The Options Trading and Investing service provides perspective on high quality setups and option trading strategies. We carefully select these setups due to their quality and profit potential and we report back on results. In the weekend free webinar I review current portfolio performance and I also discuss techniques that I utilize to help reduce risk and, in some instances, lock in profits from previous trades. This week I discuss positions in EEM and AAPL.

Please refer to our education video HERE for more information in the option strategies used in this post.

The entries and cost basis of new positions will appear on our private twitter feed during the coming week.

Currently the portfolio is down 2.4% of the portfolio’s $50,000 value. Over the past few months I had established multiple long term short positions (Sep expiry) in SPX correlated products that have performed poorly as the market has continued to move higher. In this video I will discuss techniques that I will utilize to turn these positions around and get them profitable without adding any additional upside risk. You will not hear me discussing any strategies that involve ‘doubling down’ on a losing position! There are ways to increase potential profitability without taking on additional upside risk.

All new trades will be posted on the subscriber private Twitter feed.

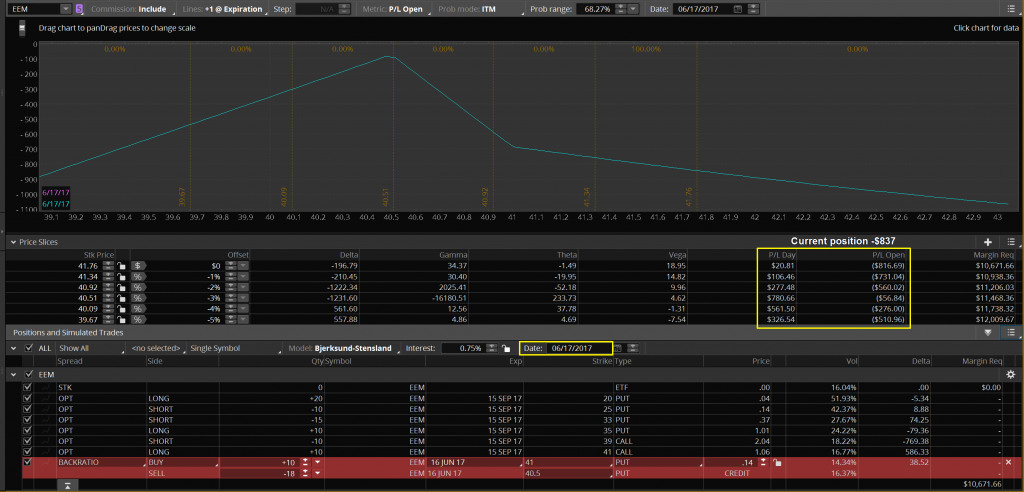

Let’s start with the current position in EEM. Position has a loss of $837 with -184 Deltas and -$.29 in Theta. This position was designed back in Feb when a large move lower was expected into Sep. With this position a move of 5% lower is needed by Sep15 expiry to get to break even. Based on Stan’s chart analysis that is still expected but managing option positions is more than just establishing a position and then waiting for price to move into the profitable range. Usually I try to be proactive to make adjustments that bring in Theta (premium from option decay) while maintaining the Delta bias. Currently, Theta is working against this position and needs to be adjusted.

Here is an adjustment I am considering for Monday, 6-5. 2 goals here with the adjustment, generate positive Theta and maintain the negative Delta’s of the current position. Below is a 10×18 Put Ratio Spread that shows a $.14 credit. Why do I need a credit? At this point in time I am unwilling to take on any additional upside risk in any of my positions that are highly correlated with the SPX. This market seems as if it doesn’t want to go lower. However, markets often seem that way just before they do go lower. I want to be careful in adding to a long position here but it would be a mistake to keep adding upside risk (aka. doubling down) at this point. That is poor risk management. More traders have gone bust over the years by continuing to leverage a directional bet even when price is moving against them. That doesn’t mean I have to flip the cards and go long here however.

Adding that adjustment turns the position into Theta positive and also maintains a short Delta bias but won’t add to my losses if EEM continues higher. The sweet spot is obviously at the 40.50 price level on EEM at Jun16 expiry. If EEM goes to the price tomorrow it won’t be that helpful as the position will only recover about $100 of it’s current loss.

However, if EEM is at 40.50 as of Jun16, the current loss of $837 will be reduced to just $57! This adjustment will not be beneficial if EEM is below 39.90 at expiry but, above that price, the adjustment will pay off and potentially almost completely eliminate the current loss. The $.14 credit that the adjustment is showing is weekend pricing so I will have to see what the mark price is Monday morning to decide if I place this position adjustment or if it has to be changed to generate a sufficient credit. I will notify subscribers through the Art of Chart twitter feed. If you are not a subscriber, we offer a 30 day free trial that includes access to the private Twitter feed.

Current AAPL position. This is the portfolio’s long-term stock replacement strategy targeting a 150 price on AAPL at Jan2018 expiry. Seems like a reasonable target and if AAPL ends up there at expiry this position will have an over 60% return on risk for a 1 year investment. This position has no downside risk and the risk to the upside is defined at $4,667. So far so good. Due to the relentless grind higher in AAPL’s price the current loss is $782. That loss will be completely eliminated if AAPL goes down in price or time goes by and AAPL doesn’t go up in price. The price of AAPL can only do 1 of 3 things between now and Jan2018; go up, go down, or go sideways. This position wins with 2 of those 3 outcomes. That doesn’t mean I just have to sit back and keep my fingers crossed if Stan is projecting AAPL higher in the short term or if I just want to limit upside risk.

Below I have zoomed in on the current position to show what might happen over the next 2 weeks on a move in price anywhere from down 2% to up 2%.

Below I am considering 2 Ratio Diagonal spreads. These are long (positive) Deltas with a large amount of Theta. These will be profitable as long as AAPL doesn’t go lower in price by more than 1.5% by Jun16. It is important to note this is a margin intensive adjustment.

Below is what the risk profile would look like if I added the 2 Ratio Diagonal Spreads to the current position. Again, this position would be generating very good Theta over the next 2 weeks. It would also cause the portfolio’s overall adjusted position to be long Deltas instead of short.

Below is what the risk profile would look like at the close on Friday Jun16. The ‘P/L Day’ reflects the profit/loss from the combined position from today thru Jun16 and the ‘P/L Open’ would be where the profit/loss of the position would be after accounting for the current $781 loss. You can see if AAPL is 1% in price as of Jun16 this adjustment will have eliminated all but $46 of the current loss. As long as AAPL is at least -1% or higher in price, the adjustment improves the overall profitability.

One final note regarding adjustments. Many option traders have difficulty dealing with the concept of adjustments. If AAPL drops more than 1.5% over the next 2 weeks I will have been better off just leaving the current position alone. It is always easy to look back in hindsight to say ‘I should have’ or ‘I shouldn’t have’ but that provides no benefit to a traders mindset. Either the adjustment makes sense or it doesn’t Based on Stan’s short term chart analysis and probability of outcome this is a ‘good’ adjustment even if it turns out to cost the portfolio money.

04th Jun 2017

04th Jun 2017