Welcome to this week’s Crypto Market Weekly Outlook, post #392, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview

Bitcoin (BTC): Trading near $113,805, continuing its post‑dip rebound supported by ETF inflows and macro stability.

Ethereum (ETH): At $3,463.86, holding gains from upgrade momentum and rising stablecoin usage.

Solana (SOL): Around $161.74, repairing after recent volatility, backed by sustained DeFi deployment.

Dogecoin (DOGE): Approximately $0.1987, firming as retail-driven interest returns following a short consolidation.

Key Developments This Week

ETF Demand Stays Strong: Bitcoin ETFs remain a source of steady institutional capital, helping maintain BTC levels near six‑week highs.

Ethereum Upgrade Buzz: Continued anticipation around the upcoming network improvements is providing lift for ETH and Ethereum-based projects.

Altcoin Rotation Gaining Traction: Investors are refocusing on Layer‑2 scaling tokens and meme‑coin catalysts as BTC volatility softens.

Regulatory and Security Headlines: EU MiCA implementation progresses while enforcement actions against ATM fraud and exchange hacks remain in focus.

Emerging Projects to Watch

Lagrange (LA): Layer‑2 ZK‑rollup experiment with notable developer engagement post-launch.

Solaxy (SOLX): Solana-layer scaling protocol gaining visibility through community traction and presale interest.

MIND of Pepe (MIND): AI‑infused meme token building buzz via community-driven presale activity.

Bondex (BDXN): Web3-based professional network token bridging LinkedIn-like functionality to blockchain.

Investor Insights

BTC & ETH: Both remain structurally intact with institutional flows and favorable technical setups holding them near recent highs.

SOL: Shows resilience backed by ecosystem activity, though supply shifts may affect near-term momentum.

DOGE: Slight recovery may signal renewed retail engagement; further upside depends on sentiment catalysts.

Looking Ahead

Fed & CPI Data: Inflation and Fed meeting minutes this week could influence broad market and crypto sentiment.

Ethereum Roadmap: Any updates on the Cancun‑Deneb rollout timeline may be a potential catalyst for ETH and Layer‑2 tokens.

Crypto Policy Movements: Watch for regulatory updates around crypto infrastructure, ETF licenses, and emissions rules.

Security Developments: Investor focus on exchange safety and on-chain storage continues, particularly after recent breaches.

BTCUSD (Bitcoin)

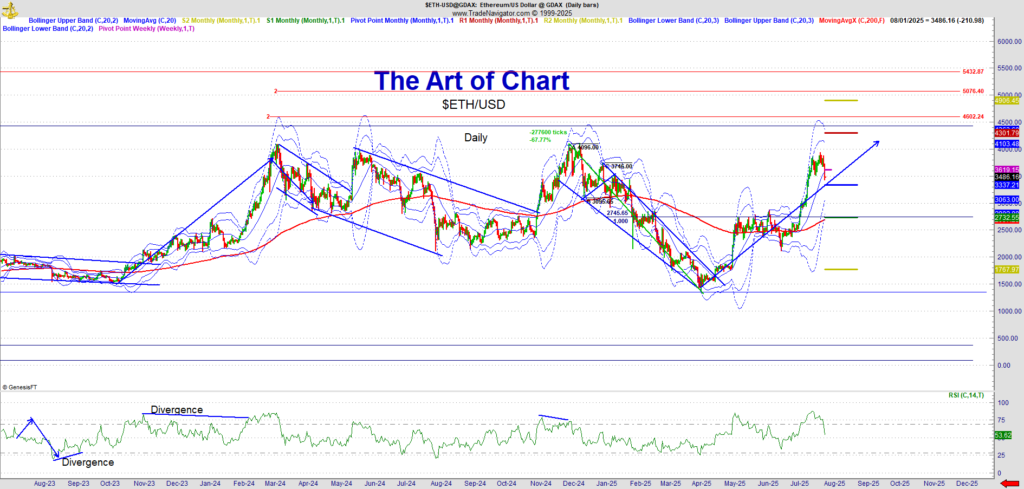

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

03rd Aug 2025

03rd Aug 2025