The Weekly Call provides perspective on high quality setups and trading strategies for the coming week. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This week we manage our trades in Soy, Wheat, Live Cattle and Natural Gas and look to initiate a new trade in Corn.

Our goal in this blog is to generate a 200% return in less than a year by swing trading futures. All trades posted here are discussed in detail on our Daily Update subscription service. Our track record is now posted below under Completed Trades. See some of our completed trade videos below.

Follow along during the week on twitter by following HERE.

To follow the trades below on The Daily Update, try our Free Trial – Click Here

Soy – Managing the Trade

Soy is another commodity where end of quarter money was put to work. I have been waiting patiently for the back test to enter the trade. I plan to enter on the next lower low. Soy has been in a multi-year triangle and our original target was $900 on the weekly chart. We came very close to that low before the turn occurred. At this point, the back test is almost complete and we are waiting on the 50% retracement at 979 with positive divergence on RSI. Watch for our entry on twitter.

7-30 – I am waiting patently on the setup in Soy. When entering a breakout trade it is often difficult to wait for the consolidation period to end. See Wheat below as a good illustration of what happens when you don’t wait for a strong setup! At this point, cycles say lower prices are expected so I will wait for $979 and a reversal pattern.

8-6 – Currently appears that Soy is finishing a flag for a smallish wave 4. Looking for the last legg lower into 950. Nice positive d is expected to hold on the next decline. Cycles say a turn this week.

8-13 – I entered Soy last week at the end of the trend day lower and we have hit target at 950 and then some. As mentioned on our private twitter feed, this may be a wave 3 so we entered 1/2 size to reduce risk. We are now seeing wave 5 play out with divergence on RSI. Waiting on the reversal pattern to add the other 1/2 size. Bigger picture we have a large multi-year triangle and and expecting a big rally into next year.

8-20 – Soy appears to have turned and I am waiting on the larger reversal pattern to add the remaining 1/2 size to my position. Expecting to find resistance at $956 and looking to add the remaining 1/2 size to the back test from there.

8-27 – Soy is in a back test and I am looking for support at $930. If seen this is the area I would like to add my other 1/2 size. Again, this type of entry I am using 1/2 size to manage risk and then adding to the position only when there is a clear reversal. Expecting a turn this week. Break the current low and this trade is invalidated.

9-3 – Soy found support at $930 and has bounced nicely. We are past the 50% back area and I will be taking 1/3 off on Tuesday and setting my stop to even. Will be posting my entry on the Art of Chart private twitter feed and discussing the exit on the Daily Update.

9-10 – I have taken 1/3 off in soy at 944.50 and have placed my stop at even. The back test that I discussed on the Daily Update is in progress and I am expecting to find support this week and higher prices. If I get stopped out, I will look for the next reversal pattern and consider this trade a base hit.

9-17 – The trade was stopped out on a lower than expected back test and a V bottom last week. Sometimes market makers run stops and do a radical turn to create a retail chase. Well, I’m not a chaser. I will be back in the trade later this week when the setup presents itself. Watching weekly pivot at 961s.

9-24 – Expecting a rally this week, I entered Soy at 971 with a tight stop and got stopped out. I then re-entered again at 965.25 and managed to catch the rally. I exited 1/3 of the trade at 983 and set my stop to even as we are now at an inflection point. I am looking for a retest and higher prices into January. My plan is to hold the remaining position and let the trade work. If stopped out I will find another entry. I like Soy long into January.

Wheat – Entering a Breakout

Wheat has seen quarter end money flow into it like corn. This is the time of year for grains to be at their lowest prices as farmers begin a new agricultural year. There is a lot of volatility with sales, new hedges, etc coming into the market. I am expecting Wheat to find it’s footing here and I am expecting a rally into October. I entered long last week per the private twitter post at 501 and am holding the trade until either divergence breaks or the support trend line breaks. On a break of the trend line, I will be watching the Monthly S1 pivot for support.

7-30 – My entire position has been stopped out last week at 482 and I am now waiting for a lower low and a reversal pattern to re-enter. As mentioned, the consolidation pattern after a breakout is often difficult to find the right entry without adding risk to your portfolio. I am managing this portfolio with the idea of limiting my maximum draw down to not more than $3200. In this case, I was looking for both the monthly pivot and the .618 retracement for support and both failed. I will wait patently for the next setup depicted below and I will likely be long again later this week or next.

8-6 – At this point, I am waiting on a reversal pattern. Nice positive D here on Wheat, the formation needs a lower low just to 52s or 46s before we see a turn. There is risk to 439’2 and the monthly S1 pivot. Being patient here and waiting on the setup, I expect an entry this week.

8-13 – As per Corn and Soy, I entered another 1/2 size last week in Wheat. Nice trend day and likely end of wave 3, if 4 and 5 are seen then I will add remaining size after the reversal pattern is formed. I normally do not trade both Corn and Wheat as it is basically the same trade. So technically I already have a full position at risk. With this being the case, any adds will be done after reversal patterns are well defined.

8-20 – As mentioned last week, our initial 1/2 size entry was at the wave 3 low. We have completed the wave 4 and now finishing wave 5. I am expecting to add the other 1/2 size this week when we see a reversal pattern.

8-27 – A potential reversal pattern is forming, looks like a possible IHS. Once it completes, I am expecting weekly pivot to convert and I will then add the remaining 1/2 size to the trade. So far so good, waiting for price confirmation of a turn.

9-3 – Wheat has rallied from the potential reversal pattern and I am expecting a retest. Any break of $426’2 and likely we see new lows and I plan to exit this trade if seen. We are in a small flag here to we need to be aware of the retest, support found above $426’2 will cause price to challenge the monthly pivot next at $454.

9-10 – Wheat has finished a three up and is now in a back test. I am expecting $431 to be support. Any break if that level and we possible open a low retest. Convert the weekly pivot this week at $440’4 and we open the next legg up into September 20th and $475s. I am waiting on the larger reversal pattern to add more size.

9-17 – Wheat is almost done with the initial structure off the bottom. Appears to be in the last legg up into 457 this week and I am expecting a larger back test no lower that the trendline at 438s. The structure is flaggy, so a break of the lower channel is fair warning of a possible lower low. At this point, I am expecting the lower channel to hold.

9-24 – The back test held and higher we have gone to form a possible bear flag. I am out 1/3 of the trade at 448 and am waiting a possible back test. Break the lower channel trend line and we open new lows. I am expecting the trendline to hold. I still prefer Wheat long into the end of October.

Live Cattle – Entering the Trade

Live Cattle is an old friend and it’s time to consider a long. A nice three wave move into the low window and also 50% back of the whole formation. I am 1/2 size long here per my post on our private twitter feed and looking for a reversal pattern. Expecting a turn this week as we are well into the timing window.

8-20 – First 1/2 size long was a little early, likely the low in RSI is a sign of wave 3 completion. We are now in wave 5 and expecting a turn between here and 102.625. I will add the remaining 1/2 size to this position when a reversal pattern is seen.

8-27 – Still waiting in the next 1/2 size add and looking at the next low cycle around Sept 11 or so. Trade has risk to 102.625. Once we have a reversal pattern I will add the remaining 1/2 size to the position. This style of entry is different than the others that we have done with other trades. It depends on the instrument and your personal trading style. Waiting for price confirmation is often best and with certain commodities, having your small toe in the water as a starter works too, as long as you do not add on the way down, which is how many traders create trouble for themselves. I am happy to wait on the next low window and see.

9-3 – Still waiting on the reversal pattern and also waiting on 102.625 which is the risk on this trade. I will wait patiently as we are now in the low window and looking for a turn. I will add 1/2 size when the reversal pattern forms.

9-10 – A nice impulse on Live Cattle this week and a possible flag formation. Bulls need to put in support at 50 back at 105.90 which will open a break of monthly pivot. Any break of this level and we can open lower lows. I am waiting on the larger reversal pattern to add more size.

9-17 – No break of monthly pivot yet, but looking for it this week. A larger reversal pattern is now present and the lower trendline needs to hold on a back test or we may see lower lows. Timing Cycles are pointing higher into November.

9-24 – A break of the monthly pivot and convert and we see higher prices. I have taken 1/3 off at 109.50 as we are 50% back the previous swing. I am expecting the lower channel trend line to hold and I like higher prices into November.

Natural Gas – Re-entering the Trade

Natural Gas has been in a basing pattern for over a year and I am looking for a turn in the next week or so. Cycles say this is an 18 month cycle low, we have a reversal pattern, an IHS with support at $2.92. If this breaks down I am looking for $2.80. Center date for the turn is 7-10. Watch the twitter feed for our entry.

8-6 – I added anther 1/2 size position last week as mentioned on our private twitter feed and discussed in the Daily Update video. Currently I see NG in a small 5th legg lower with positive divergence and I am expecting a turn this week. There is risk to the Monthly S1 pivot at 2.683. A break of weekly pivot at 2.809 is a positive sign, break the upper channel trend line and we confirm a turn.

8-13 – As mentioned above, we broke and converted the weekly and monthly pivots and the declining resistance trend line. We have taken 1/3 in profit and stop is at even. Looking this week for a back test of weekly/monthly pivots to convert to support and the next impulse higher. Still expecting $3.40 in Sept.

8-20 – Still holding 2/3s of a position long and waiting for a three up to 3.12 to exit another 1/3. Still expecting $3.40 by Sept 14th or so.

8-27 – Last week I exited the Natural Gas trade as I was expecting a hurricane and flooding in my area. I am still expecting a high in mid Sept but for now I am exiting and taking profits. I will consider re-entering the trade next week once the triangle completes.

9-10 – Last week I re-entered the Natural Gas trade on a pullback as I am still expecting higher prices into September. The triangle has completed and we have a possible flat with risk down to $2.826. I expect to see support early next week and a break of $3.00.

9-17 – As expected, NG broke $3.00 and hit the upper bollinger band. I took off another 1/3 of the trade in profit at $3.10. I prefer to take the second legg of a trade three up and in this case, a touch of the upper bollie. The pullback then started and I am waiting on a turn and higher prices. I will hold the last 1/3 into the cycle date.

9-24 – NG broke lower this week forming a flat on news after hitting the upper trendline. I added at legg on the way down and took off the last 1/3 October contract legg at even. I currently have one legg long in Novi at 3.033 and plan to add lower on the wave 5 at the lower trendline. Cycle are pointing higher and I like NG long into February next year.

Corn – Planning the Entry

Corn Is getting close to a reversal pattern and I am planing to enter sometime this week. Either corn is going to double bottom or just break out to the upside. I plan to enter on the pullback if the breakout is seen. Members of our private twitter feed see the actual post for the entry and all trades are reviewed on The Daily Update Video.

9-24 – No clear reversal pattern yet, I am waiting patiently for a quality setup. If we have turned, I will enter on the first back test. I am standing aside until price shows me something worth buying.

Come see what we are trading – Try our 30 day FREE trial – Click Here

Have a GREAT trading week!!!

COMPLETED TRADES

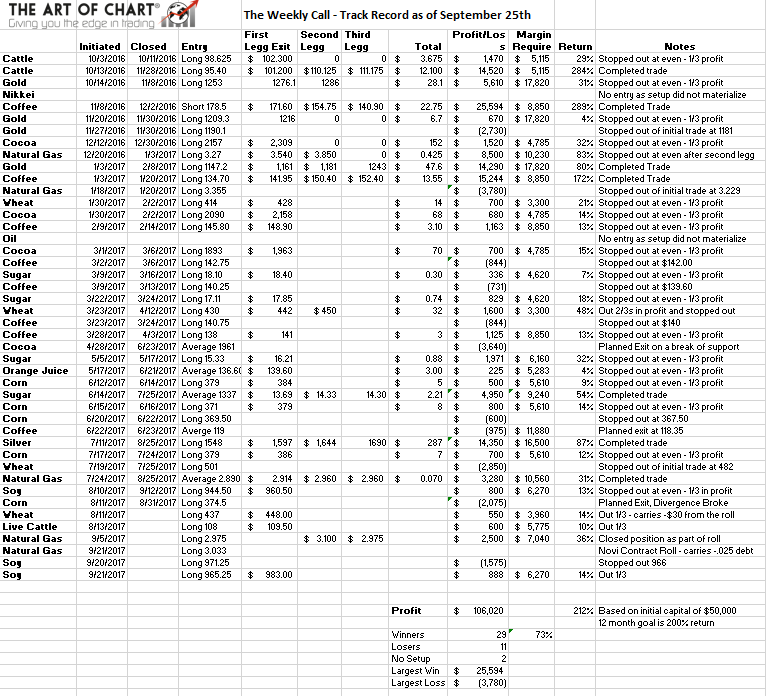

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a $50,000 account limited to a three contract position size. We will increase position size after we generate a 200% return. See the videos below for more information.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in Live Cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in Coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with Natural Gas, we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the Coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the Gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter Gold in a few weeks after a back test.

25th Sep 2017

25th Sep 2017