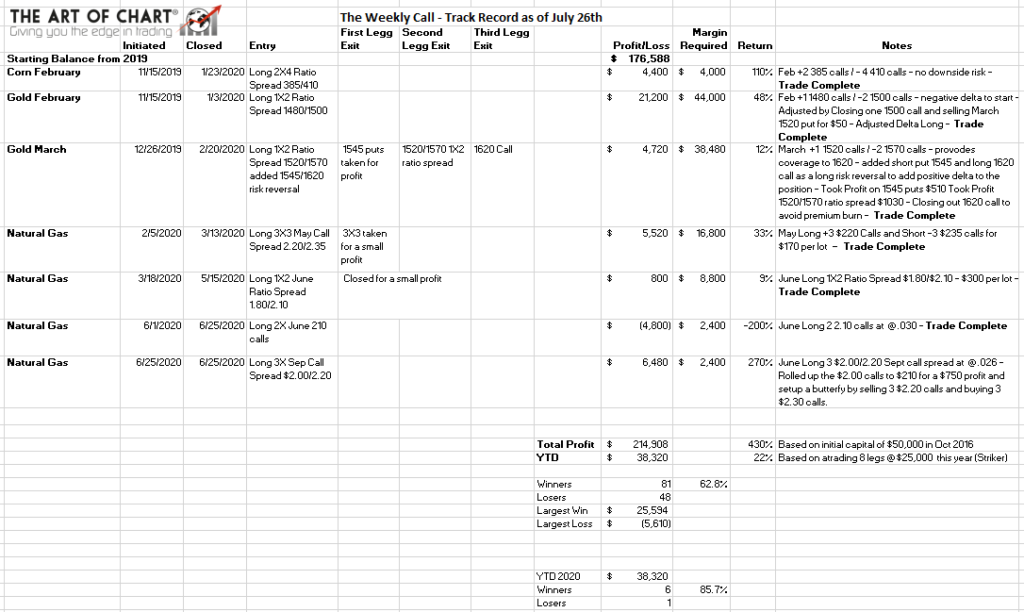

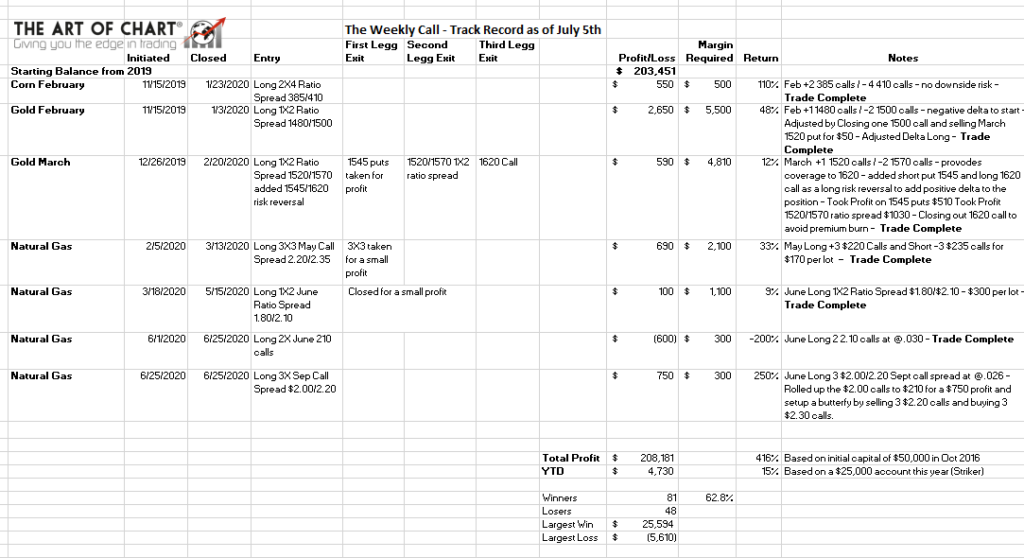

The Weekly Call provides perspective on high-quality setups and trading strategies focused in the Commodity world.. My current performance shows a 430% return since October 2016. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach.

Last Thursday we saw an increase in the Initial Jobless Claims which is an indicator that the economy might be worse off than most thought. It is clear that the V shaped recovery is likely going to be a W and a retest of the low in the S&P will occur. The Fed cannot protect asset prices forever, and inflation is already being seen in Healthcare and Food of around 6%. The S&P 500 is about to retrace this week and I am still looking for a print at the 3100 area. Back to school this fall will likely means online classes which also means parents are likely to stay at home which will further slow the economy. Commodities to watch this week are grains as the China relations with the US are getting worse. This could promote a pullback especially in Soybeans. Sugar needs a lower low before we see the next high in October of about $15. We hit target on Gold and am looking for a pull back and another buying opportunity. Oil should follow the S&P lower into $35 as the next step down. I am still in the butterfly on NG which is doing well. Cocoa is about to rally and we should see continuation higher for about two months. I am hunting short entries in Oil and Copper. My track record is posted below under Completed Trades. I have modified the track record to reflect 8 lot trades using the information in this Blog assuming $25,000 per lot with the current portfolio is over $200,000. See some of my completed trade videos below.

The Weekly Call can now be auto-traded on Striker.com. Just call Striker Securities and open an account of at least $25,000 and every trade I make here will be made for you automatically there. I am planning to use the same methodology and risk management approach with the auto-traded account at Striker that I have been using here. If you have a Daily Update or Trader Triple Play membership, there is no subscription fee for the auto-traded account at Striker. For more information, call Striker.com and speak with William at (800) 669-8838. For more information, you can also watch this video from our subscriber Q&A HERE.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Sugar

3-22 – Initiating coverage of Sugar this week. Looking long with a buy on any long setup. This is very beat up and oversold and a rally into the July time frame of around $15 is likely. We will bottom in the next two weeks, watch for a reversal pattern by Friday.

3-28 – Nice break of the trend line and a higher low here into my cycle date gets me long into the $15 target area into July. Waiting on a pull back this week and a demonstration of support for a long.

4-5 – As mentioned above, the higher low is in and this is a decent setup. Stop below the low and let’s see how this progresses this week. Convert the weekly pivot and we have a reversal.

4-12 – Consolidation pattern, expecting it to break up this week into $11 and put in a inverted right shoulder, then rally. Looking for a high in August in the $15 area.

4-19 – A break of the resistance trend line and we see Sugar rally. This week in Brazil, unless emergency measures are put in place, the sugar mills there may be shut down for 2-3 weeks. We should see a pop higher on that announcement. Looking for 11.50 next and $15 by August.

4-26 – Price broke down last week invalidating the long setup. This week a lower low sets up positive divergence on RSI and likely we see a reversal. The key is the declining resistance trend line and a conversion will open up higher prices. Still looking for a August high around 15.

5-3 – Nice rally this week and a break of the declining resistance trend line. Likely we will see the trend line or monthly pivot this week. Look for a pull back to buy in the 10.20 area and higher highs expected into August.

5-10 – Sugar has retraced into out target area and I am looking for a reversal pattern and the next rally. Targeting $15 in October and $12 in August, a reversal is expected this week.

5-17 – Sugar has a break up from the flag we finished last week and the key now is to see continuation higher. This is a good spot to enter some out of the money calls at $15 in October.

5-24 – Sugar is retesting and I am looking for the rally to continue into the 100% fib next. Continuation higher into $15 still expected into October. Watch for a negative D RSI setup on the next higher high.

5-31 – Sugar appears to have completed the retest and I am looking got the next fib higher into 11.85 this week. Watch for the start of a rally above the weekly pivot.

6-7 – Sugar has made target and is likely to set up for a pull back into $11. Take profits here and wait to re-enter lower. You can optionally carry a trailer and add back into the $11 area.

6-14 – Sugar has reversed and still awaiting the $11 area and the break of the trend line. The USD rally expected this week will help.

6-21 – Sugar making a higher high in a three wave move, appears to be wave B of an expanded flat. Looking for a reversal and a 5 down into the $11 area next. Nice Neg D on RSI on the Daily Chart – still expecting a trend line break.

6-28 – Sugar almost at target for the retracement. Looking for $11-$11.40 as the 5 down target. Looking for a positive D setup on RSI. Likely we see a low toward the end of this week.

7-5 – Sugar made target and has reversed and likely will see $13 next. Looking for this in the next 5-6 trading days. We will see the monthly pivot tested once we have target. After this consolidation, looking for $15 next.

7-12 – Sugar now testing the monthly pivot and the support trend line. It needs a bullish day to follow through and push for $13. Brazil sugar production is up, ethanol production is down which makes for weak price action.

7-19 – Weak price action did develop last week and we have a larger three down into the 100% fib. Likely we should see a retest of the low and a lower low to set up positive

D on RSI. Looking for the next rally into $15 by October.

7-26 – Movement lower last we as expected, still looking for a lower low and a pos D setup on RSI. Still expecting $15 into October. Welcome to the summertime tape.

Coffee

3-8 – Coffee to test 105s this week and if support is found, we can start he next legg up. There is no reversal pattern here yet and the new crop looks to be big. There is a lot of supply right now and currency fluctuation are the main reason for the big changes in price. With the Saudi’s changing the value of oil, the Brazilian Real is likely to drop and so is Coffee. You don’t want to be long below 105.

3-15 – Coffee being pushed around by the currency markets and likely we see $100 first before the next rally into 130. Look for the weekly/monthly pivots to be resistance this week.

3-22 – Coffee rally last week and with the current over supply in Coffee watch for this to retrace into 105s this week before moving higher. Coffee is being moved around a lot by the currency markets so look for a strong retracement this week.

3-29 – Coffee is coming off and looking into the 105-108 area for this retracement to find support. A big crop, lots of supply should push this lower. We may rally again into April 15th but this is just temporary as I am expecting a lower move in Coffee after mid-April.

4-5 – Coffee still finishing the retracement as discussed and looking for 110-108, slightly higher then the next rally. I have serious doubts about the rally due to the large crop this year and steady supply. After April 15, Coffee should be a good sell. For now looking lower to the next long setup.

4-12 – Coffee did not hit the full retrace target. I am expecting the rally to continue into our high window April 15th or so, then look out below for a move to $100 – big supply and big crop coming.

4-19 – Looking for the pattern to complete and higher prices into 124-126. There is no short setup here. Looking for pattern completion first then lower prices into $100.

4-26 – No short setup and we had lower prices directly. Looking for a bounce here into $115 then lower lows into $95. A big crop this year and ample inventory should drive prices lower.

5-3 – So far so good on Coffee, it has found support at the trend line and about to retest 113-114 area before seeing lower lows into the $95 area. Poor demand and also big crop means lower prices.

5-10 – Coffee has hit our retrace target and looking for resistance and the next trip lower into $95. Big crop and demand issues should push prices lower.

5-17 – So far so good on Coffee, lower is still the theme and big crop mean big supply so looking for lower lows into now EARLY JUNE. We may see a long setup here soon.

5-24 – Lower lows still expected on Coffee. Big crop and weak demand still in play so $95 still target. A few weeks of downside action is expected into early June.

5-31 – Lower has played out beautifully. We need a wave 4 and wave 5 to finish the structure. Looking for this to play out this week and then we can consolidate before seeing higher prices.

6-7 – Coffee is at target and wave 4 has played out – looking for a lower low here and likely we see at least $94 next. Wait for the long setup, not ready yet.

6-14 – I have extended the amount of time for the lower low in Coffee, looks like we will be seeing a lower low into the June 28th timing window. Looking for a test of the Monthly S1.

6-21 – Lower so far on Coffee, needs a lower low next and a long setup coming. Looking for Pos D on RSI and then a break of the declining resistance trend line.

6-28 – Almost at target and Coffee can turn up directly. My bias is a lower low for a positive D setup as the current bear flag should break lower. Brazil is not exactly in great shape so watching this reversal carefully. Big crop still in the plans for this year, we could consolidate once the low is in.

7-5 – Coffee has turned up directly, and we are on the way to $115s. First step is to retest the monthly pivot and it needs to hold. Any break down and we can make a new low. We should see the retest complete this week.

7-12 – Monthly pivot did not hold last week which means we are now seeking a lower low. This will be a stronger setup when seen with positive D on RSI. We should see $93.xx print.

7-19 – Rally on Friday and a three up which could be wave C of a triangle. I am still leaning lower in Coffee and looking for a lower low to set up a long play. This invalidated on a break of the monthly R1.

7-26 – Invalidation with a break of the R1 and we are now in a retracement pattern higher. Looking into August for the high as we need to set up negative D on RSI, once seen, a lower low into Mid-Sept. is expected.

_

Live Cattle

3-1 – Low retest and lower has played out and Live Cattle being hit with demand concerns. A marginal lower low provides the next long setup. Once seen a conversion of monthly pivot is needed to see higher prices into the end of the month. Larger double bottom is bullish.

3-8 – A positive D setup is coming in Cattle and a lower low is likely. Demand is soft and we should see a reversal later this week.With the virus news, be cautious with an entry, wait for the setup and confirmation for the next Long.

3-15 – Positive D setup and looking for a rally this week. This is very over sold and is reactive to possible recession and the Virus news. Looking for a conversion of weekly pivot and higher into the end of the month.

3-22 – Limit up move last week in Cattle and a likely reversal is in progress. I am expecting a rally into the 110 area by the first week of May. Expecting more moovement this week to the upside.

3-29 – I consider this one of the Shelter in Place commodities that should see upside in the Corona Virus period. Limit up last week and a big pull back into the gap here, likely we see the rally continue if the low holds.

4-5 – The low did not hold and we now have another opportunity as we have made the 100% fib for the last three down move. Watch for a conversion of the weekly pivot. Cattle prices are out of whack here with the cash prices, should see this resolve this week.

4-12 – Nice reversal pattern here, the low needs to hold and looking for the next legg higher into $100. Get through monthly pivot and we have a confirmed reversal and higher into 115s expected later this year.

4-19 – So far so good on Live Cattle… There is a lot of volatility expected in the coming weeks from plant closures. When they restart, look for higher prices. Looking for $100 price target into May. $94 is resistance first pass then look for weekly pivot support and higher prices.

4-26 – A triangle is forming which should resolve to the upside on live cattle. While a few plants are closing due to COVID, chances are that we will see the market continue sideways and then rally. While the virus is moderating, beef prices should go higher as a result of these same plants re-opening. Sideways price action expected this week then a break our higher into 100 into June.

5-3 – The compression with the triangle has broken up and is retesting and I am looking for a rally next into the June time window. As plants come back to work this instrument should rally into $100.

5-10 – Target made at $100 and chances are we will pull back and consolidate before seeing next window into 110. As plants come back on line we should see cattle prices continue to go higher. Watch for support at $90.

5-17 – Retest not yet complete, so waiting on Wave C lower. Looking for the next legg higher once complete this week. Next target is 105.

5-24 – No change in forecast, Cattle still needs a wave C lower. Once complete still expecting a rally into 105 next.

5-31 – No wave C lower. Sometimes markets correct in time instead of price, so the consolidation sideways was the finish of wave 4 – wave 5 is next into 105. We have little time to complete, neg D setup is expected then a retest before seeing next target to the upside of 115.

6-7 – Wave C is now playing out so look for $94 and then a rally into the 105 area as discussed. Should see the support trend line in the $94 area this week.

6-14 – Target made on Live Cattle. Time for a reversal and a higher high. Next timing window is 7-10 and looking for a confirmed turn this week. Monthly pivot is the key to the upside.

6-21 – Live Cattle needs to see the Bulls confirm the upside. $94 support as discussed but no umph, needs to convert the monthly pivot and break the channel resistance trend line. Lean is still long into 105-109.

6-28 – With the spread of COVID, if there is a plant shutdown, we should see price collapse here. Be aware of the risk here. My bias is still higher as we need to convert monthly pivot to see the 105 area next. The lean is still higher.

7-5 – Breaking up and looks like we are heading into the next high window of 8-9. I adjust my timing cycles after a sideways consolidation like what we have seen. It tends to move cycles out, so next high early August is expected – resistance 109 then 115.

7-12 – Follow through this week and no change in forecast…. Looking for 109 target then 115. The support trend line must hold.

7-19 – Follow through this week and steady as she goes. Looking for the 110-112 area next – the support trend line must hold into the next cycle high window into August.

7-26 – Watch for the support trend line to hold, if it does, we see 110-111 into early August. This will end a 5 wave sequence and I am expecting a decent retrace then higher into September.

Gold

3-1 – Target achieved and a rejection so far. Is this the top of Wave Y? Maybe. We need to see price action this week convert the monthly pivot and if seen, then new highs are possible. If by 3-13 we see resistance at the monthly pivot we can see gold go much lower into 1520. Gold has a seasonal low in early July.

3-8 – Finishing Blue Wave Y here with a higher high this week. We have a seasonal trend that starts to play out lower into July. Given the volatility in the markets I am not expecting much right now. Higher highs still likely into 1720-25. I will be watching for a reversal pattern later this week/next week.

3-15 – Big move by the Fed on Sunday and a huge rally in the USD and big fall off in Gold. Look for gold to continue lower into 1420 after a retest into 1560.

3-22 – Gold should continue lower once the retrace into 1560 completed. I am still expecting 1420 as support. I still am expecting higher highs into December this year. Inflation will become more evident later this year and will be with us for some time to come given the latest move by the Fed. Look to buy a lower low.

3-29 – Low liquidity and a Goldman Saks recommendation last week and we got a big one day move in Gold last week. The key here is we can see 1600 as support and higher directly. The post Corona era should be one of recession and inflation and Gold should be in your portfolio. We have lower coming according to my cycle system through 4-6 so this week watch for lower prices. We could see a break of 1600 and a retest of the low which is still possible.

4-5 – Gold made the 1600 area and is in a retracement now. GC is likely going to see a wave C lower into the monthly pivot at least and best case into 1500. This is likely to be short lived and I am hunting a long when lower prices are seen.

4-12 – Gold rallied on the Fed news last week and has just finished a 5 wave sequence higher. Watch for a retest into 1650 and then the next legg higher. Gold should continue to rally into the end of this year.

4-19 – Gold has made the first legg lower into 1700 and I am looking for resistance at 1724 then lower lows. If we convert 24 we can see a direct move higher. A lot depends on equities, if we see equities lower strongly we can convert 24s and see a rally direct.

4-26 – Gold rallied last week into wave B and should see wave C lower this week as it appears we have a 5-3-5 pattern. The pattern needs the last 5 down to complete. The theme we have been disusing for the last few weeks is USD higher, Bonds higher, Gold higher and Emini lower. This theme should continue and I like Gold long over all through February. Looking for a pullback this week and looking to buy.

5-3 – Gold is still in the retracement pattern and is now in wave C, likely lower lows into 1655-1660 and this week I will be looking for a reversal patter. The lean here is long into the February 2021 window. Don’t be in a hurry here, wait for the confirmation on the long.

5-10 – Gold is correcting in time so the 1655 target is invalidated. We are in wave E and a likely break up from the triangle to end the first wave W. Looking for $1800 as target into the May high window.

5-17 – Gold has broken out of the triangle and is likely headed for the higher high and completion of wave W. There is a decent retest setting up that will revisit the triangle before we see a much larger move higher. Higher highs should be seen this week.

5-24 – Gold is still finishing wave 5 higher and a higher high is still expected. While Silver is already near the end of wave 5, Gold needs to play catch up. Looking for a move this week to complete the small degree wave w before a retest back into the triangle.

5-31 – Gold is still finishing wave 5 here, higher highs still expected. We need to see the R1 and a higher high. While silver is already there, Gold needs follow through this week. There is no short play here, I will wait for the next long setup one the high is made.

6-7 – Silver made the higher high, gold made a lower high wave B instead and is finishing a wave C lower. Gold is targeting the 1670 are which should be seen this week. A reversal in this area then leads to a higher high at 1800. Looking for resistance this week at the weekly pivot and the lower low to complete the structure.

6-14 – Gold and Silver both have reversed early without the lower lows to setup positive D on RSI. At this point, higher highs are expected into the 6-22-25 timing window. We should see 1800 by then.

6-21 – Gold should break out this week, looking for 1800 by the end of this month. Once the resistance trend line is broken we should see a squeeze higher. Indexed lower may help the cause this week if seen.

6-28 – Gold almost made the higher high as mentioned but did not make it completely. Therefore, I am still expecting a last legg up before the pull back. Needs a higher high above 1800. Once seen then we see the pull back next. Look for a spot for the next long, I like this higher into February of 2021.

7-5 – Target made on Gold and a reversal as expected. No confirmation yet as we need to break the support trend line next. Targets the 1720-13 area next. This may play out quickly this week.

7-12 – A higher high this week and a reversal is still expected on Gold. We are testing the trend line and weekly pivot, convert and we open monthly pivot. We should see 1745-50 as a retracement area.

7-19 – Retracement pattern should break lower into 82 and then possibly into 45-50. Waiting on the next move and a long setup. I like Gold long into February 2021.

7-26 – The full retrace target was not made, gold has turned and last week completed a 5 up structure with Neg D on RSI. Looking for Gold to retrace into 1800-1810 or so before the next rally which should see 1950. Buy the dips through Feb 2021.

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog. I am using 8 lots for the Striker trades which is based on this account being $200,000. Each lot for auto trading at Striker requires $25,000 per lot. See the videos below for more information.

Track Record January 2019 thru December 2019 Click Here.

Track Record January 2018 thru December 2018 Click Here.

Track Record October 2016 – December 2017 Click Here.

*** Trading futures contracts and futures options involves substantial risk of loss, and may not be appropriate for all investors. By reading this web site, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced on this web site and associated documents and emails are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

26th Jul 2020

26th Jul 2020