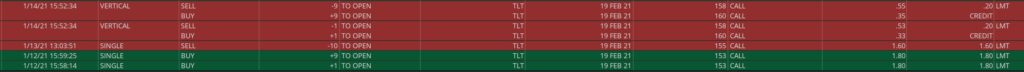

On 1/12 I went long TLT by buying Feb 153 Calls for $1.80. The next day, as price moved higher, I sold the Feb 155 Calls for $1.60 leaving me with a $2 wide spread with a cost of just $.20! Then on 1/14 I turned the position into a Call Condor by selling a $2 wide Call credit spread for a $.20 credit. At that point I owned a Call Condor for free! Below are my actual transactions which I always post for the subscribers to see.

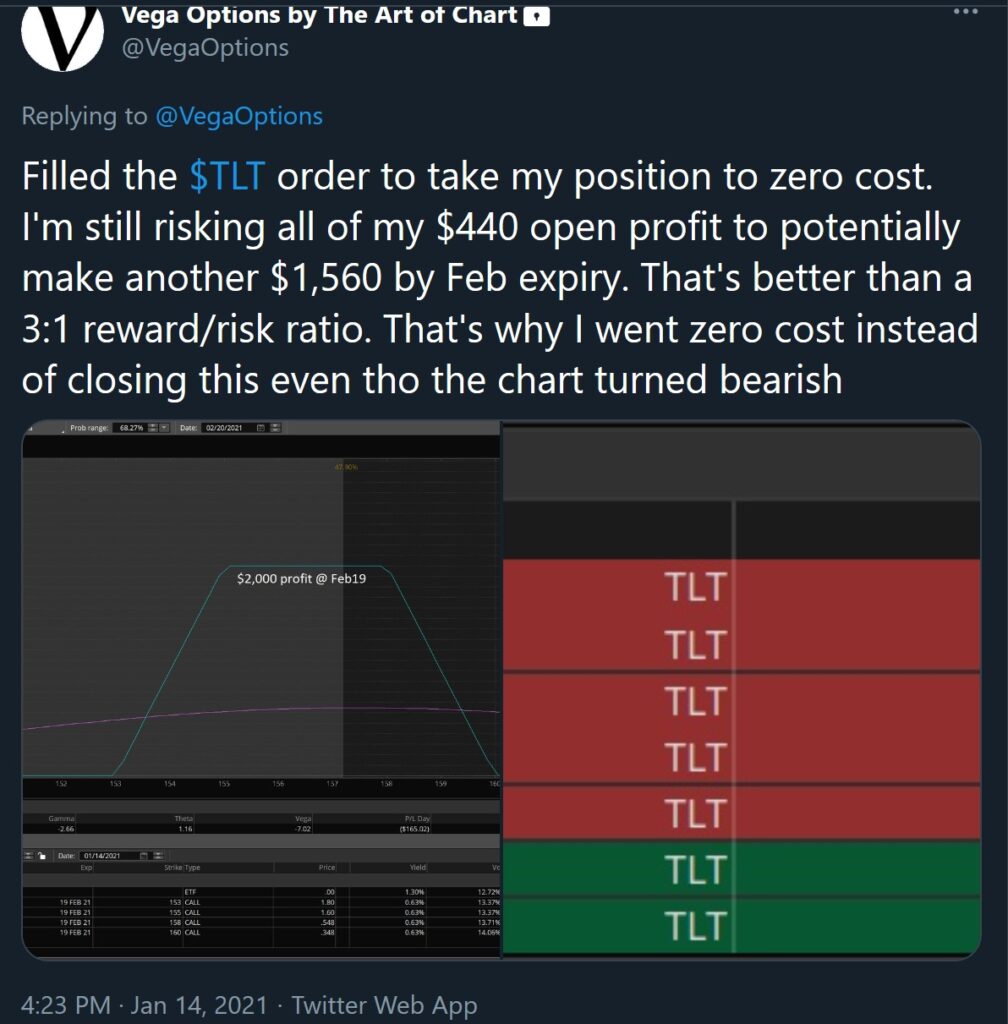

The tweet below was referring to the second adjustment to my initial position In TLT. To summarize; I saw a bullish setup on the daily chart, bought Calls and then Delta Hedged the position by first turning it into a Vertical spread then into a Condor as TLT moved higher in price. Pretty standard stuff for the Vega Options subscribers. Below is the zero cost tweet as well as the position after the adjustment.

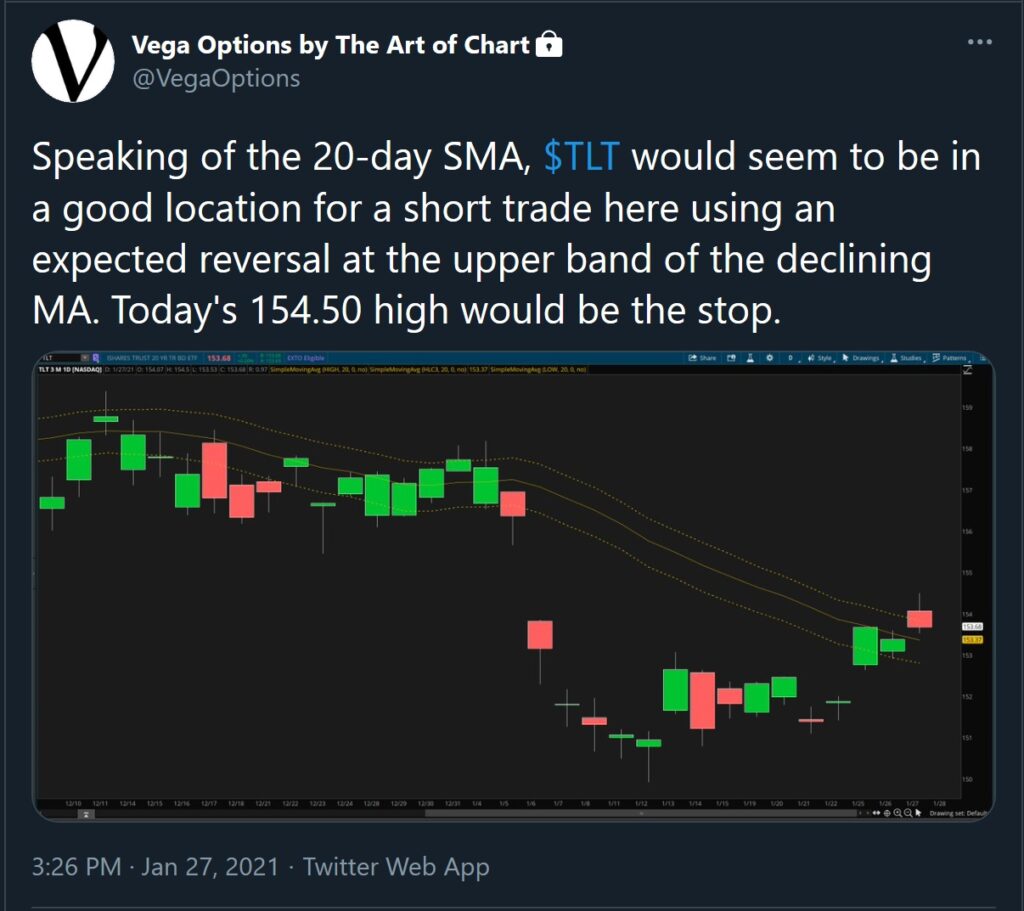

I was fine continuing to hold that bullish zero cost position until the daily chart indicated a bearish setup. Time to close the bullish position? Hell no! I had no idea idea if that bearish setup would follow through or not. Here’s the tweet about the setup.

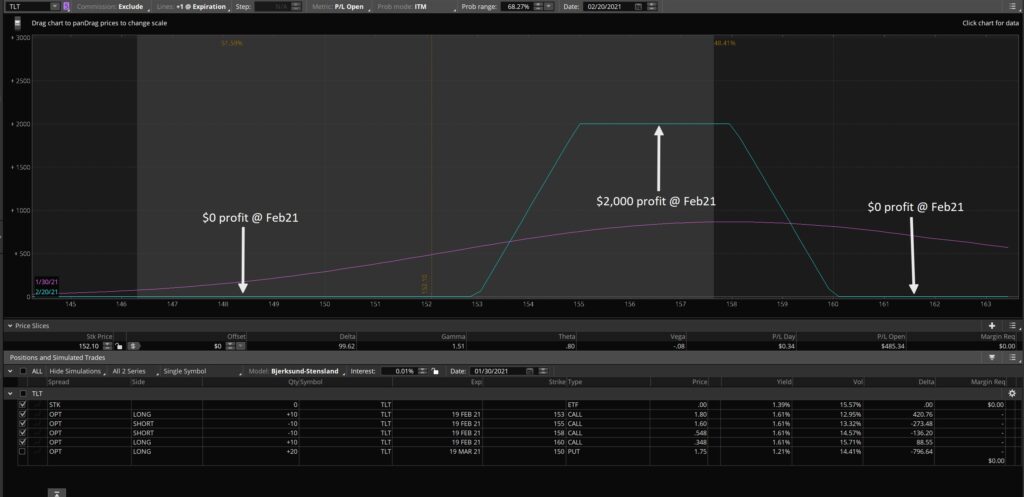

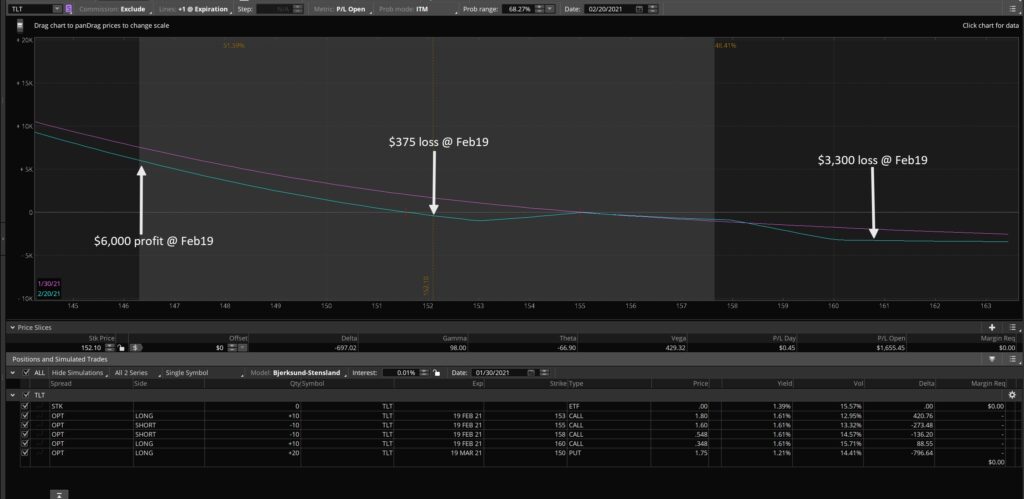

So if I wasn’t going to close the bullish position what do I do? Establish a new bearish position is the answer of course. I simply bought some Puts. I went bigger on the Put side then my initial Call purchase. Below is the current risk profile as of Friday’s close.

I’ll agree, not a great looking position! But, as always, let’s consider what it could look like with the application of a Delta Hedge. Below is the risk profile I could’ve have as of Friday’s close.

If you’re interested in learning more about how I establish trades and make adjustments to the positions, sign up for the free trial. What have you got to lose?

Vega Options is a options educational service managed by Paul Frey in conjunction with TheArtofChart.net. The service includes access to a private twitter feed and a private blog where option strategies and price action analysis are discussed throughout the trading day.

CLICK HERE for the Vega Options Free Trial.

Our other services are listed below.

![]()

![]()

01st Feb 2021

01st Feb 2021