PayPal offers an interesting opportunity this week. Price appears to be forming a bullish ascending triangle on the daily chart so a long position seems warranted but there is always the potential for failure. Is there a option trade structure to minimize risk and maximize gains? Let’s see what might work best in the current environment.

It is always important to know where the implied volatility (IV) of the underlying instrument in a trade is in relation to past IV levels. The current IV in PYPL is in the 5th percentile of it’s yearly range. That is obviously quite low. I would like to initiate a position with long (positive) Vega to benefit from an expected rise in IV.

Below is the risk profile of a Double Calendar spread. Why a Double Calendar? That particular spread benefits from an increase in IV and offers positive Theta after a small move higher in price. Even if price moves somewhat lower, as long as IV increases, the loss will be minimized. The position has a good amount of duration to maximize the benefit from Vega. Remember that longer duration and further out of the money (OTM) options have the greatest sensitivity to Vega.

Ultimately, the Double Calendar could show a reward/risk ratio of as much as 5:1 without requiring a big move in price.

To summarize, if PYPL price moves above 108.50 then that confirms the upside breakout of the ascending triangle trade and the initiating of the Double Calendar spread. After that, if price falls back below 108.50 on a closing basis I would certainly take notice and be prepared to exit the position with a modest loss. If price were to then fall back below the rising trend line and certainly if it were to drop below the 50 day SMA I would find no reason to continue to hold a bullish position. I could always re-enter the position at a later date if it were to move back up above 108.50 again.

That is all I have for you now. If you are not a subscriber and you would like access to the Options for Income subscriber chat room, you can sign up for a 14 day Free Trial to try out the service. What have you got to lose, it’s free!

CLICK HERE for the Options for Income Free Trial.

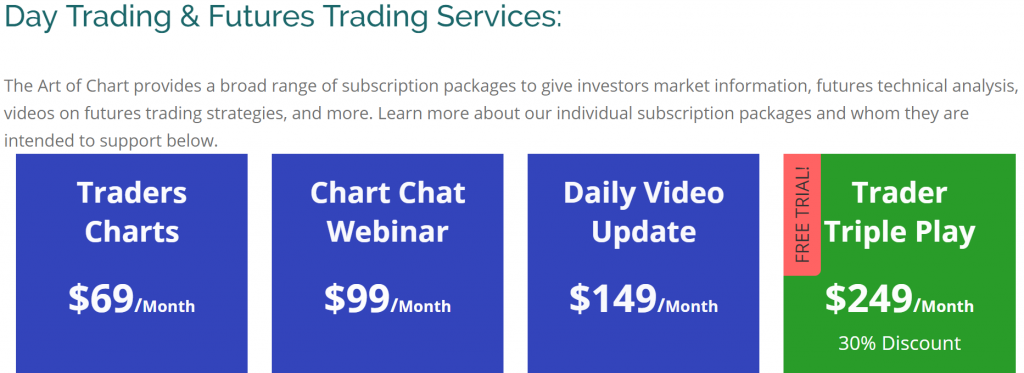

Our other services are listed below.

15th Dec 2019

15th Dec 2019