This is a weekly post covering Cryptocurrencies, specifically Bitcoin, Litecoin, and Ethereum. These instruments provide trading opportunities with out sized gains. I hope the analysis presented here helps you profit in these instruments.

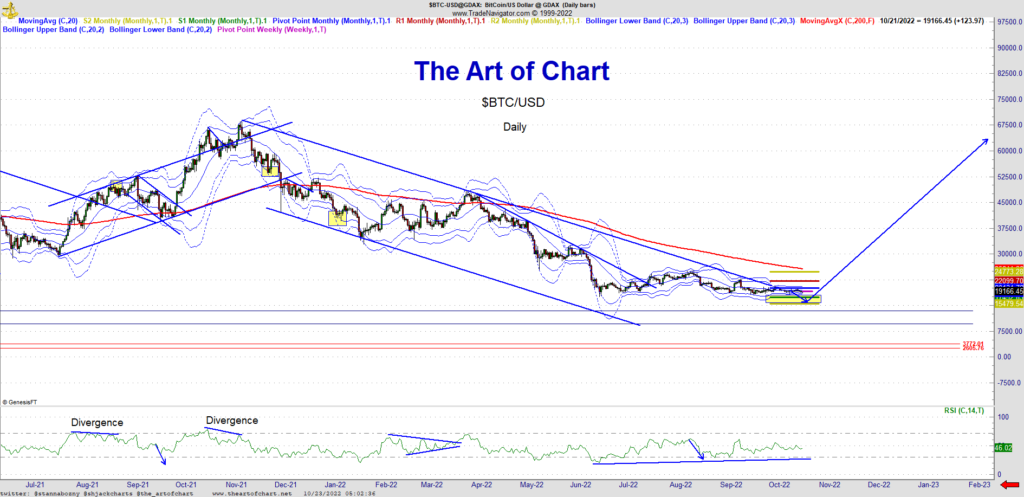

BTCUSD — No change in forecast and still waiting on the lower low for BTC, ETH has made the higher low as forecast and may see lower. BTC could see as low as 16000 which would be more of a wash out and buy-able low. For now waiting on the lower low in BTC and expecting ETH to continue lower with BTC before Cryptos turn. This is a major turn in Crypto and looking for a reversal across the board and a long term uptrend.

ETHUSD – No change in forecast here = we made the higher low into 1179 which is wave C playing out. A lower low is a gift and a strong buy if seen. This is my preferred Crypto and with the merge complete. We should be seeing institutional support later this year. For now waiting on a confirmation but first we likely see the tend line at 1102. Bands are very tight, not yet at the 3rd SD band yet. Once seen look for a long term long and hold.

LTCUSD – Possible higher low at $39, if we convert this area then a lower low will open. I prefer the lower low here along with BTC. Still waiting on the consolidation to break down.

ETH made target last week and BTC did not. I am expecting BTC to make the lower low for a long setup so waiting on ETH to make 1100 or so as a potential low and hopefully BTC will produce a lower low and positive D on RSI. Bollinger bands are extremely tight and should expand for the low. Mind your risk until the turn is confirmed. This is a significant long setup across Cryptos. Trade Smart and Trade Safe.

23rd Oct 2022

23rd Oct 2022