The Options Trading and Investing service provides perspective on high quality setups and option trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. This week we review current positions including a new adjustment in the U.S. Dollar position and revisit planned initiation of adjustments to existing positions in Apple and EEM. We also discuss entering into a short-term position in the RUT with a good reward/risk. Finally, we look to establish 2 separate positions in USO to take advantage of a significant move in oil.

Please refer to our education video HERE for more information in the option strategies used in this post.

A summary of the plan for the week is summarized in the video below. The entries and cost basis will be highlighted on this post and on our private twitter feed.

Below is the technical review of the current option’s portfolio positions.

This is the current performance update showing the profits on all positions, both open and closed. The total profit of $1,993 represents a 4% return on the entire $50K portfolio even though we are only currently risking about 1/4 of the portfolio value.

I sold 12 of the Mar31 UUP 26 puts for $.19 each ($228) on Monday 3/20. I chose the Mar31 expiry because that is when Stan projects the price to be done rising in the dollar before reversing lower again. I selected the 26 strike because that is approximately 1% higher than the current price. Notice what the short puts have done to the option Greeks of the position. Instead of being short 791 Deltas as in the primary position, the current position is now long 279 Deltas meaning the position will profit from a move higher this week. The position also went from flat Theta to positive Theta. If, UUP is at or above $26/share by the close on Friday, the short puts will expire worthless and I will keep the $228 in premium that I collected for selling those puts as a profit. If UUP is at least above $25.81 I should be able to buy to close the short puts at $.19 meaning it was a break even trade (less commission). And, if UUP goes lower? I will be losing money on the short puts but I will be reducing that loss by the profits being made on the primary position. So, while I am short naked puts in Mar31 expiry, they are mostly ‘covered’ by the primary position. The best part of this adjustment is that it added Theta to the position. Almost all of my adjustments will attempt to increase the amount of Theta being accumulated in the option portfolio.

The main characteristic that distinguishes option trading from futures or stock trading is time. Stock and futures traders have to get the direction right in order to get paid so they have only a theoretical 50/50 chance based on probability. So that is the value that Stan and Jack bring to the table because they have the ability to raise the probability of profit considerably due to their chart analysis. If you can raise your probability to say 70/30, you can be an extremely profitable futures trader as Stan has proven with the current 160% increase on the initial capital in the Art of Chart futures portfolio. Check out the Weekly Call blog for more details if you are interested in futures trading.

The best option traders don’t think in binary terms because they know that there are actually 3 potentially profitable outcomes in price movement; up, down or sideways. I can design a position that can be quite profitable even if much of the underlying instrument’s price movement has already occurred. That is why the structure of the option position is so important. To be clear, I rely on Stan and Jack’s chart analysis just as much as the futures traders do, I just utilize it differently.

In contrast to futures traders, Stan’s time cycles are at the very least equally important to option traders as are his price targets. That is the extra bonus that option traders get from the Art of Chart that you don’t usually find with standard technical analysis.

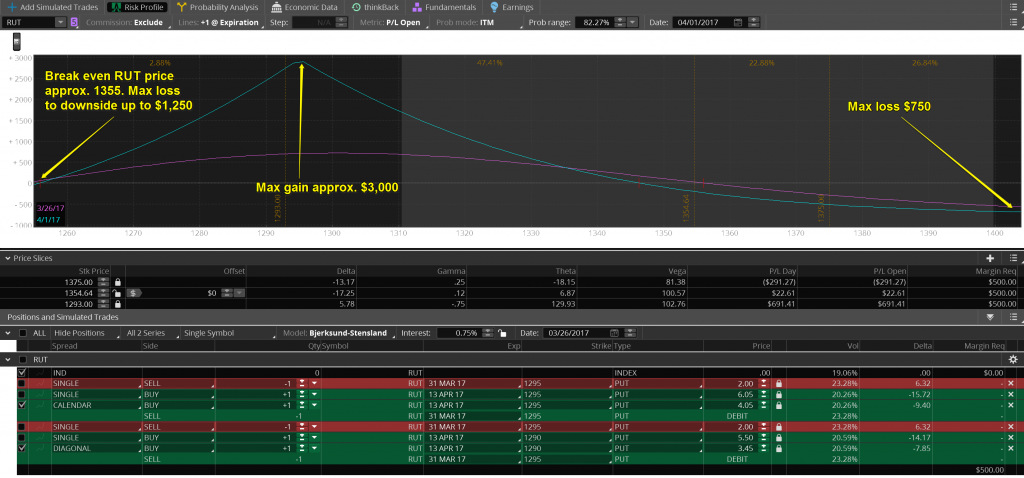

Let’s consider a new potential position in the RUT. I actually tweeted about this one on Friday but I have not added the position yet. Stan thinks that we are late in this move down before we see a retracement up in price. As I mentioned in the last slide, that is not a concern for me as long as I take that into account with the structure of the position. He has a target price for the RUT low to be in the 1290-1300 area by the end of the week. That becomes my short strike target area. If I sell the Mar31 1295 put I can bring in approximately $2.00 in premium. Then I choose which option to use to ‘cover’ the short option that I am selling. I can make a standard Calendar spread by buying the 1295 put in a later expiry. I like to go 2 weeks out from the short option expiry so that would be Apr13. The 1295 put in Apr13 would cost around $6.05. The net cost of the Calendar would then be around $4.05. If I push the long Apr13 put down to the 1290 strike I can buy that for around $5.45 and so the cost of the Diagonal spread would then be $3.45. Too hard to decide which to use? How about 1 of each (shown below)? Below is the risk profile of a 1 lot Calendar and Diagonal spread. For the AOC portfolio I would like to keep the risk to around 2.5% of the $50K portfolio so I might buy a 2 lot Calendar and 1 lot Diagonal for the position. I will tweet the final decision tomorrow when I place the order.

I also have a new USO position in mind. This is a bearish position into the Jul21 expiry but first it is bullish in the shorter term. How can one position be bearish and bullish? Notice the slope of the current profit/loss (CPL) line. It is sloping upward to the right. That is higher in price on USO. So in the short term, if USO goes up in price the position will see a small profit. In fact, putting this position on for a $.39 credit means the worst the position can do if USO goes higher is make a $39 profit. So no risk to the upside. Now look at the expiration profit/loss line (XPL). The peak of that occurs approx. 10% lower in price (at the short option strike of 9) so that is the target price for peak profit in USO in July. If USO goes directly lower without first going higher, the position will have a short term loss and if it goes down more than 19% below the current price by Jul21 expiry the position will have a realized loss. However, anywhere above about 18% lower at expiry leaves this position with a profit. The margin requirement on the position will go up as the price of USO declines because the risk to the down is undefined as the position is net short 13 puts. This position is known as a Ratio Spread. (ThinkorSwim shows this position as ‘selling a backratio’ whereas it is actually ‘buying a front ratio’ but that is just option semantics and makes no difference in the actual position.)

Save

26th Mar 2017

26th Mar 2017

I don’t see the SLV trade listed in the above list of open trades. Was it closed.?

Ed, we never actually put the SLV position on in the options portfolio. I’m trying to keep the number of underlying instruments to around 10 so sometimes we will pass on a position that we were considering.