I plan to cover just three cryptos every week in this post: Bitcoin, Litecoin, and Ethereum. These instruments provide trading opportunities with out sized gains. I hope the analysis presented here helps you profit in these instruments.

BTCUSD — So far no joy on the retracement on Cryptos. I am still holding onto the interpretation that this is a larger retracement pattern and as long as the lower high holds, we should see a 5 down to complete this pattern. This week the bears need to step up and move this market. Bollies are compressing here, an expansion is coming.

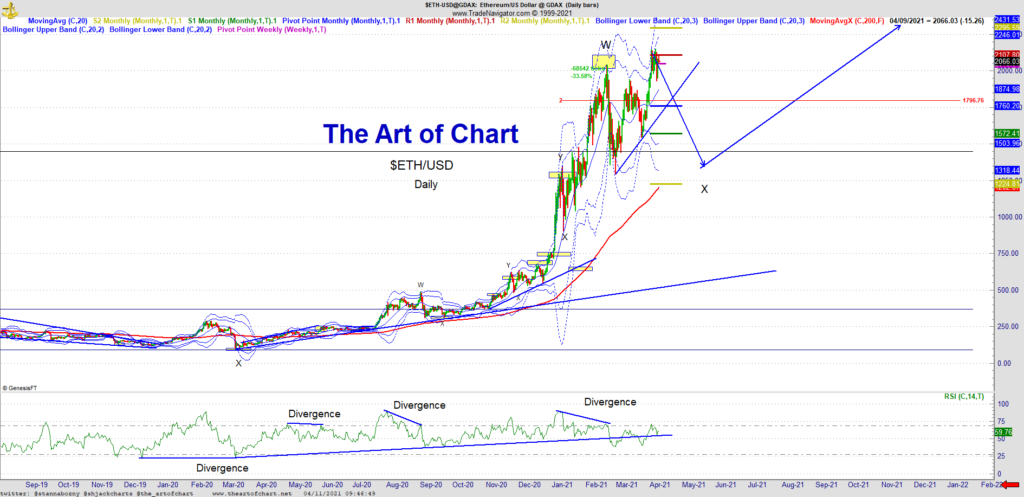

ETHUSD – We now have the same flag pattern across all Cryptos which is an expanded flat. As mentioned above, looking for bears to step up this week and push this market lower, Monthly Pivot at 1760 is first potential support and we can easily see the 2nd or 3rd lower SD band which would be the ideal area to buy.

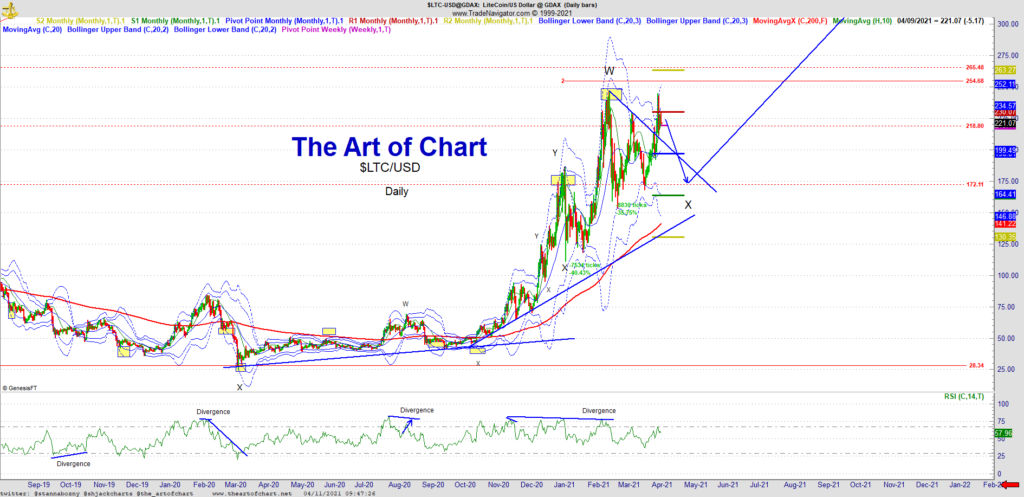

LTCUSD – Trend line resistance here is broken and we now have the same pattern across all three Cryptos. Possible flat here and a 5 down from here could form a running flat. Looking for a buy below the 2nd low SD Bollinger Band and the next major legg higher.

Across all three Cryptos we now have a possible B wave for a three up. A flat would then form a 5 down and a buyable low. Looking this week for this price action to commence and the bears must perform here. The lower high in BTC needs to hold to maintain integrity around the structure. Looking for wave C acros All three instruments. I am expecting the next big advance after the low retest occurs. These pairs will continue their bullish run as the USD continues to fall throughout the year. I remain bullish Crypto’s. Trade Smart and Trade Safe.

11th Apr 2021

11th Apr 2021