Welcome to this week’s edition of The Weekly Call, your trusted source for high-quality commodity setups and trading strategies. Since October 2016, our approach has delivered an impressive 777% return, and we continue to share the insights and methodologies that drive these results with this post #406. This week, we’ll explore the latest market trends, actionable trade setups, and global economic factors influencing commodities like sugar, coffee, live cattle, and gold.

Global Economic Overview

The global economy continues to show signs of a slowdown, with inflation gradually easing but still posing challenges, particularly in the food and agricultural sectors. The recent U.S. Consumer Price Index (CPI) data has heightened concerns about inflationary pressures, as the numbers came in higher than expected. This has led to increased speculation about future interest rate hikes by central banks, which could impact commodity prices in the short term.

Recent data indicates that consumer prices remain relatively high despite significant declines in commodity prices over the past few months. This disconnect is largely due to the lag in price transmission through the supply chain, which continues to frustrate consumers and businesses alike.

Signs of Bottoming in Commodity Prices

There are emerging signs that commodity prices might be nearing a bottom, as global central banks shift towards more dovish policies and the U.S. dollar shows signs of weakening. However, the bottoming process is likely to be prolonged, characterized by sideways trading and gradual price adjustments before any significant recovery takes hold. Given the current economic environment and uncertainties, particularly related to China’s economic performance, traders should be prepared for continued volatility and market consolidation.

Market-Specific Updates

Sugar

Current Price: $18.03 per pound

Trend: Gradual uptrend towards $28

- Recent Development: The sugar market remains highly volatile, with prices fluctuating due to changing weather patterns and global demand shifts. Brazil’s sugar production remains robust, thanks to favorable weather conditions, but the threat of El Niño could disrupt output in other regions, tightening supply later in the year.

- Actionable Insight: Traders should monitor weather forecasts closely and be ready to adjust their positions accordingly. Maintain long positions targeting $28, with consideration for adding on dips near $17.50.

Coffee (KC Futures)

Current Price: $2.46 per pound

Trend: Bullish momentum with potential for higher highs

- Recent Development: Coffee prices continue to experience significant volatility, driven by unpredictable weather conditions in key producing regions like Brazil and Central America. The ongoing issues with frost and drought in these areas have raised concerns about potential supply shortages.

- Actionable Insight: Traders should keep an eye on export data from Brazil, which will be crucial in assessing future price movements. Look to stay long, targeting $2.50, with stops near $2.40.

Live Cattle

Current Price: $175.70 per pound

Trend: Potential reversal after a downtrend

- Recent Development: The live cattle market has faced pressure from fluctuating feed costs and changing global meat demand. Drought conditions in major cattle-producing regions have exacerbated these issues, leading to concerns about supply shortages.

- Actionable Insight: Strong global demand for beef has helped support prices. Consider initiating long positions near $170, targeting $185. A break above $185 could lead to a move towards $190.

Gold (GC)

Current Price: $2,545.70 per ounce

Trend: Consolidating with a bullish bias

- Recent Development: Gold remains a key safe haven asset amid ongoing economic uncertainty. The recent CPI data, which indicated higher-than-expected inflation, has further bolstered gold’s appeal as a hedge against inflation.

- Actionable Insight: Traders should closely watch inflation data, central bank policy decisions, and geopolitical developments. Maintain a bullish outlook with targets at $2,550 and $2,570. Consider adding on dips towards $2,520, with stops below this support level to protect against downside risks.

Outlook for the Week Ahead

Looking ahead, traders should brace for continued volatility across most commodity markets. Key factors to watch include central bank policy announcements, particularly any signals of shifts in interest rates, as well as weather forecasts in major production regions that could impact supply. Additionally, geopolitical tensions, especially in regions critical to commodity production and transport, could lead to sudden supply shocks, further influencing price movements.

As always, stay informed and be prepared to adapt your strategies as market conditions evolve. All trades are posted on our Private Twitter Feed for subscribers and are included in the track record posted below under Completed Trades. I am currently trading 15 lots given the account balance and will adjust as necessary based on market developments.

The Weekly Call can now be auto-traded on Striker.com. Just call Striker Securities and open an account of at least $25,000 and every trade I make here will be made for you automatically there. I am planning to use the same methodology and risk management approach with the auto-traded account at Striker that I have been using here. If you have a Daily Update or Trader Triple Play membership, there is no subscription fee for the auto-traded account at Striker. For more information, call Striker.com and speak with William at (800) 669-8838. For more information, you can also watch this video from our subscriber Q&A HERE. Trading futures contracts and commodity options involves substantial risk of loss, and may not be appropriate for all investors. Past performance is no guarantee of future results. Please see our Disclaimer for more information.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Sugar

Current Price: $18.03 per pound

Trend: Gradual uptrend towards $28

Technical Overview:

- Recent Development: Sugar continues its steady upward trend, with the price currently at $18.03. The market is being supported by the strength in the Brazilian real and favorable weather conditions in key growing regions, which have provided some price stability.

- Support and Resistance: Strong support remains at $17.50, with resistance expected around $19.00.

- Pattern: The bullish flag pattern indicates potential for continued upward movement towards the $28 target.

Actionable Insight: Maintain long positions targeting $28. Consider adding on dips near $17.50 with stops placed below this support level.

Coffee

Current Price: $2.46 per pound

Trend: Bullish momentum with potential for higher highs

Technical Overview:

- Recent Development: Coffee has surged, currently trading at $2.46, driven by concerns over stressed coffee trees in Brazil due to ongoing dry conditions and higher production costs.

- Support and Resistance: Immediate support is at $2.40, with the next resistance level at $2.50.

- Pattern: The breakout above $2.40 confirms the bullish trend, with expectations for continued movement towards $2.50 and possibly beyond.

Actionable Insight: Look to stay long, targeting $2.50. Utilize $2.40 as a stop level to protect gains. A break above $2.50 could see further extension towards $2.60.

Live Cattle

Current Price: $175.70 per pound

Trend: Potential reversal after a downtrend

Technical Overview:

- Recent Development: Live Cattle is stabilizing around $175.70 after finding support near $170. The market is showing signs of a potential reversal, driven by strong demand and tighter supplies.

- Support and Resistance: Key support is at $170, with resistance at $185.

- Pattern: The current formation suggests a possible double bottom, indicating a reversal may be in play.

Actionable Insight: Consider initiating long positions near $170, targeting $185. A break above $185 could lead to a move towards $190.

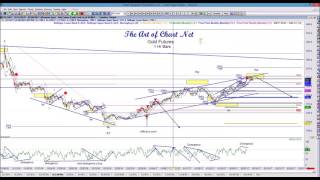

Gold (GC)

Current Price: $2,545.70 per ounce

Trend: Consolidating with a bullish bias

Technical Overview:

- Recent Development: Gold is holding steady around $2,545.70, reflecting its continued appeal as a safe-haven asset amid global economic uncertainties and inflation concerns. The market responded positively to the Federal Reserve’s cautious tone at the Jackson Hole Symposium.

- Support and Resistance: Immediate support is at $2,520, with resistance at $2,550.

- Pattern: The current consolidation phase suggests a potential breakout towards $2,570 if resistance is breached.

Actionable Insight: Maintain a bullish outlook with targets at $2,550 and $2,570. Consider adding on dips towards $2,520, with stops below this support level to protect against downside risks.

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog. I am currently using 15 lots for the Striker trades which is based on this account being over $375,000. Each lot for auto trading at Striker requires $25,000 per lot. See the videos below for more information.

Track Record January 2022 thru December 2022 Click Here.

Track Record January 2021 thru December 2021 Click Here.

Track Record January 2020 thru December 2020 Click Here.

Track Record January 2019 thru December 2019 Click Here.

Track Record January 2018 thru December 2018 Click Here.

Track Record October 2016 – December 2017 Click Here.

*** Trading futures contracts and futures options involves substantial risk of loss, and may not be appropriate for all investors. By reading this web site, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced on this web site and associated documents and emails are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas; we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

25th Aug 2024

25th Aug 2024