Welcome to this week’s Crypto Market Weekly Outlook, post #353, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

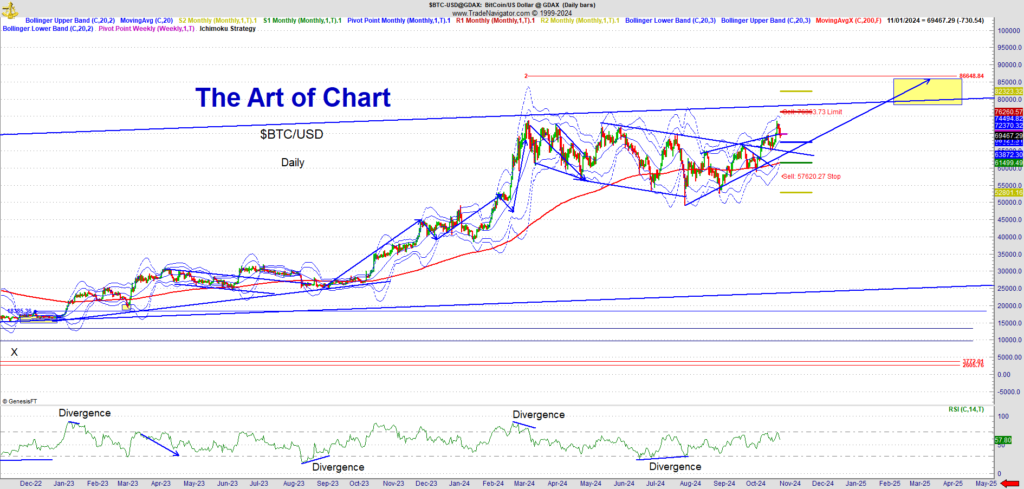

Bitcoin (BTCUSD)

Recent Developments: Bitcoin has maintained its resilience amidst market fluctuations, continuing to show stability despite global macroeconomic uncertainties. Notably, recent signals from the U.S. Securities and Exchange Commission (SEC) suggest that the approval of a Bitcoin spot ETF may be imminent. This potential development has fostered optimism among investors, as such an approval could trigger a wave of institutional investments and further integrate Bitcoin into mainstream finance. Additionally, the crypto market has been responsive to broader economic data, including the U.S. job report, which showed stronger-than-expected job growth and steady wages. This economic backdrop affects risk appetite and indirectly influences Bitcoin’s position as an alternative asset.

Outlook: Bitcoin is poised for potential volatility as market participants keep a close watch on ETF news and macroeconomic indicators, such as U.S. inflation data. A positive ETF approval could boost momentum, driving BTC past key resistance levels. Conversely, further delays or unfavorable macroeconomic conditions might cap gains. Investors should monitor key support and resistance levels as the market responds to developments.

Ethereum (ETHUSD)

Recent Developments: Ethereum continues to gain traction following the success of its Shanghai upgrade, which enhanced withdrawal capabilities for staked ETH and improved scalability. This has strengthened Ethereum’s position as a cornerstone for decentralized finance (DeFi) and non-fungible tokens (NFTs). Analysts highlight that sustained growth in layer-2 solutions like Arbitrum and Optimism further bolsters ETH’s ecosystem. However, persistent concerns about rising gas fees remain a focus.

Outlook: Ethereum’s price movement is expected to align with broader crypto market trends, particularly Bitcoin’s performance and regulatory shifts. Further adoption of layer-2 solutions and any significant regulatory updates could attract more institutional interest. Positive developments in network upgrades that enhance scalability and manage transaction costs may trigger a bullish breakout.

Litecoin (LTCUSD)

Recent Developments: Litecoin has enjoyed modest gains, capitalizing on Bitcoin’s steadiness. Known for its low-fee transactions and consistent network reliability, Litecoin has attracted risk-averse investors. The recent addition of network enhancements aimed at further lowering transaction fees has reinforced its utility. However, Litecoin continues to be overshadowed by larger-cap cryptocurrencies.

Outlook: Litecoin’s future price action will likely track the broader crypto market, with an emphasis on investor preferences for stability during uncertain times. Key technical levels will play a pivotal role in determining momentum shifts, with potential growth tied to market trends that favor lower-volatility assets.

Solana (SOLUSD)

Recent Developments: Solana has strengthened its position in high-speed blockchain applications, expanding its ecosystem with new development tools and updates designed to enhance stability. Despite past network outages, recent improvements have helped restore some investor confidence. Solana remains a popular choice for developers in the DeFi and NFT spaces, supported by its efficient, low-cost transactions.

Outlook: Solana’s trajectory will hinge on its ability to maintain consistent network performance and onboard new projects. Sustained interest in its ecosystem and improvements in reliability could drive price action. However, volatility remains a concern, with key support levels essential to maintaining upward momentum.

Regulatory Landscape and Market Sentiment

Recent News: The SEC’s potential approval of Bitcoin spot ETFs has sparked hope in the market. Additionally, Japan’s Financial Services Agency (FSA) introduced guidelines that simplify compliance for blockchain projects, making the region more attractive to startups and potentially increasing innovation and capital flow. Regulatory discussions at the G20 summit continue to signal a global push for clearer digital asset frameworks, although definitive regulations are still pending.

Blockchain Ecosystem Developments

Ethereum Layer-2 Solutions: The success of Ethereum’s Shanghai upgrade has been complemented by growing adoption of layer-2 solutions like Arbitrum and Optimism. This week, Arbitrum announced plans to decentralize its governance further, fostering greater community involvement, which may enhance confidence in its scalability solutions.

Solana Ecosystem: Solana continues to attract developers for DeFi and NFT projects, bolstered by newly introduced tools that facilitate ecosystem growth. However, its history of network disruptions still poses concerns, particularly for institutional investors.

New Developments in Altcoins: Altcoins linked to artificial intelligence (AI) and data processing have seen significant gains, driven by partnerships and technological advancements. This trend indicates growing interest in projects that combine blockchain and AI, offering potential high growth outside the major tokens.

What to Watch This Week

- Macroeconomic Data: Keep an eye on U.S. inflation data and any commentary from the Federal Reserve on interest rates, as these will influence market sentiment.

- Regulatory News: Updates from the SEC on Bitcoin ETF decisions and further international regulatory discussions could impact market dynamics.

- Blockchain Innovations: Advancements in Ethereum’s layer-2 scaling and Solana’s network stability are expected to play a role in shaping short-term price trajectories.

The crypto market remains cautiously optimistic, with a mix of regulatory developments, institutional interest, and technological innovations poised to drive market sentiment in the near future.

Stay tuned for further updates, and as always, trade smart and trade safe!

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

03rd Nov 2024

03rd Nov 2024