How can a option position be free? Just 1 day after establishing a NFLX position this week I had the opportunity to eliminate all cost in the position while still maintaining a potential maximum profit of $10,020. Actually, I did a little better than that. I locked in a minimum $20 profit even if NFLX never trades down into the heart of the profit zone below 408. Interested in learning how I did that? Keep reading!

On Wednesday morning I was watching the price action in NFLX and I tweeted this to the Vega Option subscribers:

An hour later I followed up with this tweet:

Later on Wednesday I initiated a bearish position and showed 2 different Vertical Put spreads to choose from. I often do that because the cost of the spread that I choose for my position maybe too large for some of the subscribers to do even a 1-lot while staying within their budget.

Less than 1 hour into trading the next day, the opportunity to lock-in a $20 profit while maintaining the potential for a $10,020 profit presented itself. Being of reasonably sound mind I took advantage of that opportunity to ‘seal the deal’. This was my tweet to the subscribers:

I show all of the transactions that were executed to develop the current position. That allows the subscribers to study these trades and potentially simulate them in their own trading platform to learn the techniques. Here is the full-size view of the current risk profile. And yes, if this seems to be too good to be true, it is possible to have a position where you have eliminated all of the original risk and still maintain a large potential profit.

I post my actual transaction history so that all can see I’m really doing these trades and this isn’t just a theoretical discussion! The transaction history shows the date, the time and the fill price for each trade. I view this as a key part of the service because until a trade is actually filled it is theoretical.

Vega Options is an educational service, not a trading service. However, because all of my price action analysis and option trading is done in real-time there is an opportunity for the subscribers to place similar trades from their own account. My job is to simply make available to the subscribers all of the information that I use to make trades. What they choose to do with that information is entirely up to them.

That is all I have for you now. If you are not a subscriber and you would like access to the Vega Options private Twitter feed, you can sign up for a 14 day Free Trial to try out the service. What have you got to lose, it’s free!

CLICK HERE for the Vega Options Free Trial.

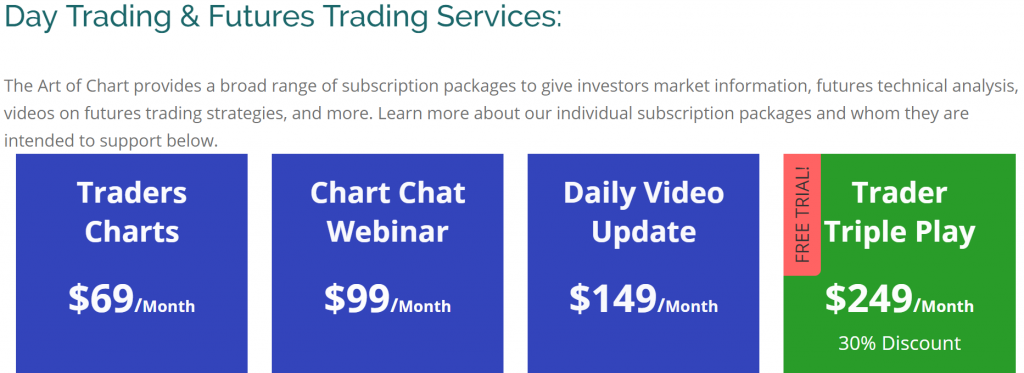

Our other services are listed below.

24th May 2020

24th May 2020