Welcome to this week’s edition of The Weekly Call, your trusted source for high-quality commodity setups and trading strategies. Since October 2016, our approach has delivered an impressive 777% return, and we continue to share the insights and methodologies that drive these results with this post #482. This week, we’ll explore the latest market trends, actionable trade setups, and global economic factors influencing commodities like sugar, coffee, live cattle, and gold.

U.S. Markets

S&P 500 (SPY): Closed Friday near $684.6, up about 0.2% on the day and roughly 0.3% on the week, sitting just shy of all-time highs as traders lean into high odds of a Fed rate cut at next week’s meeting

Nasdaq 100 (QQQ): Finished around $625.5, flat on Friday but up about 0.9% for the week, with large-cap tech still leading but seeing more two-way trade ahead of the Fed and big AI-linked earnings

Dow Jones (DIA): Ended near $480.0, up ~0.2% Friday and about 0.5% for the week, keeping the broader index grind toward record territory intact.

Takeaway: We’re essentially at the doorstep of new highs with the market priced for an ~80–90% chance of a 25 bp Fed cut on Dec 9–10, so the risk is now more about the tone of Powell’s guidance than the cut itself.

Global Markets

FTSE 100 (UK): Slightly higher on the week, supported by rate-cut hopes and firmer metals, but still lagging U.S. indices as energy and domestic growth remain question marks.

DAX (Germany): Modestly positive; data remain mixed with ongoing Eurozone growth uncertainty, but global risk-on tone and strong U.S. markets keep the index supported.

Nikkei 225 (Japan): Down about 1%+ on Friday, as speculation about a BOJ rate hike and weak household spending knocked Japanese equities even while the rest of Asia traded better.

Shanghai Composite (China): Largely range-bound as investors wait for clearer signs that Beijing’s anti-deflation and stimulus measures are gaining traction

Big picture: Global risk appetite is still constructive, but Japan and parts of Europe are trading more off local macro (BOJ/ECB path, growth data) while U.S. policy dominates the narrative elsewhere.

Commodities Snapshot

Gold: Trading around $4,200/oz, up on the week and still near record territory as rate-cut expectations and a softer dollar keep real-yield headwinds in check.

Silver: Around $58–59/oz, effectively at fresh record highs after a parabolic year; ETF inflows and physical tightness are driving a “scarcity” narrative

Copper: Near $5.3/lb, holding close to record levels on the back of supply disruptions + AI / electrification demand, plus pre-emptive stockpiling ahead of possible new U.S. tariffs

Crude Oil (WTI): Spot and front-month futures sitting around $59–60/bbl, up roughly 1½–2% on the week as Fed cut hopes and geopolitical risk (Russia, Venezuela) offset OPEC+’s steady output stance

Natural Gas (Henry Hub): Around $5.3/MMBtu, sharply higher over the last month as winter demand and storage dynamics bite

Comment: Metals are trading like a leveraged bet on AI infrastructure + energy transition, while gold/silver are behaving like a hedge on policy error plus scarcity.

Cryptocurrency Market

(Prices as of Friday’s close / weekend reference levels)

Bitcoin (BTC): Around $89,000–90,000, down from the highs but stabilizing after a sharp early-December drawdown that knocked more than $1T off total crypto market cap. Options flow shows traders **betting on a range-bound “crypto winter lite” rather than another vertical leg up or full capitulation—for now

Ethereum (ETH): Near $3,000–3,050, tracking BTC lower but holding above the early-month lows as the market continues to price the next wave of L2 / restaking / DeFi activity rather than a structural breakdown

Solana (SOL): Around $133, well off recent spikes but still up massively year-to-date. Volatility has picked up as traders take profit and rotate into presales / smaller caps after a big SOL run

Cardano (ADA): Roughly $0.44, after a choppy week of double-digit percent swings as liquidity thinned into the macro events calendar

Dogecoin (DOGE): Around $0.14, drifting lower post-meme surge despite a pick-up in on-chain activity and transactions

Theme: The market is digesting a November–December shakeout: BTC and majors are off the highs, but no broad crisis of confidence—just a pivot from “everything up” to selective positioning and more focus on volatility/derivatives.

Key Market Drivers This Week

Fed Cut Almost “Priced In”

Futures put the odds of a 25 bp Fed cut on Dec 9–10 around the 80–90% zone, driven by softer labor data, mixed inflation prints, and increasingly dovish expectations—even as the FOMC itself is unusually split.

The risk now is in how divided the vote looks and what Powell says about 2026, not the cut itself.

“Bad” Data Helping Risk Assets

Weak private payrolls and labor indicators were interpreted as “good news” for markets by reinforcing the rate-cut narrative; U.S. indices finished the week just below records.

Silver & Copper Signal Tight Physical Markets

Silver printing new record highs near $59/oz and copper at multi-year records both underline structural tightness: mine disruptions, low inventories, and energy-transition demand.

Crypto: From Momentum to Risk Management

BTC and majors slid 5–7% early in the week as risk assets wobbled; derivatives data shows traders selling upside calls and buying protection, positioning for a choppy, range-bound December rather than a melt-up.

Emerging Crypto Projects to Watch

(Speculative / higher-risk segment of the market—size accordingly.)

Remittix (RTX) – PayFi / Payments

Positioning itself as a crypto-to-fiat PayFi network, aiming at low-cost payments across 60+ countries and 120+ fiat currencies with a live wallet and announced app launch.

Presale reports show ~$28–29M raised, making it one of the more visible December presales and drawing interest from ETH whales watching early usage metrics.

Bitcoin Hyper (HYPER) – BTC Layer-2 with ZK-SVM

A Bitcoin-native Layer-2 that integrates Solana-style SVM rollup tech to bring high-throughput smart contracts and sub-cent fees to BTC.

Presale has reportedly crossed ~$28–30M, with roadmap targeting a Q4 2025 mainnet launch and Uniswap listing; being positioned as a “next-wave BTC L2” in multiple presale round-ups.

DeepSnitch AI (DSNT) – AI Agents + Analytics

An AI-infra / agents play that just announced a key technical milestone and deployment of its first three AI agents, with about $690k raised so far in presale.

Narrative is “100x AI coin for 2026,” leaning on early-access tools and heavy AI-trend beta.

As always, these are early-stage, high-risk stories—treat them as optional satellite positions, not core holdings.

Outlook for the Week Ahead

Fed Meeting (Dec 9–10)

Base case is a 25 bp cut; market focus will be on:

How many dissents there are on the FOMC.

The dot plot and 2026 rate path.

Powell’s tone on inflation vs. labor “softness.”

Inflation & Labor Prints

Any upside surprise in inflation or strong labor data that pushes back on the “slowdown” narrative could knock yields higher and pressure growth / crypto again.

Equity Positioning Near All-Time Highs

With the S&P and Nasdaq within 1–2% of records, there’s room for:

A “Fed relief” breakout if Powell is dovish, or

A “sell the news” pullback if guidance undershoots the market’s cut expectations.

Crypto: Watching the Range

For now the base case is BTC chopping in a broad $80k–95k band into year-end:

Upside needs a clean macro risk-on plus renewed ETF inflows.

Downside risk is largely about macro disappointment (no cut / hawkish Fed) or a fresh security or DeFi shock.

Stay tuned as global market conditions continue to evolve, trade smart and trade safe!

As always, stay informed and adjust your strategies based on the evolving market conditions. All trades are posted on our Private Twitter Feed for subscribers and are included in the track record posted below under Completed Trades. I am currently trading 15 lots given the account balance and will adjust as necessary based on market developments.

Trading futures contracts and commodity options involves substantial risk of loss, and may not be appropriate for all investors. Past performance is no guarantee of future results. Please see our Disclaimer for more information.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Sugar

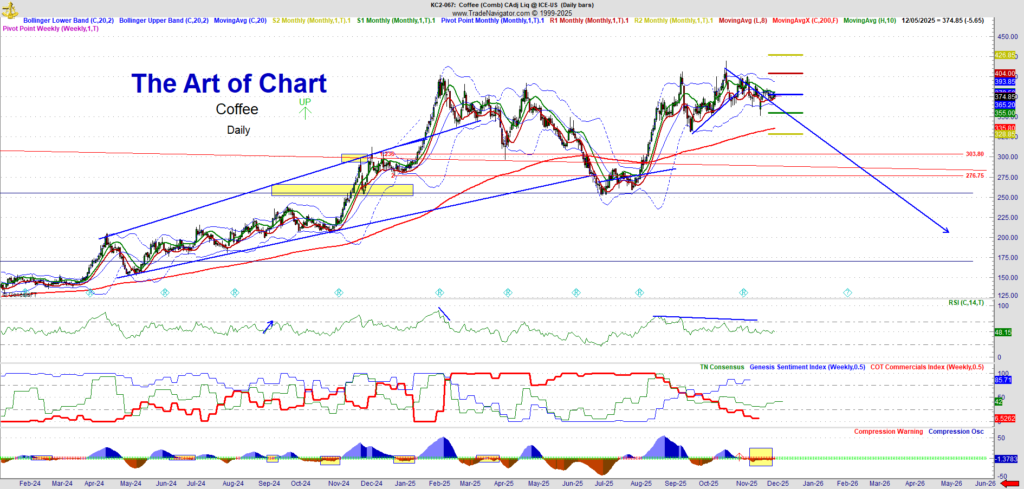

Coffee

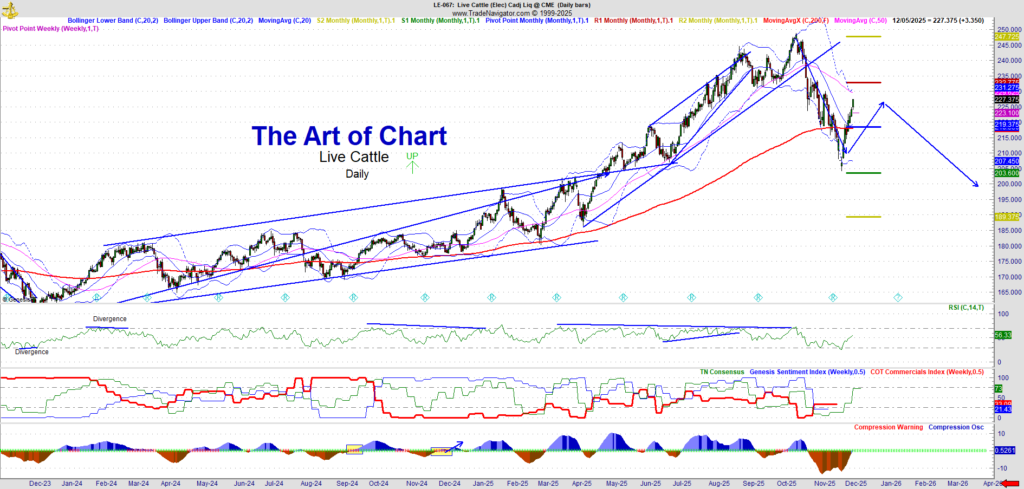

Live Cattle

Gold (GC)

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog. I am currently using 15 lots for the Striker trades which is based on this account being over $375,000. Each lot for auto trading at Striker requires $25,000 per lot. See the videos below for more information.

Track Record January 2022 thru December 2022 Click Here.

Track Record January 2021 thru December 2021 Click Here.

Track Record January 2020 thru December 2020 Click Here.

Track Record January 2019 thru December 2019 Click Here.

Track Record January 2018 thru December 2018 Click Here.

Track Record October 2016 – December 2017 Click Here.

*** Trading futures contracts and futures options involves substantial risk of loss, and may not be appropriate for all investors. By reading this web site, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced on this web site and associated documents and emails are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas; we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

07th Dec 2025

07th Dec 2025