The Weekly Call provides perspective on high quality setups and trading strategies for the coming week. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This week we manage our trades in Wheat, Cocoa, Coffee, Sugar and plan to enter Natural Gas and Silver.

Our goal in this blog is to generate a 200% return in less than a year by swing trading futures. Our track record is now posted below under Completed Trades. See some of our completed trade videos below.

Follow along during the week on twitter by following HERE.

30 day FREE trial now offered for Trader Triple Play – Click Here

Wheat – Managing the Long

We have been tracking Wheat patiently waiting for a reversal pattern. It may arrive this week before 2/7 according to our timing cycles.

1-29 Wheat has been in a downtrend since March of 2008. On the Weekly chart the falling wedge has a chance to break up this year. We have positive divergence on the weekly and the daily charts. The daily chart has a low window that ends on 2/7 and likely a higher low would form and inverted head and shoulders pattern. On the 4 hour chart, watch for an entry 415 to monthly pivot at 407. Convert monthly pivot into support and we open 475 in the next 3-4 weeks. Take your first 1/3 at 50 back of the last swing and set your stop to even for a free position.

2-5 – We entered per the instructions above at 415 and have taken 1/3 off at the 50 back and our stop is now at even for a no risk position. We will now wait to see if we advance per the chart below to a three up to the 457 area.

2-12 – We are waiting on 457 as the first three up. We expect a 50% back test then a break of the trend line. Cycles show a high window in April. We are holding 2/3s of a position with our stop at even.

2-20 – We hit 457 as mentioned last week and are now back testing in three swings into 433 support area. We are still holding 2/3s of a position with stops at even. It appears we have an expanding, leading diagonal which is a pattern that is sometimes found in a major turn off a bottom. If true, we are expecting the last legg of the diagonal to $480 by roughly end of March.

2-26 – We are about to test the lower trend line of the expanding leading diagonal. We are out 1/3 and stops are at even. We are looking for support and higher prices to $480. Alternately we are planning to re-enter at $429 if seen as a three down.

3-5 – We have bounced off the low window and are testing monthly pivot for support. If we hold the pivot and the trendline below, Wheat is expected to impulse higher into the 480-90 area. We will likely exit a 2nd 1/3 of our position in that area.

3-12 – We are waiting on support and Wheat has yet to demonstrate any. $438 needs to hold or our long has a good chance of getting stopped out. Our stop is at even and we are 1/3 in profit waiting on the decision that price will make this week. There is risk to $421.

3-19 – As mentioned last week, a break of support was possible and we might be stopped out of the trade. We have been stopped out with 1/3 of our position in profit. We took additional risk by not taking another 1/3 off in profit at 470s on the three up per our risk management rules. My thinking here was to take the additional risk as the setup of the expanding diagonal looked promising. Another valuable lesson in sticking to a system of managing risk to minimize losses and maximize returns.

We are now looking for the 421 area for a reversal pattern and another entry this week. We still like Wheat long as this is the area for a 18 month cycle low. Follow along during the week on twitter by following HERE.

Coffee – Managing the Long.

Another Coffee trade is presenting itself. We are in the low window and have risk to 141.35 and expect an entry this week. We are looking for two different types of entries. First a move to 141.35ish and then a higher low. Either is a good entry depending on your tolerance for risk. The second entry is a conversion of monthly pivot to support at 146.95. Either will work so we will be watching for an entry. Follow along on twitter here to see our entry.

2-12 – We tweeted out the entry last week on Thursday and have taken profit on the first 1/3 of our trade. Our stop is now at even. We are looking for support in the 146.50-147 area and expect to break monthly pivot at 149.30. Cycles are bulling through the end of February.

2-19 – We were stopped out with 1/3 in profit last week and are looking to reenter long on the next pullback. We are watching the 147-146-30 area patiently. If support is seen we will tweet out our entry this week. There is risk below 146.30 and we will wait if this level is broken. Follow along during the week on twitter by following HERE.

2-26 – We are in an area where we are now waiting for a reversal pattern. We are not planning to enter until one is seen. Catching a knife in Coffee is not a risk management plan that we like so patience here is warranted. There is risk to $138 in a three down. If we see support at the lower trend line and a reversal pattern form, we will enter long Monday.

3-5 – We are long Coffee on the 50 back test at 142.75. There is still risk to 138 in a three down. We plan to enter that level long if we are stopped out at $142.

3-12 – We have been stopped out of our previous attempt at a long and have waited for the next setup. We tweeted out the entry this past week on 3-9. We have re-entered the trade at 140.75 and our stop is below the swing low. There is a small triangle which has terminated lower and we have entered on the retest. If the swing low is broken we will stand aside and wait on 138.05 which is the measured move. We plan to exit 1/3 of the position around 142.75 and place our stop at even.

3-19 – We have been stopped out again – second time in a row. Granted the losses are small in comparison to the gains we have had in Coffee. My trading rules are clear entering a new position: if you are stopped out three times, even when you get stopped out at even, go find another trade. This forces me to plan my next entry more carefully so my next entry will be less aggressive. At this point I will wait for a larger reversal structure and a possible test of $138.05.

Sugar – Entering the Trade

We entered a trade last week in sugar which we have been discussing on the Daily Update. We have been tracking a flat from January 19th and we have positive divergence on RSI. The three down in Sugar measures to $18.00 which is where we found support last week. There is currently risk lower to $17.56. This appears to be a double bottom setup and we are targeting the $21-22 area by the end of March. We tweeted out the entry last week on Thursday with a stop at 17.80. So far the trade is positive. We plan to take 1/3 profit 50% back of the previous swing and place our stop at even. If we break 17.80 this week we will stand aside and wait on the next setup lower.

3-19 – Last week we recognized a triangle forming on Sugar and tweeted out to exit 1/3 of the trade to lock in small profits and place our stop at even as the triangle is a continuation pattern that had the possibility to make a new low. This is a risk management practice which I use often. If the trade is not going out as planned, protect your mental capital and invested capital. On Friday, the triangle resolved lower and we have been stopped out of 2/3s of our position at even. We take a small profit and move on. At this point, we will stand aside on Sugar and wait for a better setup.

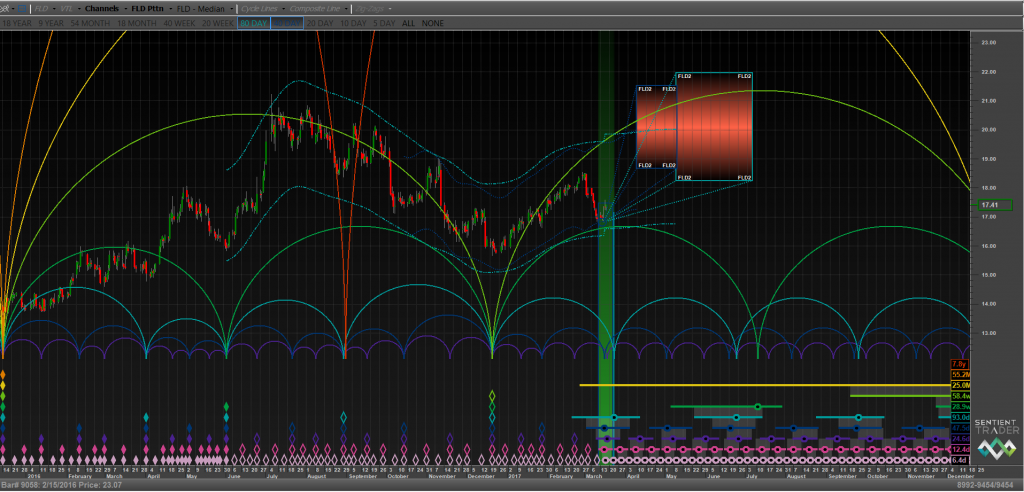

Cocoa – Finding the Turn

We were hunting an 18 month cycle low in Cocoa – this is a very volatile commodity and we suggest trading this only if you are experienced in commodities and risk management. There is a likelihood that this low cycle can initiate a change in trend for this commodity.

3-5 – Last week we were stopped out as the triangle formation broke down. We re-entered at the low with divergence at 1893. We look to exit 1/3 of the trade on Monday as we are 50% back the previous swing. We will move our stop to even and expect a back test into the 1917 area.

3-12 – Last week on Monday we exited 1/3 of the trade with profit at 1961 and placed our stop at even per the instructions above. Later in the week we were stopped out. We take away another 1/3 in profit and are waiting on the next setup to try again. 1876 may be a double bottom low and our stop system may have forced us to exit prematurely. In my experience there is always another chance to enter higher so risk management comes first. We like Cocoa long here as this is an 18 month timing cycle low. Commercials are also long here so we want to be long with them. We will wait for the retrace to form another reversal pattern and will tweet out the entry later this week. Follow along during the week on twitter by following HERE.

3-19 – So far on Cocoa, we have three entry attempts and have taken 1/3 in profit on each attempt. We are hunting an 18 month cycle low which appears Cocoa may have just completed. It appears that Cocoa has enough separation from the lows and commercial longs are larger than commercial shorts. We have hit our high window and are looking to re-enter long on the next pullback.

As mentioned last week, we are waiting on a reversal pattern for the next entry. This week we may see that possibility at 1977, the 50% back area. We are also watching the Monthly Pivot at 1987. We will be tweeting out the entry later this week. Follow along during the week on twitter by following HERE.

Natural Gas – Planning the Entry

Natural Gas is close to ending a flat pattern and is setting up for a rally. March is typically a shoulder season for natural so seasonality is on our side. We have broken RSI divergence so we need a back test and a new low with positive divergence for the setup. We will be tweeting out our entry if seen this week.

2-26 and 3-5 – NG needs another low with divergence. We may see higher prices in the near tern but we are waiting patiently on the setup with a lower low in the $2.60 area.

3-12 – NG has moved higher as mentioned last week and is now at resistance. We are waiting on a setup on the next backtest which is expected by March 20th. We will be watching for a reversal pattern and support in the 2.787 -2.832 area. If support is not found we will wait on $2.60 and a new low with divergence. The next high timing cycle is around April 12th. We will be tweeting out the entry on twitter this week if the setup presents itself.

3-19 – The setup on NG has not presented itself yet. After missing the double bottom in the low window, we have been waiting patiently for the setup. I am expecting an entry this week per the plan that was described above. Follow along during the week on twitter by following HERE.

Silver – Planning the Entry

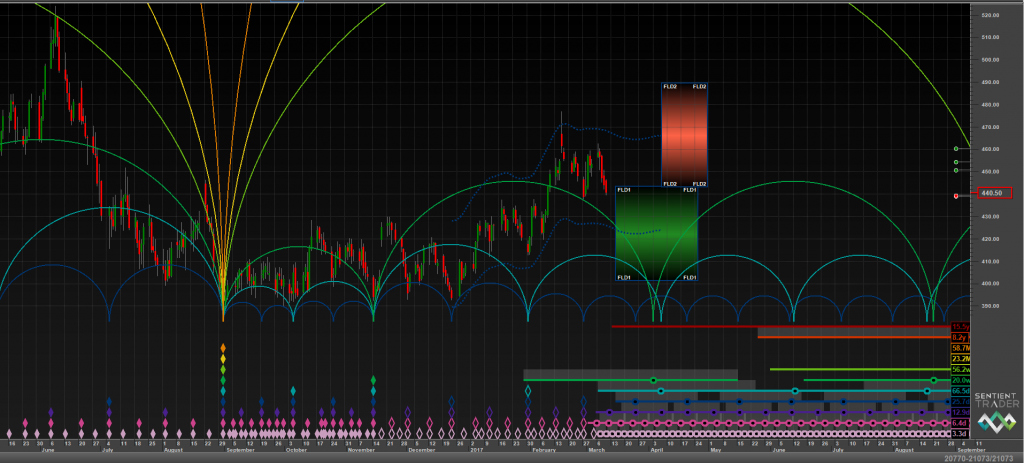

We have been looking at an entry in Gold last week on the Daily Update and so far the trade is working. This week we want to watch for a longer term setup in Silver for a swing into Mid-April. We are looking for a reversal pattern in the 1707 area.

Silver appears to have made a 40 week timing cycle low on 12/20/2016. We captured a long in metals on Gold on the first impulse up and exited on 2/8/2017 with the last 1/3 of the trade capturing 94 handles. We do not believe in counter trend swing trading unless it is a move of a month or more. We have been patiently waiting on this backtest in metals to enter long.

We are now at the point to re-enter long into metals and the reversal pattern we may see Monday on Silver. We have backtested in Silver into the 1692 area with a low 40 day timing cycle and are expecting higher prices into Mid-April. We are looking for the three down to complete at 1707 or so for an entry. We will tweet out our entry early this week if the reversal pattern presents itself.

Have a GREAT trading week!!!

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a $50,000 account limited to a three contract position size. We will increase position size after we generate a 200% return. See the videos below for more information.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in Live Cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in Coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with Natural Gas, we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the Coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the Gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter Gold in a few weeks after a back test.

19th Mar 2017

19th Mar 2017