (30) of the Jan2021 GOLD 22 Calls on 12/24. I used the rally in price during that time to remove all risk and lock in a minimum $105 profit *as long as price is below 32 at Jan2021 expiry.* Consider a free trial to the options service (see link at the bottom of the page) if you would like to learn this and many other option strategies!

I like the gold miner position but I also like the precious metals in general. Today I am considering adding a new position in silver (SLV). One of the benefits of taking risk out of the GOLD position is that I can leverage my exposure to the precious metals sector without letting the sector risk exceed a reasonable percentage of my portfolio. When I sold (30) of the Jan2021 GOLD 22 Calls I brought in $3,780 in premium. I can now take that money and put it into a SLV trade. I will then own two separate positions with the risk of just one position.

I’m not quite ready to initiate a new position in SLV. I am hopeful I will get a better buying opportunity as early as this week. Here is what I am seeing on the chart.

Below is the risk profile of long Calls in SLV. I often initiate longer-term positions by simply buying options but it is always with a plan to sell additional options to hedge the position and to reduce the negative Theta that comes with long option positions.

I could wait to sell the hedging options later as I did with the GOLD position or I can do it now. Let’s look at one way to do it now. To be clear, this position is the hedge to be applied to the long Call position shown in the risk profile above. In the risk profile below you’ll see that I would be selling a 10×20 Mar20 SLV 17/18 Call Ratio Spread for a $.02 Credit. Since this position is initiated for a Credit I don’t have to close it out if SLV goes lower in price instead of higher as I expect. This position only generates a loss if price goes much higher and, if that happens, the long Calls would be showing a bigger profit.

When the two positions are combined the risk profile below shows the position would show a nice profit if SLV is around the 18 strike at Mar20 expiry. In fact, the profit from the Ratio Spread would exceed the cost of the long Jan2021 Calls. So, if SLV is around 18 at Mar20 expiry, the Ratio Spread is closed out and the *net* cost of the long Calls is less than zero. I would still have 10 months of duration left in those Calls where I could continue to sell other options to bring in more premium!

This week, subscribers also will see a new two week position in TSLA based on the current price action.

That is all I have for you now. If you are not a subscriber and you would like access to the Options for Income subscriber chat room, you can sign up for a 14 day Free Trial to try out the service. What have you got to lose, it’s free!

CLICK HERE for the Options for Income Free Trial.

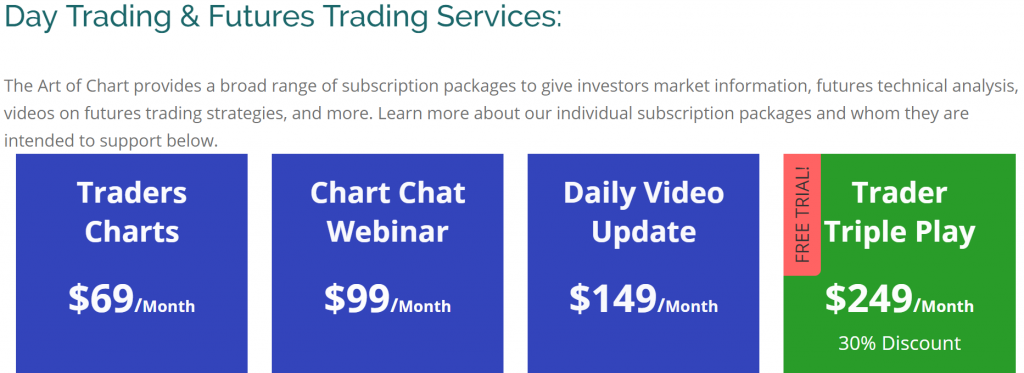

Our other services are listed below.

29th Dec 2019

29th Dec 2019