Welcome to this week’s Crypto Market Weekly Outlook, post #363, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview

- Bitcoin (BTC):

Bitcoin is trading at $94,694, reflecting a slight increase of 0.24% over the past day. After a sharp correction in December 2024, Bitcoin remains resilient, holding above key support levels. - Ethereum (ETH):

Ethereum is priced at $3,266, down 0.18%. The network continues to benefit from ongoing developments in DeFi and layer-2 scaling solutions. - BNB (BNB):

Binance’s BNB token stands at $692, with a weekly decline of 0.48%, as the token remains a cornerstone of the Binance ecosystem. - XRP (XRP):

XRP is trading at $2.50, up 4.60% in the last week. Its recent price action is bolstered by increasing adoption in cross-border payment solutions. - Cardano (ADA):

Cardano is priced at $0.99, reflecting a weekly increase of 5.67%, as it continues to attract attention for its expanding ecosystem of decentralized applications.

Recent Market Developments

- Market Correction in December 2024:

The cryptocurrency market saw a significant correction last month, resulting in $1.7 billion in liquidations, the largest since 2021. Bitcoin dropped to $94,150 from its all-time high of $101,109, while altcoins experienced sharper declines. The correction highlighted the market’s volatility and the importance of managing risk effectively. - Institutional Gains:

Brevan Howard’s crypto hedge fund posted a 51.3% gain in 2024, following a 44% gain in 2023. Institutional inflows into cryptocurrencies continue to highlight growing acceptance and confidence in the market’s long-term potential. - Regulatory Concerns:

The outgoing Chair of the Commodity Futures Trading Commission (CFTC) warned of risks in the largely unregulated $3 trillion cryptocurrency market. Calls for comprehensive regulations are increasing, aimed at mitigating fraud and market instability.

New Cryptocurrency Projects

- Wall Street Pepe (WEPE):

A meme cryptocurrency blending internet culture with practical trading tools. It provides holders access to trading signals and decentralized exchange features designed for meme coin enthusiasts. - Solaxy (SOLX):

A blockchain project focusing on sustainable energy solutions, Solaxy aims to revolutionize the renewable energy sector by creating decentralized platforms for energy trading and investment.

Market Sentiment

The cryptocurrency market remains volatile but continues to attract institutional interest. The introduction of innovative projects and increasing regulatory attention underscore the sector’s dynamic nature. While potential rewards are high, investors are urged to approach the market with caution and conduct thorough research before making investment decisions.

Staying informed and adopting a strategic approach will be essential for navigating the opportunities and challenges that lie ahead.

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

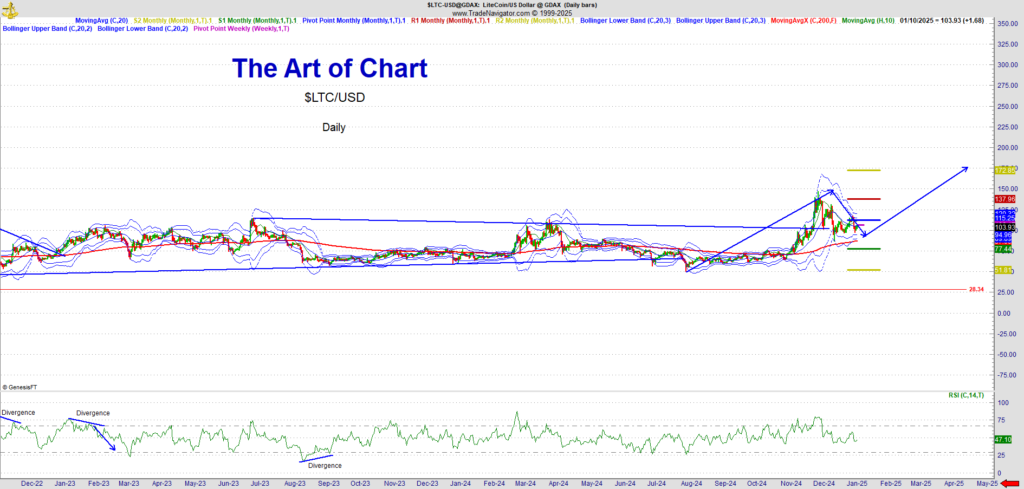

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

12th Jan 2025

12th Jan 2025