The Weekly Call provides perspective on high-quality setups and trading strategies. Our current performance showing a more than 290% return since October 2016. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This week, I am managing trades in soy, soybean oil, natural gas, and looking to initiate new trades in corn, copper, gasoline, and live cattle.

Last week, I took profits in my second position in soy and now hold two trailers. The pop on Sunday should find resistance around 1003. I also took profits in copper last week and was stopped out of the trade. I also attempted to enter gasoline on two separate occasions and was stopped out within an hour. Nothing like real-time feedback. Portfolio stands at 297% profit since inception and a 66% win rate.

All trades posted here are discussed in detail in our Daily Update Subscription Service and posted on our private Twitter feed. Our track record is posted below under Completed Trades. See some of our completed trade videos below.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Soy – Re-entering the Trade

1-7 – I entered soy last week at 962 and am expecting a rally into February. I am already off 1/3 of the position as are 3 up and are past 50% of the previous swing. I am waiting for the trend line support and am looking for more upside this week. Break the trend line and I am out of this trade.

1-14 – After developing a bear flag, I decided to exit the soy trade at 962.75 for a 12% return on margin. Good decision as the he bear flag has played out lower. I have reentered at the three down target at 952.50 and am waiting on the higher low to add more size.

1-21 – The recent low was a good entry and I have exited my first 1/3 as always at 50% back the previous swing at 969s and the second 1/3 at the monthly pivot 979s. I am now waiting for a pullback into February 1st or so and will add size when seen. February has historically been a bullish month for Soy so I am watching the retest this week with interest.

1-28 – Still waiting on the retest and so far I see an “a” wave lower, looking for a three-down to complete around the monthly pivot (the blue line) and then expecting a rally. There is usually a seasonal rally in soy that starts in February. There is no guarantee that it will play out but the chart is aligned with seasonality so looking forward to adding size to this trade this week.

2-4 – I have added size to the trade at 978.50. Chances are that we will see a rally directly OR we will see 973s first and then a rally. I like this trade long through the month of February. Break the .618 and I am out of both the trailer I am carrying from the last long as well as this new position.

2-11 – Last week, I exited my first 1/3 at 984.50 from the new entry from 2-4. On the Sunday open we have gaped up and I have exited my second 1/3 at 998.25 so I hold a trailer currently on the add from the week of 2-4. I also hold a trailer from January from 952s. I see resistance at 1003 and am expecting a pullback and higher into the 1030 target.

Corn – Planning the Entry

Corn is getting close to a reversal pattern and I am planning to enter sometime this week. Either corn is going to double bottom or just break out to the upside. I plan to enter on the pullback if the breakout is seen. Members of our private Twitter feed see the actual post for the entry and all trades are reviewed on The Daily Update Video.

1-7 and 1-14 No entry this week as I am waiting for the crop harvest in the southern hemisphere to play out. I like to wait until all the signals I watch line up. We have a nice reversal pattern here, but chart patterns alone are not enough. I have plenty of time to make money here, so prudence outweighs getting into a trade that seasonality does not support. I will wait another week for an entry.

1-21 – Possible entry this week as I am watching for a pullback 50% or so into 348s. I will be watching RSI and price to look for a reversal pattern. We may see a marginal new high before the retest. I am expecting a rally into May.

1-28 – I missed the entry last week and will not chase, there will be another bite at the apply. At this point, I need to see negative D on RSI and marginally higher prices. The next retest should hold at monthly pivot and this is the entry I am looking for, three back into this area.

2-4 – Still waiting on the retest. Wheat is well into the retest now, and corn will likely follow. Expecting the monthly pivot (the blue line) as support. Corn needs a little negative D which now has to retest the low. Expecting a pullback this week.

2-11 – Pullback as expected and close to a turn. Looking lower still into at least 360 and more than likely 357. This is a decent area to either add size or initiate a new long.

Gasoline – Managing a Seasonal Trade

Seasonal trades make sense if, in the last 15 years, you can find a pattern with greater than a 70% win rate. This is the case with gasoline as typically we see a rise in price into the summer season. I have already entered a 1/2 size position with no stop at 1.7946. I will allow this position to swing quite a bit as I am looking into the March time frame for an exit. I will be adding size and legging in and out multiple times between now and then. This is just small size to put my toe in the water for now. More on this trade next week.

1-14 – I entered long at 1.7946 and last week I exited 2/3s of the trade at 1.8110 and 1.8321. I am holding the trailer and am waiting for the H&S formation to either succeed in which case I will then add more size or fail in which case I will get stopped out. I expect heating oil producers to flip over to making gasoline in the March time frame so I will be out of this trade at that time.

1-21 – I am still holding the trailer as we are still making new highs and moving toward my three-up target at 1.9123. I will be looking to exit my last 1/3 in this area and looking for a backtest into previous resistance at 1.83s. I will be looking to add more size at that time.

1-28 – I have punched out of my trailer at 1.9202 and am flat gasoline with an 81% profit in 2 1/2 weeks. At this point, the seasonal cycle should continue higher after a backtest in the 1.86-1.88 area. I will be looking for a second entry when seen.

2-4 – Getting close to the flag target and a new low. Once seen I plan to start another long into the early March time frame. A new swing low is required here to set up the next move higher.

2-11 – Last week I attempted two longs from the trend line at 1.8144 and the other three down at 1.7249. Both failed and I was stopped out for small losses within an hour of the entry. Nothing like real-time feedback when you are wrong! I have a rule that when I get stopped out on the day of entry unless there are unusual circumstances, I stand aside until the next day. This rule has served me well and is a good way to prevent revenge trading. With the broken trend line, I will be waiting for a better quality entry.

Soybean Oil – Managing the Trade

Soybean oil is a seasonal trade this time of year as there is not another harvest until May. I expected prices to rise steadily through the end of February. I have initiated a 1/2 size position at 33.29 and am waiting on a reversal pattern to add more size to the trade.

1-21 – Soybean oil is usually a seasonal long this time of year and I still like this long into the end of February. My stop is below the triangle trendline and I am planning to add size this week as we have clear positive divergence on RSI. I am a little early on my 1/2 size entry. Soybean oil usually has a decent February along with soy so waiting patiently on a reversal pattern here to add size.

1-28 – The seasonal trend in soybean oil I believe is now in action. I am riding only a 1/2 size position and will hold the trade for now until the retest of the low. Once seen, I plan to double my size.

2-4 – It is time this week to add size. We are now in the retest and likely done here. I am waiting for a reversal pattern to enter. When seen, I will double up my size. We are in a seasonal trend higher and I am expecting the next high in early March.

2-11 – A reversal pattern here has formed. It appears to be an expanded flat with a target in the $32 area. At this point, it appears that there is also a double bottom. There is risk to 31.50. I will be looking to add size this week.

Natural Gas – Re-entering the Trade

2-4 – I have re-entered natural on the pullback into the $2.90 area with risk down to 2.80. My entry was 1/2 size and $2.916. I am expecting a turn and support at $2.80. Any break of $2.80 and I plan to exit the trade as the next support level is lower at $2.60. I plan to re-enter the trade in the $2.60 area if seen. Cycles support a turn this week.

2-11 – Poor entries happen in trading. You see a trend line, expect it to hold, and sometimes, it does not. My entry style on this trade was to enter on a three down and if a small wave 5 developed, I would add size. So my plan was to add on a reversal pattern, which has yet to form. So the good thing that this trade is showing is how to not add size too early. The bad habit this trade is showing is not exiting as planned. Even if the trade is only 1/2 size, the discipline required still calls for an exit. The 5th wave has turned out to be larger than expected. The trade is not yet broken as divergence is holding, two areas I am watching, 2.70 and 2.83. Each can be resistance, if converted this week, we can see 3.20 easily. First I need to find my add spot which requires a reversal pattern. I may exit at one of the resistance areas if manifested. The cycle chart below calls for a turn by 2-13.

Copper – Entering the Trade

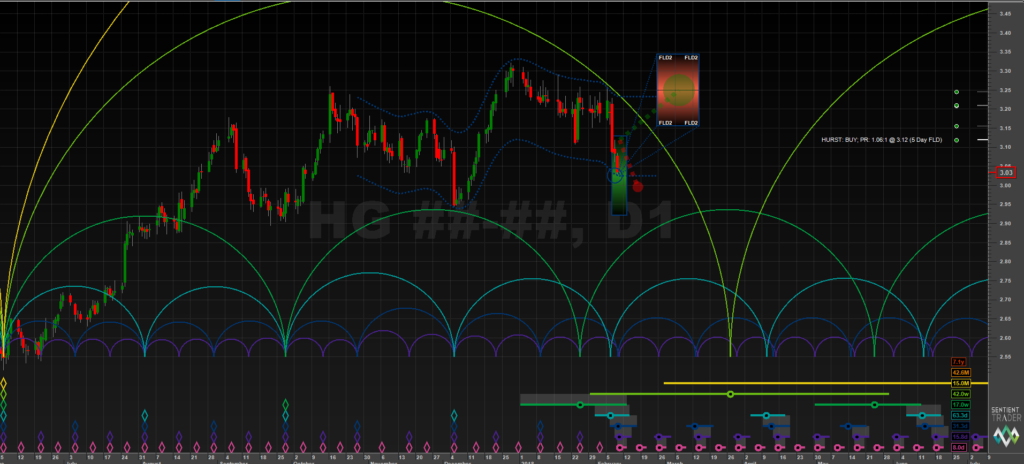

2-4 – Last week I started a new position 1/2 size in copper at $3.1950 looking for a break up into the $334 area. Copper appears to be forming a triangle with support in the $316 area. My plan is to hold the trade and take my first profit at $325 and exit in $334ish area. On a break below $316, I plan to exit as there is risk lower to $309s.

2-11 – I exited my first 1/3 last week at 3.225 and took a small profit. Copper was forming a triangle and with the risk of a triangle, I decided to take 1/3 profit at the top of the range. When we broke 3.16, I exited the last two leggs at 3.159 for a small loss. Taking your first 1/3 early is a key to minimizing risk and is a nice way to make a small profit when wrong. In this case, the first legg was not large enough to offset the risk of the last two leggs—it has minimized my loss. So now we get to do it again, but at better prices! Looking for a long entry this week.

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a $50,000 account limited to a three contract position size. We will increase position size after we generate a 200% return. See the videos below for more information.

Track Record October 2016 – December 2017 Click Here.

Track Record October 2016 – December 2017 Click Here.

There is a substantial risk of loss of capital when trading and/or investing. Past performance is no guarantee of future results. See our disclaimer Here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas; we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

12th Feb 2018

12th Feb 2018