Welcome to this week’s Crypto Market Weekly Outlook, post #389, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview

Bitcoin (BTC): Trading around $118,071, surging to fresh all-time highs above $118,000, supported by record ETF inflows and growing institutional interest.

Ethereum (ETH): At $2,963, steady post-upgrade lift, buoyed by stablecoin demand and corporate Ethereum adoption.

Solana (SOL): Near $161.72, reversing earlier weakness as DeFi activity rebounds and technical indicators improve.

Dogecoin (DOGE): Around $0.1985, consolidating after recent volatility; retail interest remains modest.

Key Developments This Week

Bitcoin Records Peaks: BTC hit new highs near $118,800 on strong ETF capital, short-covering, and a macro “risk-on” backdrop.

Ethereum Institutional Momentum: Wall Street companies are increasingly allocating to Ethereum, viewing it as a productive asset—staking and smart contract use cases are accelerating.

China Opens Door to Stablecoins: Shanghai regulators are now exploring yuan-linked stablecoins and crypto frameworks, signaling potential easing of past restrictions.

Crypto Legislation Week: U.S. lawmakers kicked off “Crypto Week,” progressing bills tied to stablecoins, market structure, and regulation, boosting sentiment.

Low‑Cap Token Surge: Renewed investor attention is shifting toward sub‑$1 tokens with solid communities—appealing for asymmetric upside plays.

Emerging Projects to Watch

Worldcoin (WLD): Crypto under $1, gaining traction after re-entering accumulation zones.

Top Undervalued Picks: Analysts highlight several sub‑$1 tokens as high-potential altcoins during July’s rebound.

Innovative Utility Tokens: Focus on DeFi, real‑world asset integration, and hybrid token models driving early interest.

Investor Insights

Bitcoin: Momentum remains strong; watches: $118K–$120K resistance zone.

Ethereum: Institutional adoption supports higher highs; key level: $3,000.

Solana: Short-term rally on DeFi resurgence; monitor volume and on-chain metrics.

Dogecoin: Volatility still high; thematic bets hinge on social media and retail narratives.

Looking Ahead

U.S. Macro Signals: Fed minutes and CPI releases will guide risk sentiment and liquidity trends.

Crypto Legislation: Outcomes of U.S. “Crypto Week” may influence markets and regulatory clarity.

China Policy Update: Any official stablecoin framework or pilot could ripple through global crypto markets.

Altcoin Rotation: Continued attention to sub‑$1 tokens and emerging utility/meme hybrids may define July’s flow.

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

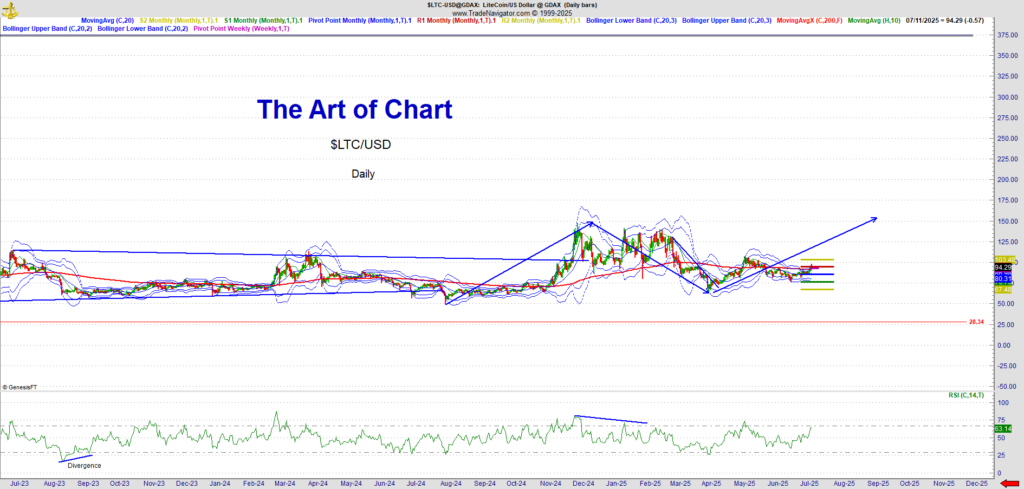

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

13th Jul 2025

13th Jul 2025