The first week of The Art of Chart’s new option service, Vega Options, is in the books. We’ve had a number of people take advantage of the 14 Day Free Trial to test out the service. This blog post will review some of the actual tweets from the past week. First, since it is a new real-time educational service, we start out most days reminding the subscribers of the purpose of the service. As you read the actual tweets below you’ll see why the emphasis is on real-time. This is not a trading service, however, since I tweet these opportunities as they occur, someone could mimic my trades if they wanted to do that. Subscribers are essentially looking over my shoulder at my screen as I discuss potential trades and analyze price action. What they do with that information is solely their responsibility!

I have had a very profitable bullish Ratio Spread position in GOLD (Barrick Mining) for some time now. In this tweet I demonstrate for the subscribers the actual price action trigger that could be used to initiate a new bullish position (in any instrument) as well as the technique I use to manage the trade by following the price action as time passes.

On Tuesday after the close, IBM had an earnings announcement. On Wednesday, I made mention of the price action and introduced the option strategy I would use to add a bearish position to my portfolio. The Put Vertical Debit spread that I mentioned in the tweet was trading $1.85 at the the time. It ended the week at $3.03 or 64% higher.

On Thursday I tweeted about the 2 different SPY Diagonal Put spreads that I had discussed earlier in the week. The Jan27/Jan24 SPY 300/329.50 Put Diagonal spread was trading at $.34 when I tweeted about it. It traded $1.08 just before the close on Friday. That is more than 3 times the $.34 cost.

As the NASDAQ futures pushed to new all-time highs on Thursday after the close of regular trading I pointed out the bearish divergences it had with the other major indexes. My comments included that those divergences don’t typical show up in a strong market and since I was trading a position in SPX that was the price I had to keep my eye on.

Yesterday the price action in GS attracted my attention and I saw the potential for a new trade. These are the tweets that I sent out.

Finally, this is the actual position in my portfolio. I bot a 2-lot to start the position with the intention of adding more later. Currently the position is up over 10% in just 1 day. Want to know when and why I add more to the position? Sign up for the free trial and join the twitter feed and then you’ll be the first to know!!!

That is all I have for you now. If you are not a subscriber and you would like access to the Vega Options private Twitter feed, you can sign up for a 14 day Free Trial to try out the service. What have you got to lose, it’s free!

CLICK HERE for the Vega Options Free Trial.

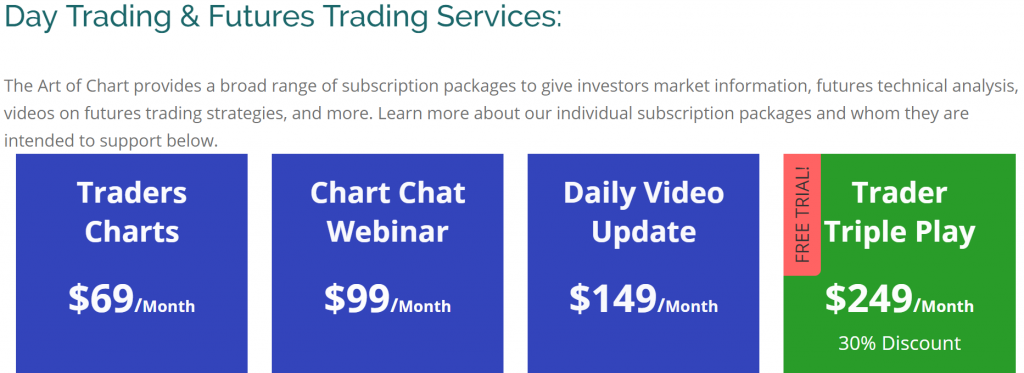

Our other services are listed below.

26th Jan 2020

26th Jan 2020