The Weekly Call provides perspective on high quality setups and trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. This week we manage our trades in Coffee and Wheat and plan to enter Oil, Natural Gas and Cocoa.

Our track record is now posted below under Completed Trades. See some of our completed trade videos below.

Follow along during the week on twitter by following HERE.

30 day FREE trial now offered for Trader Triple Play – Click Here

Wheat – Managing the Long

We have been tracking Wheat patiently waiting for a reversal pattern. It may arrive this week before 2/7 according to our timing cycles.

1-29 Wheat has been in a downtrend since March of 2008. On the Weekly chart the falling wedge has a chance to break up this year. We have divergence on the weekly and the daily charts. The daily chart has a low window that ends on 2/7 and likely a higher low would form and inverted head and shoulders pattern. On the 4 hour chart, watch for an entry 415 to monthly pivot at 407. Convert monthly pivot into support and we open 475 in the next 3-4 weeks. Take your first 1/3 at 50 back of the last swing and set your stop to even for a free position.

2-5 – We entered per the instructions above at 415 and have taken 1/3 off at the 50 back and our stop is now at even for a no risk position. We will now wait to see if we advance per the chart below to a three up to the 457 area.

2-12 – We are waiting on 457 as the first three up. We expect a 50% back test then a break of the trend line. Cycles show a high window in April. We are holding 2/3s of a position with our stop at even.

2-20 – We hit 457 as mentioned last week and are now back testing in three swings into 433 support area. We are still holding 2/3s of a position with stops at even. It appears we have an expanding, leading diagonal which is a pattern that is sometimes found in a major turn off a bottom. If true, we are expecting the last legg of the diagonal to $480 by roughly end of March.

Oil – Waiting on the Setup

We have been trading oil short and believe that cycles are now showing a road higher later this week / early next week. This week timing wise shows a turn around 2/7. We have two entries, $51 and $49.21. We will adjust on twitter as we come closer to target. We will be watching for Positive Divergence on a 1 hour basis.

2-5, 2/12, 2/19 – So far the setup has not presented itself. Low odds that it will at this point. We will remove this trade next week.

Coffee – Managing the Long.

Another Coffee trade is presenting itself. We are in the low window and have risk to 141.35 and expect an entry this week. We are looking for two different types of entries. First a move to 141.35ish and then a higher low. Either is a good entry depending on your tolerance for risk. The second entry is a conversion of monthly pivot to support at 146.95. Either will work so we will be watching for an entry. Follow along on twitter here to see our entry.

2-12 – We tweeted out the entry last week on Thursday and have taken profit on the first 1/3 of our trade. Our stop is now at even. We are looking for support in the 146.50-147 area and expect to break monthly pivot at 149.30. Cycles are bulling through the end of February.

2-19 – We were stopped out with 1/3 in profit last week and are looking to reenter long on the next pullback. We are watching the 147-146-30 area patiently. If support is seen we will tweet out our entry this week. There is risk below 146.30 and we will wait if this level is broken. Follow along during the week on twitter by following HERE.

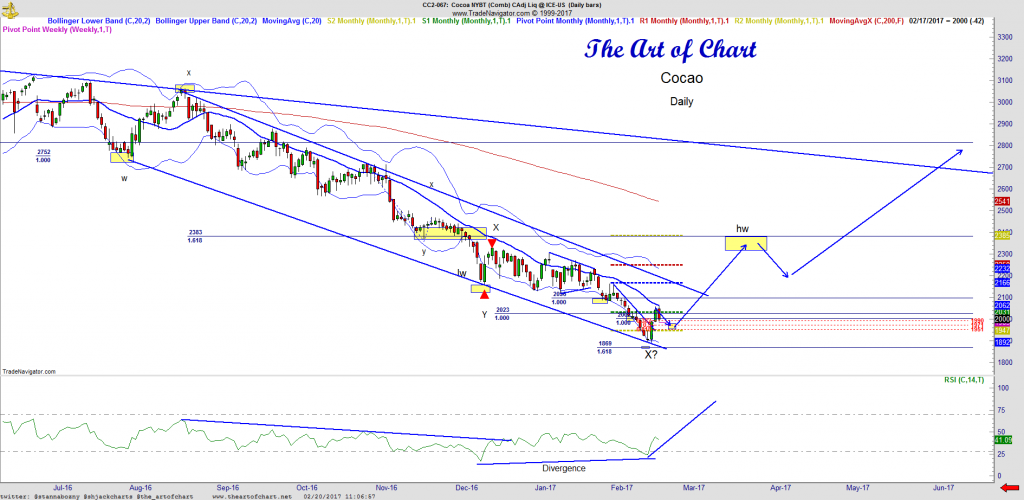

Cocoa – Finding the Turn

We were hunting an 18 month cycle low in Cocoa – this is a very volatile commodity and we suggest trading this only if you are experienced in commodities and risk management. There is a likelihood that this low can be the beginning of a change in trend for this commodity.

1-1 – We have been stopped out at even with 1/3 of our trade in profit. We are expecting a lower low and a reversal pattern. We expect another setup and a turn between now and 1-12. Watch for a new low and reversal pattern in the 2060-2080 area.

1-8, 1-15 and 1/22 – We are waiting patiently on a better setup which may occur by the end of January. An entry at 2096 or 2073 on positive divergence is a possibility this week or early next week.

1/29 – We have achieved our first target area at 2096 and suggest an entry here with a potential add in the 2073 area. No reversal pattern yet but the low window is ending by 2/2. Take your first 1/3 at 2165 and set your stop to even for a free position.

2/5-2/12 – We entered per the instructions above and took our first 1/3 at the 50 back per our twitter update. We did get stopped out of the remainder of our position on a new low. We are waiting on a reversal pattern and expect to see it in the next week.

2-19 – Cocoa has reversed and we are looking for a higher low to enter in the 1971 area. We are not expecting it to break 1951. This may be the 18 month cycle low, if true, we will see a break of the trendline and conversion of 2166 in the next two weeks.

Natural Gas – Planning the Entry

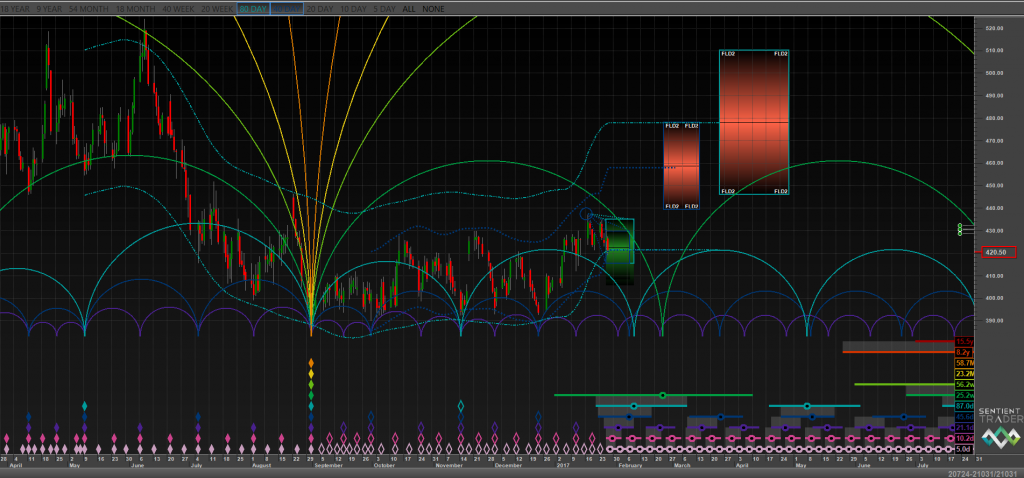

Natural Gas is close to ending a flat pattern and is setting up for a rally. March is typically a shoulder season for natural so seasonality is on our side. We have broken RSI divergence so we need a backtest and a new low with positive divergence for the setup. We will be tweeting out our entry if seen this week.

Have a GREAT trading week!!!

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a three contract position size. See the videos below for more information.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in Live Cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in Coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with Natural Gas, we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the Coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the Gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter Gold in a few weeks after a back test.

20th Feb 2017

20th Feb 2017