The Weekly Call provides perspective on high-quality setups and trading strategies. Our current performance showing a more than 200% return since October 2016. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high quality setups and manage the trade with our risk management approach. This week I am managing trades in soy, live cattle, coffee, and natural gas, and look to initiate new trades in corn.

I plan to continue to operate this blog into the end of 2017 and plan to compete in the World Cup Trading Championships starting in January 2018. I will change this blog at that time to post all trades that I make during the competition here on this site. My goal in the competition is to exceed the returns that I have achieved here.

All trades posted here are discussed in detail in our Daily Update Subscription Service and posted on our private Twitter feed. Our track record is posted below under Completed Trades. See some of our completed trade videos below.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Soy – Managing the Trade

10-15 – As mentioned on our private twitter feed and the Daily Update, I took profits at 974.50 as the first 1/3 off after seeing more than a 50% retracement of the previous swing. Later in the week on Thursday I took off a second 1/3 after we achieved a three up to 992.50. At this point I am holding the last 1/3 long into target at 1018.

10-22 – The retracement is still in progress after we completed the three up last week. I am looking for a turn mid week around the 973 area and may add back the two leggs I took off for a run up into 1018. I am still expecting the next cycle high sometime in the January time frame

10-29 – The retracement finished at the trend line and I added two leggs at 978s that I previously took off. I am looking for the next impulse higher this week. I am placing the stop for the new leggs below the trend line, still expecting the next swing high in January.

11-5 – Last week, I took off 1/3 of the new position from 978s at $998. This is my standard risk management approach of being 50% back the previous swing. I was expecting a back test and we certainly have gotten one. My stop is at even on the new position and I still hold a trailer from 964.25. I plan to hold it into expiration. This is what I call collecting trailers. So as I add position size, I always exit Last In – First Out. This supports me in holding positions in larger bullish and bearish moves. It is highly unlikely that Soy will see 64s, anything can happen, but odds are in my favor that I will exit this trade with a nice profit in about 24 days. Still hunting the swing high in January.

11-12 – Last week, I took off the second 1/3 of the new position from 978s at the three up target at 1002, which was immediately followed by a big retracement. While this was expected, it has gone very deep very quickly. A possible outcome is a lower low to 70s by 11/14. Timing still says to expect a rally so the question is do we do it direct or from 70s. I plan to add size this week before the next impulse higher. So far I have two trailers which I plan to hold for now.

11-19 – So the 70’s were elected by the market and one of my trailers was stopped out. I still hold another and we have a nice reversal as expected. I plan to hold the trailer into expiration and look to add size this week. I missed my opportunity last week, but will find a way into the legg higher after a pullback. Still trading this swing long into January.

11-26 – Nice rally last week, have encouraged subscribers to take off 1/3 in profit and hold the rest. Looking for a second 1/3 early this week at 1004. There is a strong low window around December 5th which appears to be another buying opportunity. Still expecting the rally to continue into early January.

Live Cattle – Managing the Trade

Live cattle is an old friend and it’s time to consider a long. A nice three wave move into the low window and also 50% back of the whole formation. I am 1/2 size long here per my post on our private Twitter feed and looking for a reversal pattern. Expecting a turn this week as we are well into the timing window.

10-15 – I exited another 1/3 in profit last week as we began a backtest. The indicator I used is the RSI price cycle, a break of that trend line and the backtest was on and I exited at 118.025. I am looking for the $115 area then higher again into the $120s. I plan to hold the last 1/3 into that target area.

10-22 – We hit the $115 target area on the retracement as discussed and am now looking for $120 for the last legg up for W. I may exit the last 1/3 of the trade at 120s but I do plan to re-enter the trade with additional size after the X wave on or around November 9th.

10-29 – We have hit the $120 target area and I have encouraged subscribers to take profits here and leave a trailer. We have negative D on RSI and am expecting a pullback where I plan to add size. I am currently holding a 1/3 size position.

11-5 – This is why I always exit three up and hold a trailer. My intention here was to take profits, reduce size and risk, and also look for a good entry to add size on a decent pullback. Well what do you so when there is NO PULLBACK and no opportunity to add size …. you do nothing except ride the trailer higher. I am still long, stop is still at even and we have seen a big move higher. Cattle is in a smaller pullback now for for a wave 4 which may be complete. I do not plan to add size for the last legg higher, that is a fools game on a 5th wave into a cycle date. Very happy with the trade and looking to exit in the low 130s. Cattle is still on time for a higher high in the first week of December.

11-12 – This week, I am expecting the retracement to end on live cattle and will be looking to add size long. I currently am holding a 1/3 size trailer and am currently looking for a reversal pattern. Timing says higher into first week of December.

11-19 – Nice double bottom setup on live cattle. I plan to enter this week and expecting a rally into the first week of December. The monthly S1 is just below as max risk on the trade. I am still holding a trailer and will exit sometime near the cycle end date in December.

11-26 – Last week, we added size to this trade at 117.50 and have seen a nice impulse higher. Currently, there is a reversal pattern which is calling price higher. I am holding this position with my stop at even and plan to take 1/3 off when three up is seen. I am expecting a rally into the second week of December.

Natural Gas – Re-entering the Trade

9-10 – Last week, I re-entered the natural gas trade on a pullback as I am still expecting higher prices into September. The triangle has completed and we have a possible flat with risk down to $2.826. I expect to see support early next week and a break of $3.00.

9-17 – As expected, NG broke $3.00 and hit the upper bollinger band. I took off another 1/3 of the trade in profit at $3.10. I prefer to take the second legg of a trade three up and in this case, a touch of the upper bollie. The pullback then started and I am waiting for a turn and higher prices. I will hold the last 1/3 into the cycle date.

9-24 – NG broke lower this week forming a flat on news after hitting the upper trendline. I added at legg on the way down and took off the last 1/3 October contract legg at even. I currently have one legg long in Novi at 3.033 and plan to add lower on the wave 5 at the lower trendline. Cycle are pointing higher and I like NG long into February next year.

10-1 – I added another 1/3 on a lower low last week and now have two leggs on long. NG is testing the lower trend line and has support at 2.956. I am looking for a reversal pattern to add my last 1/3. There is support also at 2.892. The key decision on NG early this week. My lean is still long into the end of the year.

10-8 – I have two leggs on and I still like natural long into year end. I am watching with interest the natural support area at $2.843. If I see a reversal pattern, I will add another 1/3 to my current position.

10-15 – A nice move in natural – expecting a backtest into weekly pivot in the 2.95 area then higher into the $3.20 target area. I plan to exit the second 1/3 on Monday if I can get a decent fill and then hold the balance into target.

10-22 – On a news driven move on Thursday, NG went lower quickly and I took the opportunity to double my size at 2.783. The reason I doubled size is that this type of move lower is often followed by a squeeze, which did occur. By the end of the day we were printing 2.892 and I decided to exit the whole position at a small $300 loss. Given the news, the next day would go one of two directions, a new low or a 50 back and higher prices. Having “reset” my position, I looked for an entry on Friday and saw support at 50% back and am now long 2.875 a 1/2 size position.

I call this sequence in trading lowering my basis. When a trade goes against you, your options are to capitulate or look for a creative exit and possibly re-enter lower. News driven days often demonstrate a V type pattern so I was fortunate to catch the low and punch out at good levels.

The story on this long is incomplete as the market needs to convert the monthly pivot to show bullish signs. I am long and will be rolling this position into the December contract next week.

10-29 – I re-entered the trade on NG at 2.875 with a 1/2 size position on a 50% pullback from the previous rally. On the next rally as I usually do, I exited 1/2 of the position at 2.990 after we retraced more than 50% of the previous stop near the trend line. The trend line has been hit six times and is very solid and we have rejected to new lows. I am stopped out and will wait for the next setup lower on NG. Base hits like this looking for the low are just fine, I’ll continue to do this until I find the turn. I am looking for the next reversal pattern marginally lower at 2.935ish.

11-5 – I re-entered the trade on NG at 2.905 with a 1/2 size position and exited the first 1/3 per my post on our private twitter feed 50% back the previous swing as I usually do at 2.924. So why only take 20 ticks? Because this is my discipline. I could had done a better job with the entry so this is why the profit is not larger. From my perspective trade discipline is trade discipline, so no matter how small I am following the 3P method. I am looking for a three up to take off another 1/3 and plan to hold the balance into Mid December. I am expecting a pop higher in natural gas into $3.10ish where I will take my second 1/3.

11-12 – Per the plan last week, I took another 1/3 in profit a little early at 3.066 and exited the trailer at 3.201 so as of now I am flat. Nice trade and first impulse off the bottom. I am expecting a decent retracement this week and I am standing aside as my practice is to capture the trend which is up until mid-December. Looking for another entry somewhere in the 3.07 area and NG can go deeper into $3.00.

11-17 – Now trading Jan contract and waiting on $3.10, likely we will see it this week and I plan to enter after a reversal pattern is seen. I am looking for a long into the December 15th time frame.

11-26 – Holiday globex trading sometimes creates exaggerated moves. This is the case in Natural Gas. Friday we have a flush lower on low volume and I am expecting an immediate reversal higher and a test of the Weekly pivot. Convert this pivot into support and we begin the rally, convert into resistance and we will see a lower low with positive D. I am expecting a rally in NG in the next few days. I added a 1/2 size position earlier in the week at 3.131 and am waiting on the resolution of the pivot test. I plan to add more size on a lower low if seen.

Corn – Planning the Entry

Corn is getting close to a reversal pattern and I am planning to enter sometime this week. Either corn is going to double bottom or just break out to the upside. I plan to enter on the pullback if the breakout is seen. Members of our private Twitter feed see the actual post for the entry and all trades are reviewed on The Daily Update Video.

10-29 and 11-5 – No entry yet on corn. I have been very patient waiting for the setup. Last weeks reversal pattern failed on Monday so I am looking for the next one. It pays to be patient and wait for definitive signs for the right entry. I am expecting a lower move into the monthly s1 (the green line). If support is seen this can be the reversal pattern I have been waiting for.

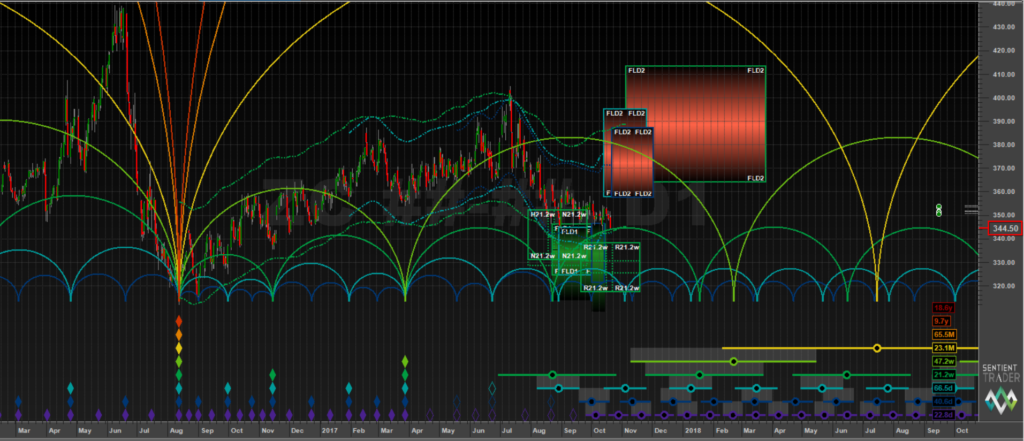

11-12 – Standing aside waiting for a setup requires discipline. And this wait has paid off as the triangle has broken to the downside. I am expecting a better entry lower for the long I am planning in Corn. I am expecting 336’4 and will be watching for a reversal pattern there.

11-19 – Nice movement into our target area at 336’4 – a nice reversal from that area and now waiting on the retest. Once seen, we enter long Corn and plan to manage the trade into January.

11-26 – Right now, we have a potential reversal pattern which can break lower as a triangle thrust. I am waiting to see the resolution of this swing lower. If we break the monthly S1 (the green line) we likely head lower directly and I will wait to enter in the $344 area.

Coffee – Managing the Trade

Coffee is a familiar trade and it appears we may have reversed and I am expecting a longer term move into the $174s by March of 2018 for a Y wave then even higher into Q4 of 2018. It appears the major degree X wave is in and we have crossed above the 20 day Donchian average. A backtest that holds 50% back the previous swing and I am in long for a trade into November.

10-15 – Last week I entered coffee 1/2 size at $126.50 and have a stop below the current low. We have a bit of a compression pattern short term and coffee may still see $122. If this is the case, I will get stopped out and will re-enter the trade lower.

10-22 – Last week I was stopped out on the initial 1/2 size long for a small loss. I re-entered the trade on Friday on the lower high at 124.80 with a stop below the current low. We can still see $122s. I am looking for a rally in coffee into 2018.

10-29 – The price action on Friday appears that we may have the turn in coffee. I will be looking for enter on the next pullback. Did I miss anything? Not really, by waiting I am reducing my risk on this trade. I am looking for a big swing into March of 2018 so the first move off the bottom is not may main interest here. The reversal pattern at $122 did not work out as planned so I will wait for the larger reversal pattern on the next pullback. I plan to enter when seen.

11-4 – Still no entry on coffee. I see a potential for a lower low here. We have no price confirmation here yet – any break above the Monthly pivot – the blue line on the chart – and I will enter at that time OR on a lower low and reversal pattern into the next low window next week. I have plenty of time to find an entry and am confident this is a significant low in Coffee. No need in being afraid of missing out, we have a long run higher into March, I am waiting on a better setup.

11-12 – Waiting for the entry and I think we are close. We have a small triangle and a break up, waiting on the backtest of the triangle which is very common and will start a new position in the area of the trendline at 125s. Demonstrated support and a reversal pattern is required. I am looking for a big move in Coffee into 175s into 2018.

11-19 – Nice pullback and into our cycle timing window. I am waiting for a reversal pattern to put on a position. I’m looking to enter this week with a stop below the low.

11-26 – Last week I enter coffee at 126.25 and we have had a nice impulse higher late last week. I have already scaled out 1/3 in profit at 128.90 and my stop is currently at even. The 50% back the previous swing area is ideal for taking initial profits as this is often a reversal area. At this point, I am waiting on a conversion of the Monthly Pivot (the blue line) as confirming price action and am expecting higher prices into March of 2018.

Come see what we are trading – Try our 30 day FREE trial – Click Here

Have a GREAT trading week!!!

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog using a $50,000 account limited to a three contract position size. We will increase position size after we generate a 200% return. See the videos below for more information.

There is a substantial risk of loss of capital when trading and/or investing. Past performance is no guarantee of future results. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas. We exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

26th Nov 2017

26th Nov 2017