There’s ‘trading’ options and then there’s ‘buying’ and ‘selling’ options. Of course trading involves buying and selling but it’s much more than that. Successful traders plan their trades and take advantage of opportunities when they present. Unsuccessful traders play options like the roulette wheel in Vegas. Put 10% of my entire portfolio on red 7. Loser. Alright, how about 10% on red 12. Another loser. Crap! I see what I did wrong there, I should have put it on black 10. This time I’ll risk 20% to try to make up for my losses! Spinning a wheel is not a trading plan!

My intention is not to mock anyone here. Many option traders haven’t learned any other way to trade other than simply playing probabilities or worse, buying cheap options and hoping for a big move. I do want traders to be aware there is another way to trade options and that is what I’m trying to demonstrate everyday on the Vega Options Twitter feed. Let’s consider my trades in SPY over the last 2 weeks as an example of what I’m talking about.

I opened 3 positions (4 different transactions as position #3 needed 2 fills to complete). I paid a total of $1.52 for the 3 positions. 2 of the positions have been closed and the 3rd one has been ‘adjusted’ and is still open. I’ve taken in a total of $2.93 in credits and the remaining open position could bring in another $3.00 credit. The open position can only add to the total profits so the worst potential performance for the SPY trades is a 93% return on the original cost.

I paid a total of $1.52 for the 3 positions. 2 of the positions have been closed and the 3rd one has been ‘adjusted’ and is still open. I’ve taken in a total of $2.93 in credits and the remaining open position could bring in another $3.00 credit. The open position can only add to the total profits so the worst potential performance for the SPY trades is a 93% return on the original cost.

To really understand a typical strategy that I use to reduce the cost of a position, I want to focus on the Jun1/May29 SPY 303/305 Diagonal Call spread that I bought for $.66 on 5/19. That’s transaction #1. When the SPY rallied the next day and the opportunity to roll the Diagonal up into a Calendar spread for a $.60 credit presented itself, I took that opportunity and lowered my net cost in the position to just $.06. That’s transaction #2. As the close on Friday’s May29 expiry approached I decided I would like to have the chance to increase my profit should SPY rally again before Monday, Jun1 expiry. So instead of closing the Calendar I decided to buy back (to close) the 305 Call in May29 expiry and sell the 308 Call in Jun1 expiry for a $.28 credit. That’s transaction #3. I now own the Jun1 SPY 305/308 Vertical Call spread for a net $.22 CREDIT. That means I can do no worse than keep the $.22 credit if SPY closes below 305 on Monday. If SPY closes at or above 308 on Monday I will have earned a $3.22 credit for this position.

As the close on Friday’s May29 expiry approached I decided I would like to have the chance to increase my profit should SPY rally again before Monday, Jun1 expiry. So instead of closing the Calendar I decided to buy back (to close) the 305 Call in May29 expiry and sell the 308 Call in Jun1 expiry for a $.28 credit. That’s transaction #3. I now own the Jun1 SPY 305/308 Vertical Call spread for a net $.22 CREDIT. That means I can do no worse than keep the $.22 credit if SPY closes below 305 on Monday. If SPY closes at or above 308 on Monday I will have earned a $3.22 credit for this position.

To recap this SPY position: I started out with a Diagonal spread that I bought for a $.66 debit, rolled into a Calendar spread for a $.60 credit then rolled that into a Vertical spread for a $.28 credit. And I can still make up to an additional $3.00 credit by Monday’s close.

It’s nice to be in a position where you have eliminated all of the original cost and actually locked-in a profit while still benefiting from the adjusted position. Everyone can learn to do this! At first it’s hard to plan the potential adjustments but after you’ve been doing it awhile it gets easier. Join me on the Vega Options twitter feed and you’ll see lots more trades just like this one.

Lastly, I want to mention something that I think inhibits the potential success of many traders. It is the focus on all things other than price when designing a trading plan. I saw this tweet today. I can’t say that this person is wrong with the content of this tweet. In fact, they’re probably correct. But, how do you trade this? Do you buy a bunch of long-term Puts and wait for the downturn? At the very least you wouldn’t have any bullish positions on, right? The ‘rug could be pulled’ at any minute now.

This is not helpful information for trading! In fact, having these kinds of tweets show up in your timeline can be very harmful to your performance. Try to follow the price action on the charts without any bias and don’t overthink it. I can’t tell you how many times I’ve seen people on twitter lament the fact that the ‘dumb money’ has been killing it while the ‘smart money’ has been getting crushed. Sometimes the dumb money is the smart money when a market is trending! So here’s my challenge for you. Below is a weekly Heikin Ashi chart of an unidentified instrument. It could be a stock, ETF, inverse ETF, commodity, bond or anything else that can be charted. You can’t possibly have any preconceived bias since you don’t know what it is. Would you rather be long or short it?

This is not helpful information for trading! In fact, having these kinds of tweets show up in your timeline can be very harmful to your performance. Try to follow the price action on the charts without any bias and don’t overthink it. I can’t tell you how many times I’ve seen people on twitter lament the fact that the ‘dumb money’ has been killing it while the ‘smart money’ has been getting crushed. Sometimes the dumb money is the smart money when a market is trending! So here’s my challenge for you. Below is a weekly Heikin Ashi chart of an unidentified instrument. It could be a stock, ETF, inverse ETF, commodity, bond or anything else that can be charted. You can’t possibly have any preconceived bias since you don’t know what it is. Would you rather be long or short it? Feel free to respond by commenting on this post!

Feel free to respond by commenting on this post!

Vega Options is an educational service, not a trading service. However, because all of my price action analysis and option trading is done in real-time there is an opportunity for the subscribers to place similar trades from their own account. My job is to simply make available to the subscribers all of the information that I use to make trades. What they choose to do with that information is entirely up to them.

That is all I have for you now. If you are not a subscriber and you would like access to the Vega Options private Twitter feed, you can sign up for a 14 day Free Trial to try out the service. What have you got to lose, it’s free!

CLICK HERE for the Vega Options Free Trial.

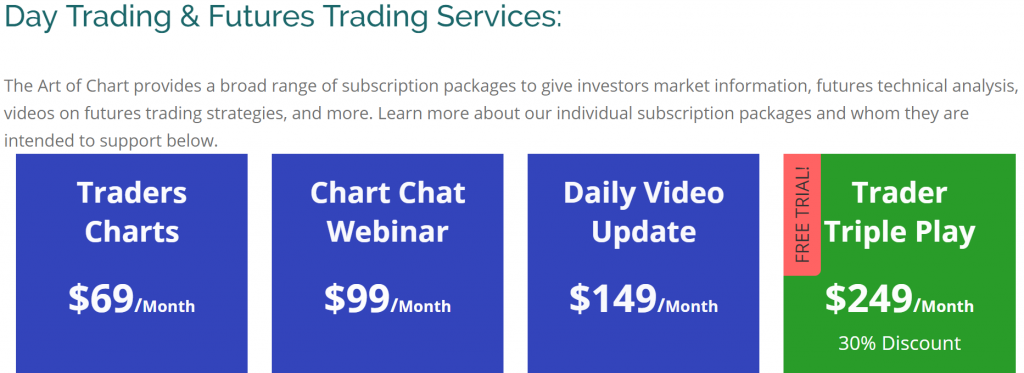

Our other services are listed below.

30th May 2020

30th May 2020