Welcome to this week’s Crypto Market Weekly Outlook, post #393, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview

Bitcoin (BTC): Trading near $118,600, holding firm as ETF inflows and macro tailwinds keep prices close to multi-week highs.

Ethereum (ETH): At $4,170, benefiting from strong ETF demand and anticipation of the Cancun-Deneb upgrade.

Solana (SOL): Around $178.50, lifted by ecosystem growth and renewed developer activity.

Dogecoin (DOGE): Approximately $0.203, edging higher as meme-coin sentiment strengthens.

Key Developments This Week

401(k) Crypto Inclusion: U.S. executive order allowing crypto in retirement accounts boosted institutional inflows.

Ethereum Upgrade Buzz: Ongoing optimism around Cancun-Deneb continues to drive ETH and L2 interest.

Altcoin Rotation: Capital moving toward Layer-1 and Layer-2 projects with active ecosystems.

XRP Surge: Regulatory case dismissal triggered double-digit weekly gains.

Emerging Projects to Watch

Little Pepe (LILPEPE): Layer-2 meme coin closing presale with strong exchange-listing interest.

Pudgy Penguins (PENGU): NFT-linked token gaining momentum as whales accumulate.

SPX6900 (SPX): Technical breakout drawing speculative flows.

Bondex (BDXN): Web3 career-network token blending LinkedIn-style functionality with on-chain credentials.

Investor Insights

BTC & ETH: Strong ETF flows and policy tailwinds keep price structures bullish.

SOL: Solid fundamentals from DeFi and NFT growth, though large holder activity could impact price action.

DOGE: Modest rebound may signal retail re-engagement; watch for social sentiment catalysts.

Looking Ahead

CPI Data (Tuesday): Could sway both equity and crypto sentiment depending on inflation trends.

Ethereum Roadmap: Any confirmed launch dates for Cancun-Deneb could trigger renewed upside.

Regulatory Watch: Expect developments on ETF approvals, MiCA rollout, and exchange compliance measures.

Security Focus: Investor attention on custody solutions and hack prevention remains elevated after recent breaches.

BTCUSD (Bitcoin)

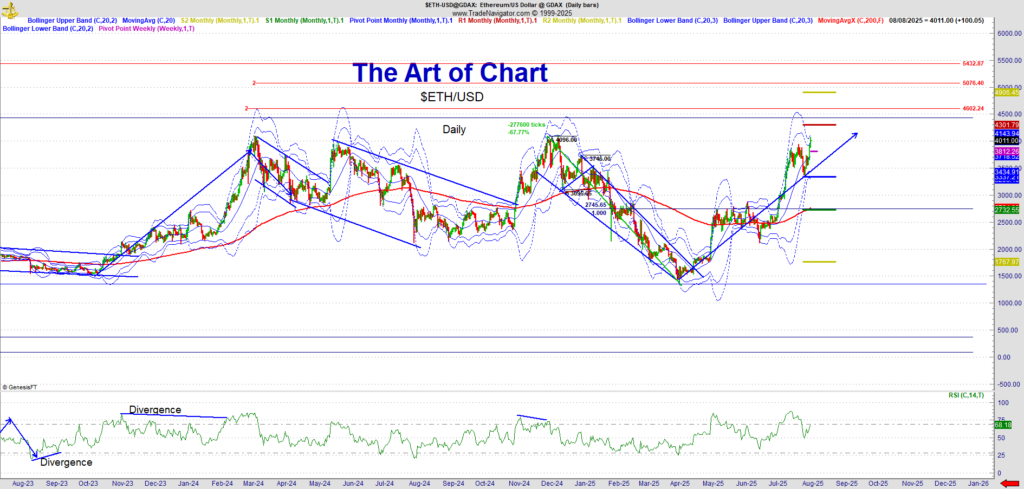

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

10th Aug 2025

10th Aug 2025