Crypto-currencies are now becoming more mainstream and I am starting coverage of these instruments in this blog on a weekly basis. I plan to cover just three: Bitcoin, Litecoin, and Ethereum. The point of the weekly posts is to show the crowd psychology behind the price movement and to eventually find profitable trades among these instruments. With the CBOE now providing access to crypto-currencies and with ETFs, these instruments are now easily tradeable.

Last week, I showed the ratio charts between BTC and ETH and LTC and showed how the ratios were heavily inflated toward BTC. We expected a reversal in the ratio charts which would, in turn, cause LTE and ETH to rally. We did get the rally, especially in ETH. See the ratio charts below.

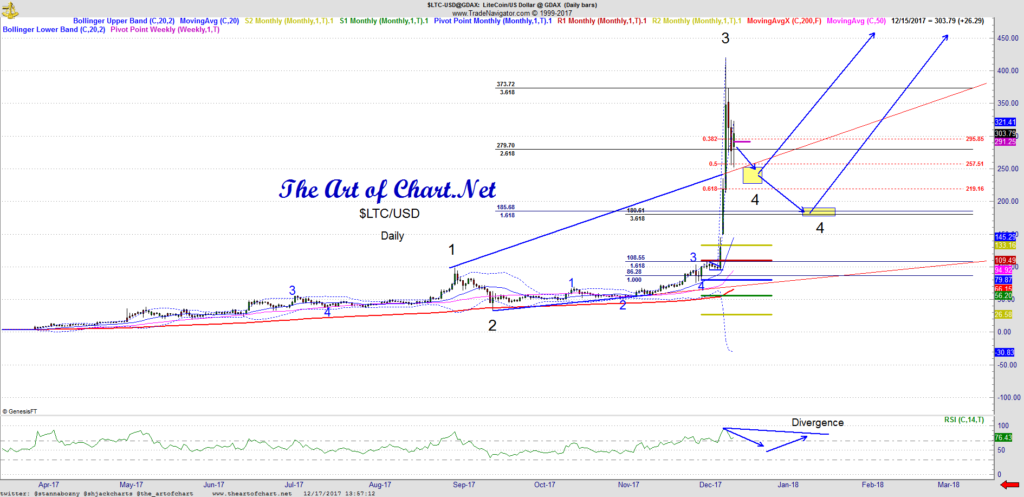

The shift in ratios left BTC fairly flat for the week, but the exaggerated move in LTC was amazing. Also a nice rally in ETH.

The rallies here are clearly 3rd waves, I see no divergence yet as the crowd is still piling into the trade. BTCUSD are in a bollinger band ride between the 2nd and 3rd standard deviation bands, which calls for higher prices. My plan is to stand aside for now and wait for a decent short setup at roughly 21,511 and then a bigger short higher in the 25,000 area.

We are not finished with this bubble. When trading, please remember the overnight action is likely the best volatility as Korea and China are big in volume in these markets. These are markets we have not seen before, and while this is a bubble and all bubbles end badly, we are witnessing price action that is historic.

We are not finished with this bubble. When trading, please remember the overnight action is likely the best volatility as Korea and China are big in volume in these markets. These are markets we have not seen before, and while this is a bubble and all bubbles end badly, we are witnessing price action that is historic.

I am expecting an increase in crowd following to culminate in a big 3rd wave peak. I will be posting more charts observations next week and will be adding a volatility measure to next week’s charts.

17th Dec 2017

17th Dec 2017