The Weekly Call provides perspective on high quality setups and trading strategies for the coming week. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This week we manage our trades in Cocoa, Sugar and Orange Juice and are looking for entries in Coffee, Live Cattle and Silver.

Our goal in this blog is to generate a 200% return in less than a year by swing trading futures that are not part of our regular service. Our track record is now posted below under Completed Trades. See some of our completed trade videos below.

Follow along during the week on twitter by following HERE.

30 day FREE trial now offered for Trader Triple Play – Click Here

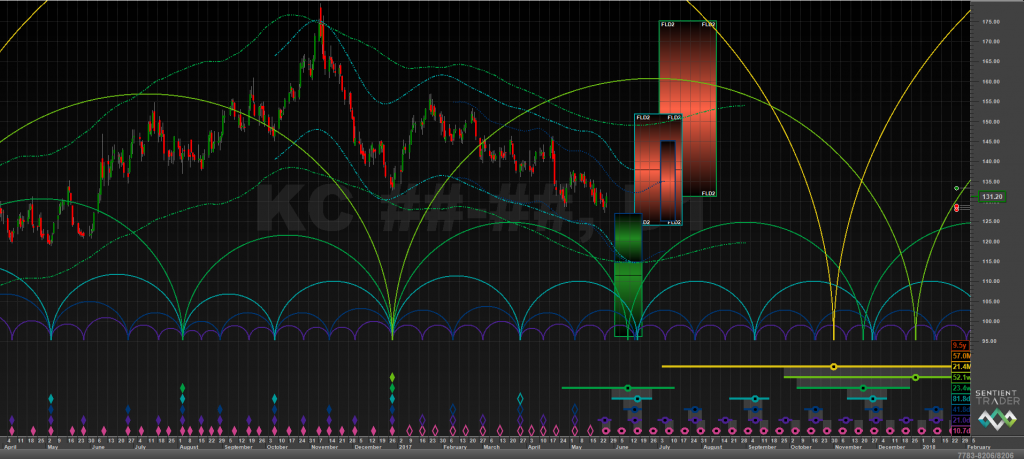

Coffee – Hunting the Long

4-30 – As expected, we have a turn in the $130 area and a potential rally into 5-8 as mentioned. The inflection box on 5-8 will make the decision if the low is in. Timing cycles call for another low in the 6-10 time frame. We will wait for a reversal pattern as we are expecting a major rally in Coffee that is likely to last well into 2018.

5-7 & 5-14 – We are close to the inflection area in Coffee and our lean is a turn and lower prices into 6-10. We will stand aside and wait for the next low window and reversal pattern. There is an alternate which is shown on the chart. We are waiting patiently for the next long setup.

5-28 – A nice setup is coming in Coffee – near the turn date and cycles are looking good. We will tweet out our entry once we see a reversal pattern.

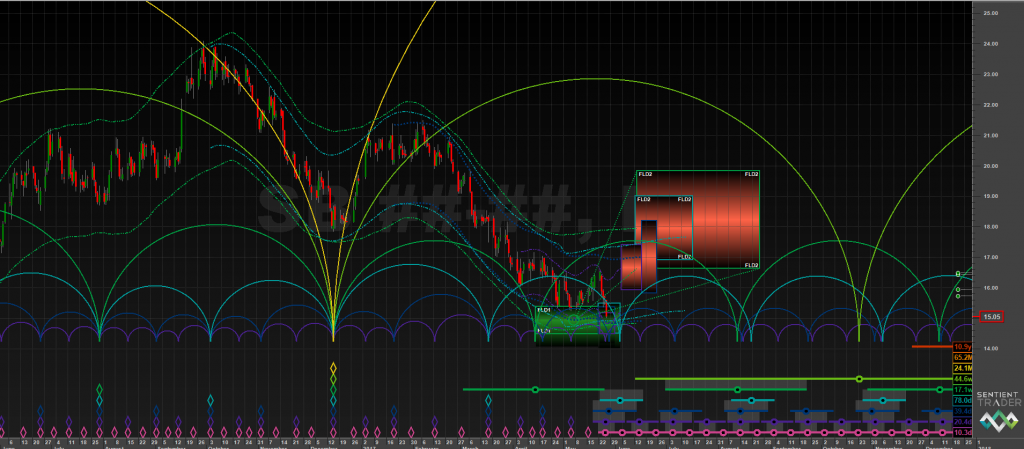

Sugar – Entering the Trade

4-23 – We have a potential reversal pattern here and are waiting to convert weekly pivot at 16.62. If seen this can begin the next legg higher in Sugar. We like sugar long here as timing cycles are pointing higher into the beginning of June and we are exiting the low timing window.

4-30 – The setup is developing as we have a turn and a rally through channel resistance. The rally should continue this week through 5-4 and we are expecting a retest and an entry. The retest will be either a higher low or a double bottom. We expect the entry sometime next week. Commercials are long Sugar and we expect a significant bullish move soon.

5-7 – We are long a 1/2 size position as of Monday morning at 15.33. If we see the trendline at 14.85, this would be our next add. Nice reversal pattern, Pos. D, cycles all aligning. We are looking at a move higher into the November time frame.

5-14 – We are long 1/2 a position and now have resistance at the trendline. There is risk to $14.50-80 and the lower trendline. We plan to add another 1/2 position long if seen. There is a nice reversal pattern in place now so the lean is this week we see the declining resistance trendline break.

5-21 – Last week we tweeted out a partial profit as we were 50% back the previous swing and placed our stop at even. We waited for the backtest which occurred the next day and found support at the weekly pivot. We have now broken the flaggy pattern to the upside and expect another backtest in Sugar this week before we see a larger impulse to the upside. We are even stop and a hold.

5-28 – A news announcement from China about changing tariffs on sugar export hammered sugar prices. We were stopped out of the trade at even stop and exit with 1/3 in profit. This is a great example of how our risk management approach of taking profits at key fibs and transition points prevents loss of capital. We are looking for a re-entry once we see a reversal pattern. Timing shows a high window into 7-15.

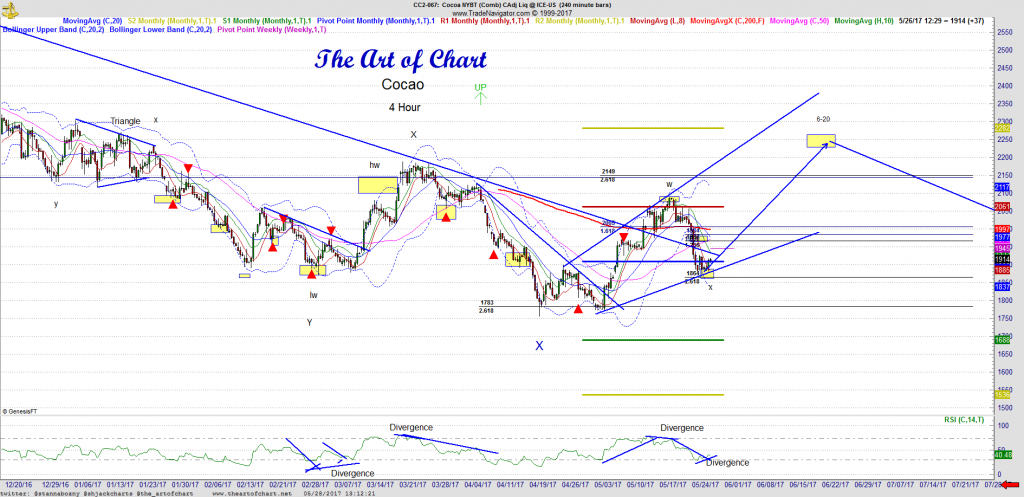

Cocoa – Managing the Long

We were hunting an 18 month cycle low in Cocoa – this is a very volatile commodity and we suggest trading this only if you are experienced in commodities and risk management. There is a likelihood that this low cycle can initiate a change in trend for this commodity.

4-2 – We have initiated a 1/2 size position at 2088 in Cocoa and are managing risk using size instead of using stops. The 18 month cycle has printed on Cocoa so we have some confidence the low in now in. We will add to our position if 2030 is seen.

4-9 – We have added a 1/2 size position at 1996 – the three down a=c. The 18 month cycle low has printed at the low and we are looking for an impulse higher this week into the high window at the end of April. We are expecting 2252 as a first target. Longer term we are looking for 2685 by year end.

4-16 – We have two 1/2 size positions long and expect a reversal this week in Cocoa. We may see a full retest of the low and a double bottom setup. Nice positive divergence setup on RSI and timing cycles are indicating we are in a short term low window with the larger degree 18 month cycle low now complete. On a break of divergence we will look to exit this trade, until then we are holding.

4-23 – We have a new low and a 5 down structure and are planning to add another 1/2 size position. This will be our last add to this trade. Conditions for this next add are to see resistance in the 1950ish are and then add on the next pullback. A break of the positive RSI divergence will cause us to exit this trade.

4-30 – We have added out last 1/2 size position at 1832 and have a potential reversal pattern in Cocoa. We are waiting for a confirmation and a conversion of monthly pivot at 1909 and the next high window on 6-15. We will be taking our first profit at the 50 back of the previous swing at 1962 and placing a stop at even.

5-7 – Price has broken the trendline last week which is a bullish sign. Bulls need to create more separation from the low and convert 1910. The entry strategy used was to manage risk through size and enter in three leggs slowly. Our exit strategy is the same, we plan to take off the leggs we added LIFO (last in first out). We are looking for bullish price movement through 6-15.

5-14 – Price has moved higher and price closed above the declining resistance trendline Friday which is a bullish sign. We expect higher prices into the monthly R1 (the red pivot line) and then a backtest into the monthly pivot (the blue pivot line) to find support. We have taken 1/3 in profit at 1962 as mentioned in the previous post. We plan to hold 2/3s of the trade into 6-15 for a three up.

5-21 – Cocoa continued last week to move higher, we have completed the first legg up marked “w”. Waiting on the back test to the trendline or the previous degree wave x. We are a hold and expecting higher prices into 6-15.

5-28 – Cocoa back tested as expected and went deeper than expected. The back test structure appears to be a flat and the downside on cocoa appears to be finished. Support is at 1864 and we are expecting a rally into June 20th.

Silver – Planning the Entry

Silver appears to have made a 40 week timing cycle low on 12/20/2016. We captured a long in metals in Gold on the first impulse up and exited on 2/8/2017 with the last 1/3 of the trade capturing 94 handles. We do not believe in counter trend swing trading unless it is a move of a month or more. We have been patiently waiting on this backtest in metals to enter long.

4-30 – We have no reversal pattern yet in Silver and there is no cross in the RSI price cycle. So we wait until those two conditions are present before entry. We will wait on the reversal pattern and the RSI price cycle cross so the setup has higher odds of success.

5-7, 5-14, 5-21 – We are standing aside in metals waiting for the next long setup.

5-28 – The rally in Silver is out of juice and we are expecting the backtest into the middle of June. We will be looking for an entry around the next low timing window.

Live Cattle – Planning the Entry

Live Cattle is nearing completion of its first legg up from the low we called back in October 2016. This is an expanding leading diagonal which is sometimes seen at the beginning of a trend change from a major turn. This pattern will likely deeply retrace and we are going to set up a trade for the correction. We are looking for a turn in the $138-$140 area near the trendline with negative divergence on RSI. We are looking for the setup in the next 10 trading days. Watch for the entry on twitter by following HERE.

Orange Juice – Planning the Entry

Trading soft commodities can be risky as many of them have low liquidity. Orange Juice is a thinly traded commodity that trends extremely well. We are waiting on a break of the trendline for a confirmation of a break in trend before looking for an entry in this instrument. Nice Positive D here and timing cycles support the entry. We expect to see the entry in the next week. Watch for the entry on twitter by following HERE.

5-21 We tweeted out an entry in OJ last week – 1/2 size position at 141.80. There is risk to 136.45 and we will add to the position lower if seen this week. Our entry strategy here is to manage risk through size by adding three to four small leggs over time. Timing cycles are supportive of a turn this week.

5-28 – We tweeted out an addition to our entry last week at 137.30 so we are now long two leggs in OJ. We are managing risk through size by adding three to four small leggs to our position. OJ is now about to break the descending resistance trendline which should initiate a move higher. We are a hold and watching the price action.

Come see what we are trading – Try our 30 day FREE trial – Click Here

Have a GREAT trading week!!!

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a $50,000 account limited to a three contract position size. We will increase position size after we generate a 200% return. See the videos below for more information.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in Live Cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in Coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with Natural Gas, we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the Coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the Gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter Gold in a few weeks after a back test.

29th May 2017

29th May 2017