Week 2 of The Art of Chart’s new option service, Vega Options, is in the books. My portfolio is 5 for 5 with profitable positions and I have shared all of the opening and closing transactions with the twitter group as the week progressed. Vega Options is not a trading service however I do share, in real-time, many trades throughout the week using our private twitter feed. I explain the reason I initiated a new position by showing the chart pattern or signal that triggered the trade and I show the option strategy that I feel best takes advantage of the current opportunity. Let’s take a look at my positions.

Here is UNH. This position started as a Calendar spread on Monday, 1/27. I tweeted out the trade setup including the price I was willing to pay to initiate the trade. I did it small.

I was filled at $1.85. By 1/29 price had moved lower and it was not centered on the Calendar spread anymore. My analysis of the price action in UNH led me to believe that lower prices were likely so I sent out this tweet This is what the risk profile from that tweet looked like.

This is what the risk profile from that tweet looked like. I did fill that Diagonal Put Spread order and then on 1/31 I tweeted that, due to the weak price action, I was going to add another Put Diagonal spread to widen the profit range to the downside. Here are all of the transactions for the week.

I did fill that Diagonal Put Spread order and then on 1/31 I tweeted that, due to the weak price action, I was going to add another Put Diagonal spread to widen the profit range to the downside. Here are all of the transactions for the week.

Here is my current UNH position reflecting all of the transactions. You can see that it has a very wide potential profit area and should add considerable value this week as the short options expire Friday.

Here is my current UNH position reflecting all of the transactions. You can see that it has a very wide potential profit area and should add considerable value this week as the short options expire Friday.

I mentioned that I have 5 profitable positions. Below are the remaining 4 positions. I won’t go into detail on each one or this blog post will start resembling an entire book but if you would like to see how these positions came to be, sign up for a free trial and get access to the private twitter feed. All the details are there for you to learn from!

Finally, this is the actual position statement from my portfolio showing the option Greeks as of Friday’s close. My goal is to have the Theta value exceed the total of Vega + (the absolute value of) Delta. This week i achieved that goal. On to next week…

That is all I have for you now. Vega options an options education service that presents trading concepts in a way that you have probably never seen before! That’s a bold statement but you’ll be the ultimate judge if that’s true or not. If you are not a subscriber and you would like access to the Vega Options private Twitter feed, you can sign up for a 14 day Free Trial to try out the service. What have you got to lose, it’s free!

CLICK HERE for the Vega Options Free Trial.

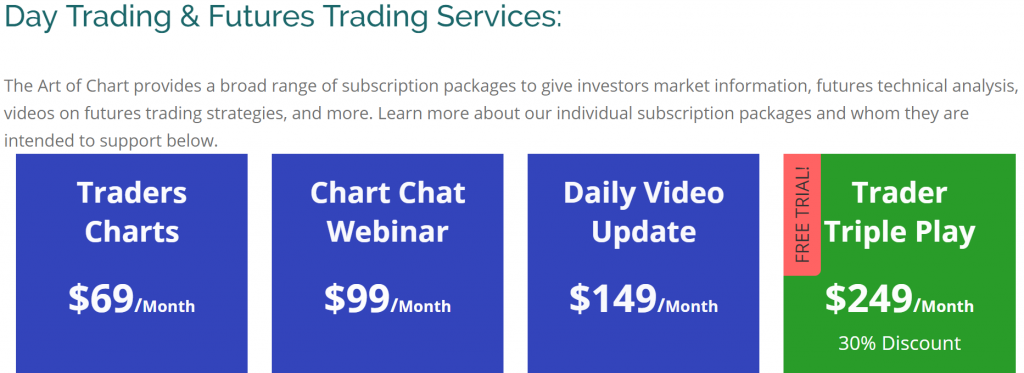

Our other services are listed below.

![]()

02nd Feb 2020

02nd Feb 2020