I plan to cover just three cryptos every week in this post: Bitcoin, Litecoin, and Ethereum. These instruments provide trading opportunities with out sized gains. I hope the analysis presented here helps you profit in these instruments.

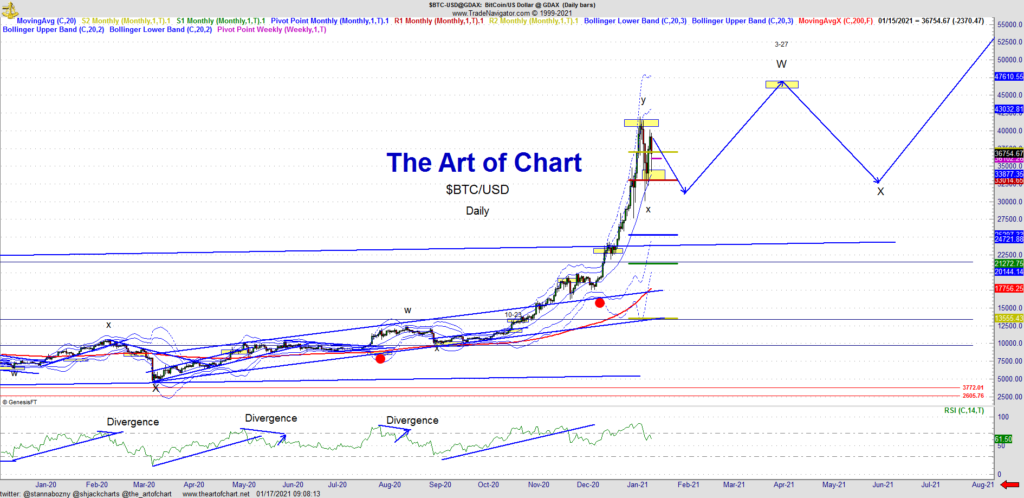

BTCUSD — BTC has pulled back as expected last week and came very close to target 29250. The retrace may be over. Look for a retest of the low this week and more upside. We are concluding the first major wave up on BTC, likely 45000 by March 27th. Major degree wave Y is still to come, more upside to come in BTC.

ETHUSD – Pull back as discussed and possible conclusion of wave X – low retest this week and look for support and next step up into March 18th and 1500. A three back is a long and higher highs expected.

LTCUSD – Wave Y has completed and wave X retrace over threw target and is likely complete. Look for a retest of the low this week and higher highs into the 3-18 window and 220. Expecting More upside on LTC and Cryptos

Crypto’s have pulled back and a low retest is needed across BTC, LTC and ETH. These pair will continue their bullish run as the USD continue to fall throughout the year. Likely this week we see a three back and the next step higher. More upside is expected into the March high window. I remain bullish Crypto’s. Trade Smart and Trade Safe.

17th Jan 2021

17th Jan 2021