The Weekly Call provides perspective on high quality setups and trading strategies for the coming week. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This week we manage our trades in Corn, Cocoa, Sugar and Orange Juice and are looking for entries in Coffee, Live Cattle and Silver.

Our goal in this blog is to generate a 200% return in less than a year by swing trading futures that are not part of our regular service. Our track record is now posted below under Completed Trades. See some of our completed trade videos below.

Follow along during the week on twitter by following HERE.

30 day FREE trial now offered for Trader Triple Play – Click Here

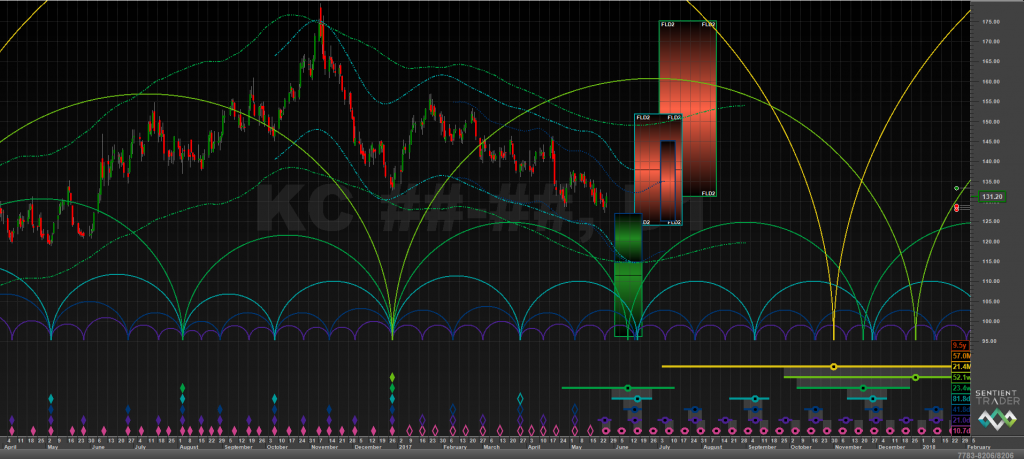

Coffee – Hunting the Long

5-28 – A nice setup is coming in Coffee – near the turn date and cycles are looking good. We will tweet out our entry once we see a reversal pattern.

6-4 – A reversal is expected soon, could happen this week. We are watching for confirming price action to enter. At this moment there is no reversal pattern. We are waiting on the setup to enter as there is risk to $120 in Coffee. We will tweet out an entry if a reversal setup is seen. Follow along during the week on twitter by following HERE.

6-11 – As mentioned, with three down fibs and extension fibs as unfinished business, we are waiting on Coffee for another legg lower. Back test in progress and a possible entry on the higher low marked as inflection on the chart – if seen. Looking for the monthly pivot area next.

6-18 – Our patience is being rewarded here with a tradable low now in place in Coffee in the $125s. Risk still exists to $122s. Looking to enter for at least a bounce into 7-27-2017. Will tweet out an entry early this week when the reversal pattern presents itself.

Sugar – Entering the Trade

5-28 – A news announcement from China about changing tariffs on sugar export hammered sugar prices. We were stopped out of the trade at even stop and exit with 1/3 in profit. This is a great example of how our risk management approach of taking profits at key fibs and transition points prevents loss of capital. We are looking for a re-entry once we see a reversal pattern. Timing shows a high window into 7-15.

6-4 – We tweeted out entries last week in Sugar and are currently holding 2/3s of a position long. We have a 200% fib which is my last legg down fib at 13.94 which we broke on Friday and we have over thrown the channel which is bullish. Having penetrated the 13.94 level we need an exit plan which I am watching the trendline at 14.19. If we see a back test into the trend line and resistnace, I will exit this position. Timing cycles call for a turn before 6-10 as we are in the 20 week low window. So if we see a convincing break of 14.19 we will hold the 2/3s of a position and add another 1/3 on a higher low into 7-15. There is risk of a full retest in Sugar to $12 so if we bail on this trade, we will look for an entry lower.

6-11 – As mentioned last week, our plan for support was blown so we chose to exit the trade. Did we exit or capitulate on the low? No – we planned an exit at the next resistance which was at 14.19 – 57 ticks higher. The point is support did not hold so to minimize risk we exited with a small loss. This is risk management. If the plan is busted, exit. Simple as that. Don’t justify or redraw your fibs to make a new plan. We are flat sugar and are now at an inflection point here against the trend line. Waiting on the resolution to see if we get the lower low.

6-18 – As mentioned, the break of support two weeks ago meant an exit according to our methodology and it was worth the effort. We now have a new low in Sugar. Looking for a turn this week with a lower low to 12.91. We tweeted out an entry last week, long 1/3 size. We will add another 1/3 on the next lower low. Cycles are set up nicely and we have Positive D on RSI. Watch for our next entry on Twitter by following HERE.

Cocoa – Managing the Long

We were hunting an 18 month cycle low in Cocoa – this is a very volatile commodity and we suggest trading this only if you are experienced in commodities and risk management. There is a likelihood that this low cycle can initiate a change in trend for this commodity.

4-30 – We have added out last 1/2 size position at 1832 and have a potential reversal pattern in Cocoa. We are waiting for a confirmation and a conversion of monthly pivot at 1909 and the next high window on 6-15. We will be taking our first profit at the 50 back of the previous swing at 1962 and placing a stop at even.

5-7 – Price has broken the trendline last week which is a bullish sign. Bulls need to create more separation from the low and convert 1910. The entry strategy used was to manage risk through size and enter in three leggs slowly. Our exit strategy is the same, we plan to take off the leggs we added LIFO (last in first out). We are looking for bullish price movement through 6-15.

5-14 – Price has moved higher and price closed above the declining resistance trendline Friday which is a bullish sign. We expect higher prices into the monthly R1 (the red pivot line) and then a backtest into the monthly pivot (the blue pivot line) to find support. We have taken 1/3 in profit at 1962 as mentioned in the previous post. We plan to hold 2/3s of the trade into 6-15 for a three up.

5-21 – Cocoa continued last week to move higher, we have completed the first legg up marked “w”. Waiting on the back test to the trendline or the previous degree wave x. We are a hold and expecting higher prices into 6-15.

5-28 – Cocoa back tested as expected and went deeper than expected. The back test structure appears to be a flat and the downside on cocoa appears to be finished. Support is at 1864 and we are expecting a rally into June 20th.

6-4 & 6-11 & 6-18 – Still holding two leggs long and watching for support on Cocoa at the trend line. Still expecting higher prices later in June. Looking to exit another 1/3 near 2134 then will hold the final 1/3 to target. Watch the trend line as a triangle has formed on Cocoa. We open new lows on a break and will exit if seen.

Silver – Planning the Entry

Silver appears to have made a 40 week timing cycle low on 12/20/2016. We captured a long in metals in Gold on the first impulse up and exited on 2/8/2017 with the last 1/3 of the trade capturing 94 handles. We do not believe in counter trend swing trading unless it is a move of a month or more. We have been patiently waiting on this backtest in metals to enter long.

6-11 – Trend line break as expected and movement lower into our timing window. Expecting a higher low to the monthly S1. We are standing aside and waiting for the setup.

6-18 – As discussed, lower low and a decent setup. Metals in a nice position here to rally. I’m expecting a lower low here as I am expecting a rally in the US dollar. Waiting on the lower low to 1632 and a reversal pattern to enter he trade. I will tweet out the entry when seen.

Live Cattle – Planning the Entry

Live Cattle is nearing completion of its first legg up from the low we called back in October 2016. This is an expanding leading diagonal which is sometimes seen at the beginning of a trend change from a major turn. This pattern will likely deeply retrace and we are going to set up a trade for the correction. We are looking for a turn in the $138-$140 area near the trendline with negative divergence on RSI. We are looking for the setup in the next 10 trading days. Watch for the entry on twitter by following HERE.

6-4 – We are approaching our timing cycle entry date and will be looking for an entry this week given the right confirming price action. At this point I am expecting weekly pivot support and higher prices into June 10th or so. A double top here would be an acceptable pattern for an entry.

6-11 – We are in the high window and at a lower high. Waiting for a reversal pattern to confirm the turn. We are close to an entry here. Convert monthly pivot (the blue line) and we confirm the move lower into August.

6-18 – My typical discipline is to pre enter my entries and exits pre market and somehow I did not do this last week on cattle just due to an oversight. What a shame as it did exactly what we expected!!! So this week I plan to stand aside as I will not chase this trade. I will instead trade with the trend around August 1st. A counter trend trade outside of a yellow box is much higher risk so I will remove this instrument until we get closer to the entry.

Orange Juice – Managing Risk Through Size

Trading soft commodities can be risky as many of them have low liquidity. Orange Juice is a thinly traded commodity that trends extremely well. We are waiting on a break of the trendline for a confirmation of a break in trend before looking for an entry in this instrument. Nice Positive D here and timing cycles support the entry. We expect to see the entry in the next week. Watch for the entry on twitter by following HERE.

5-21 We tweeted out an entry in OJ last week – 1/2 size position at 141.80. There is risk to 136.45 and we will add to the position lower if seen this week. Our entry strategy here is to manage risk through size by adding three to four small leggs over time. Timing cycles are supportive of a turn.

5-28 – We tweeted out an addition to our entry last week at 137.30 so we are now long two leggs in OJ. We are managing risk through size by adding three to four small leggs to our position. OJ is now about to break the descending resistance trendline which should initiate a move higher. We are a hold and watching the price action.

6-4 – We tweeted out a third legg addition in OJ last Friday at $131. We are in the center of the 18 month low window. Watching for a reversal pattern here this week and a break of the trend line. Looking for the window to end roughly on 6-8.

6-11 – Last week we began a rally on OJ and have broken the trend line to the upside. I tweeted out a 1/3 exit in OJ have have taken profit as we were three up. We are exiting in a LIFO fashion. I am looking for a small back test and continuation to the upside. I am watching $132 for a break which would mean look for an exit to this trade.

6-18 – We are holding 2/3’s of a position long and have taken profit on the first 1/3 at the three up. We are expecting a backtest 50% or so and our stops are even with support at 134s. We are holding patiently.

Corn – The Entry and Trade Management

6-18 I track compression moves in the market religiously as they make for fairly reliable trades. Daily Update Subscribers have been tracking a triangle in corn for a few weeks now. In Corn, we saw compression in the form of a triangle, saw the breakout, waited for the back test into the triangle which is a reliable signal and took a long at 379. The entry was tweeted out on our private twitter feed only to subscribers. Using my risk management technique, otherwise known as the 3P method, we exited the first 1/3 of the trade at 384 and moved stops to even when we were 50% back of the previous swing. We were stopped out the next day on a quick move lower. Yet another example of how this method works reliably to manage risk when trading short term.

We waited for the three down to complete and tweeted out another entry on the public twitter feed HERE at the monthly pivot at 371 on 3/15. We exited the first 1/3 again at the 50% back of the previous swing which was 379 and moved our stops to even. We currently are holding 2/3s of a position long and already have 2/3s of a position in profit. We are waiting for the move higher into our timing window of 6-30 looking for $395.

With this trade alone, trading the minimum size required, you could purchase four months of the Daily Update Service. By the time we finish this trade you will be able to purchase an annual subscription. Why not consider a trial by Clicking Here.

Come see what we are trading – Try our 30 day FREE trial – Click Here

Have a GREAT trading week!!!

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a $50,000 account limited to a three contract position size. We will increase position size after we generate a 200% return. See the videos below for more information.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in Live Cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in Coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with Natural Gas, we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the Coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the Gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter Gold in a few weeks after a back test.

18th Jun 2017

18th Jun 2017