Welcome to this week’s Crypto Market Weekly Outlook, post #350, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

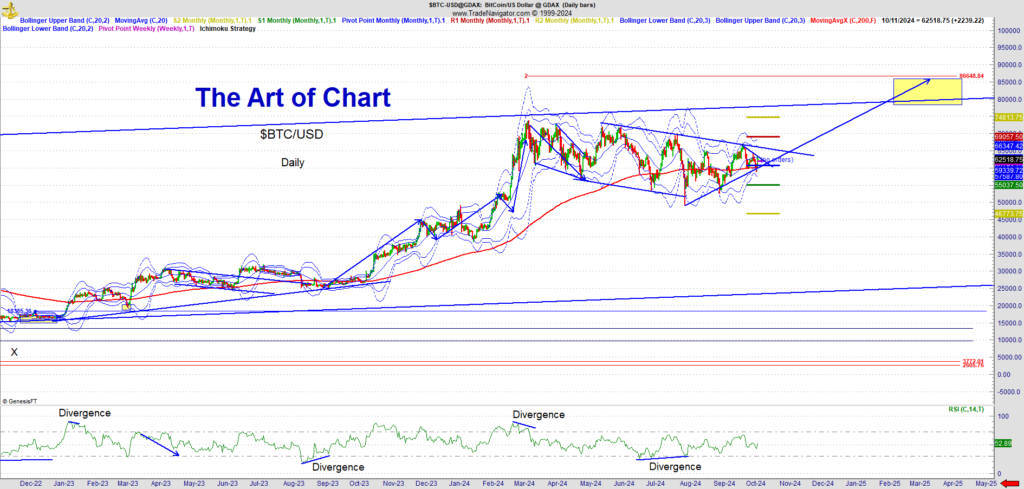

Bitcoin (BTCUSD)

Recent Developments: Bitcoin continues to show resilience, holding steady despite increased market volatility driven by macroeconomic and geopolitical factors. Over the past week, global tensions, particularly in the Middle East, have heightened investor caution across financial markets, including cryptocurrencies. However, Bitcoin has maintained its role as a hedge against traditional financial instability. Meanwhile, U.S. inflation data came in slightly above expectations, keeping market participants on edge about potential Federal Reserve policy actions. Regulatory developments, particularly surrounding Bitcoin ETFs, remain in focus, with traders awaiting any news on approval or further delays.

Outlook: Bitcoin’s performance in the coming week will largely depend on macroeconomic data and any movement on Bitcoin ETF approvals. If regulatory news takes a positive turn, Bitcoin could experience bullish momentum. However, any signals from the Fed that suggest tighter monetary policy could introduce further volatility. Bitcoin’s key resistance levels will be closely watched, as a breakout above these could signal further upside.

Ethereum (ETHUSD)

Recent Developments: Ethereum has been steady over the past week, driven by continued growth in decentralized finance (DeFi) and non-fungible token (NFT) activities. The Ethereum network also saw progress in its layer-2 scaling solutions, with protocols like Arbitrum and Optimism continuing to gain traction. However, like Bitcoin, Ethereum’s price remains influenced by broader macroeconomic trends. The market is also anticipating regulatory clarity around Ethereum ETFs, which could serve as a significant catalyst for price movements.

Outlook: Ethereum’s future price action will likely be driven by developments in its ecosystem, particularly around layer-2 scaling solutions. If these technologies continue to attract users and reduce transaction costs, Ethereum could see renewed interest. Additionally, traders are keeping an eye on any regulatory updates around Ethereum ETF approvals, which could boost institutional demand for the asset.

Solana (SOLUSD)

Recent Developments: Solana continues to make headlines, with growing adoption across decentralized applications (dApps), DeFi, and NFT platforms. However, network reliability remains a concern for investors, especially after several technical outages earlier this year. Last week saw renewed optimism for Solana, with major developers announcing enhancements to the network’s stability and scalability, aimed at preventing further downtime. Institutional interest in Solana has been strong, with some hedge funds exploring opportunities within the ecosystem.

Outlook: Solana’s trajectory will depend heavily on its ability to maintain network stability. With increased institutional interest and continued adoption of DeFi and NFTs on its platform, Solana is poised for potential growth. However, traders should remain cautious given the network’s history of outages, which could lead to sharp price corrections if technical issues persist.

Litecoin (LTCUSD)

Recent Developments: Litecoin has experienced low volatility over the past week, continuing to be a favored asset for those looking for stability in the highly volatile crypto market. While not receiving as much attention as other major assets like Bitcoin or Ethereum, Litecoin’s role as a faster, low-fee alternative to Bitcoin remains intact. With major events in the broader financial markets influencing the larger crypto sector, Litecoin has moved in line with the overall trend, maintaining stability amidst external shocks.

Outlook: Litecoin’s outlook remains neutral for the near term, with potential for upside if Bitcoin sees a significant rally. However, broader market conditions will likely dictate its movements. For traders looking for a lower-volatility option in the crypto space, Litecoin remains a viable choice.

Regulatory Landscape and Market Sentiment

News from Last Week: The SEC’s ongoing review of Bitcoin and Ethereum ETF applications remains a significant focus for traders. While there has been no new approval, market sentiment remains cautiously optimistic that ETFs will be greenlit in the near future, opening the door for increased institutional investment in the crypto space. On a global scale, regulatory frameworks are evolving, with the European Union recently discussing stricter regulations for stablecoins and decentralized finance platforms. These discussions highlight the growing attention that regulators are placing on the crypto space, which could introduce more clarity—or potential risks—for the market in the long term.

Blockchain Ecosystem Developments

The Ethereum network continues to benefit from the adoption of layer-2 solutions, which are helping to reduce congestion and lower transaction costs. Optimism and Arbitrum have reported increased user activity and transaction volumes, demonstrating the growing need for more scalable solutions on the Ethereum network. Solana is also making strides, with updates aimed at improving network reliability and scalability, which could help prevent future outages and enhance user confidence.

What to Watch This Week

- Macroeconomic Data: U.S. inflation data and any Federal Reserve commentary will be crucial for understanding broader market trends and how they may impact crypto.

- Regulatory News: Keep an eye on further developments from the SEC regarding Bitcoin and Ethereum ETFs, which could provide the next major catalyst for the market.

- Technological Developments: Watch for updates from the Ethereum and Solana networks regarding scalability improvements and network stability, as these could influence price movements in the coming weeks.

As always, the crypto market remains highly sensitive to external factors, including regulatory news and macroeconomic developments. Institutional adoption and technological advancements continue to play a critical role in shaping the future of major assets like Bitcoin, Ethereum, and Solana. Stay tuned for more updates, and trade smart, trade safe!

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

13th Oct 2024

13th Oct 2024