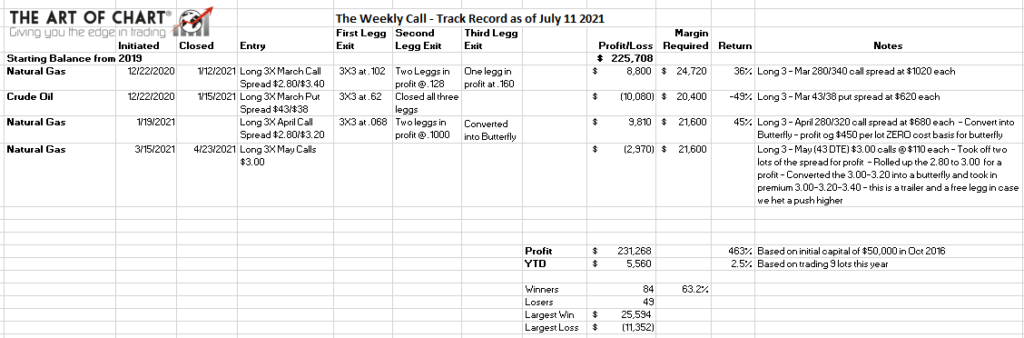

The Weekly Call provides perspective on high-quality setups and trading strategies focused in the Commodity world. My current performance shows a 463% return since October 2016. The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach.

Happy New Year and all the best for 2022!! Wishing you and yours a healthy and prosperous 2022. Omicron record infections in the US but with much lower hospitalizations, could have an impact on the equity markets depending on the economic numbers for December. December non-farm payrolls report may present no significant changes which in turn would pressure the Fed into interest rate hikes. South American weather has inflated Corn and Soybean prices. The critical week for crops in that region is January. Southern Brazil and Argentina have the lowest precipitation for December. The USDA report this month should show some impact on lower yields in these tight markets. Watching other markets: Still expecting Coffee to make 180 into February, have added a long in Natural Gas, a FEB 390/550 call spread looking for a pop, my outlook is $7 into May. Weakness in equities in the first half of 2022 is expected.

All trades are posted on our Private Twitter Feed for subscribers and are in the track record which is posted below under Completed Trades below. I have modified the track record to reflect 9 lot trades using the information in this Blog assuming $25,000 per lot as the current portfolio is over $225,000. See some of my completed trade videos below.

The Weekly Call can now be auto-traded on Striker.com. Just call Striker Securities and open an account of at least $25,000 and every trade I make here will be made for you automatically there. I am planning to use the same methodology and risk management approach with the auto-traded account at Striker that I have been using here. If you have a Daily Update or Trader Triple Play membership, there is no subscription fee for the auto-traded account at Striker. For more information, call Striker.com and speak with William at (800) 669-8838. For more information, you can also watch this video from our subscriber Q&A HERE.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Sugar

5-23 – Expecting the next rally starting this week as we are close to the 16.50 target and looking for $19 next. So far so good, looking for the next rally in Sugar.

5-20 – Rally as expected Sugar and looking for continuation higher this week and next stop is $19. The current low needs to hold.

6-6 – So far so good on the rally. Small three down in progress and looking for the next major step higher into $19. Look for support at 17.20.

6-13 – No change in forecast, bullish lean into $19 and 17.20 is support – consolidation and a correction in time instead of price, this can break up directly.

6-20 – The retest helped last week by the USD rally and the Fed meeting, made the 17.20 retest target and formed a 5 down for a wave C. Look for channel resistance to break up and target remains at $19.

6-27 – SB has confirmed the turn and is now headed into the $19 area next. We can see 20-21 by November. A continued devaluation of the USD willl help.

7-4 – SB rally continues and resistance trend line broken as expected. Looking for the $19 target next. Expect a retest of the broken trend line and higher.

7-11 – Retest of the broken trend line as expected. Now this week we need a turn and go to $19 next. Watching for a Positive D setup on RSI.

7-18 – Turned as expected and through the resistance trend line. Watch for a small back test of the broken trend line and then follow through into new highs. and $19.

7-25 – Higher highs expected in Sugar and $19 is next resistance. Sugar is through the resistance trend line and higher highs are expected. Looking for $21 into November.

8-1 – So far so good on the Sugar rally, $19 is still expected then $21 into November. Looking for continuation higher with monthly pivot as support.

8-8 – $19 target should be seen this week and once we retest look for higher into $21. Negative D on RSI is setting up so expected a pull back this week to the support trend line once we make $19.

8-15 – Third wave printing and a pull back and higher expected into $21. The $19 target was made and higher higher into November are expected.

8-22 – Wave 4 has started as expected and watch for a full three back into $19 then higher highs and $21 into the November window. Performing well.

8-29 – So far so good with the pull back and higher highs are still coming. Can still see $19 next and then higher highs into $21.

9-5 – Watch this week for a retracement to start as SB is topping out. $19 target has been achieved and $21 is next once the retracement is complete.

9-12 – Retracement has played out as expected and looking for a reversal this week and a move to begin into $21. A minor legg lower is likely into 18.30-50. Expecting a reversal later this week from that area.

9-19 – Flag has been broken to the upside as expected and looking next for the $21 target. This legg should be choppy and will be somewhat dependent on the USD dropping.

9-26 – Consolidation should break up and looking for Sugar to make target at $21. A USD drop here will help Sugar.

10-3 – Sugar is in the last legg into $21, it may make it before the November cycle date. New highs coming and should see $21-21.50 as forecasted.

10-10 and 10-17 – No change in forecast, all is going well, continuation higher expected into target $21-21.50.

10-24 – A broken trend line and a full three back with support in a channel. Expecting the channel to break up and see the $21 target. This should be the last advance for Sugar this year.

10-31 – Three back completed and still expecting $21 target. Commercials are aligned for a last rally. Looking for more upside this week.

11-7 – More upside should continue this week. Look for the flag resistance trendline to break and higher highs to $21-21.50 to finish the pattern.

11-14 – Against the upper channel trend line and the flag is about t break up. Looking for a higher high into 21.50 this week then a retest and higher highs.

11-21 – A break up from the flag channel and higher highs expected into 21.50. Pull back to previous support and higher into 2022.

11-28 – Holiday tape and a three back flag on Sugar, looking for the flag to break higher and still expecting target at 21.50. Possible triangle here.

12-5 – Trend line support and looking for the Monthly pivot to break up. Likely target is 21.50 and being patient and waiting. DX should drop this week which will help.

12-12 and 19 – The turn is in in Sugar and next stop is 21.50. The resistance trend line should break up and looking for this last legg to finish by January.

12-26 – Retesting the trend line resistance. Look for the resistance trend line next at 20.50 and 21.50 as target.

1-2 – Sugar printing a mall flag that should break up. Target remains the same at 21.50.

Coffee

5-9 – Coffee has made target and now expect a decent retracement back to monthly pivot. Should see 138-140 as the last advance was very USD driven. Likely we see the retrace start this week.

5-16 – As mentioned last week, a decent retracement in progress ad look for a turn for wave B then lower lows for wave C. Previous degree wave 4 is 140 or so, once seem we should have RSI setup for a long. Looking for the next long entry here.

5-23 – Retracement is still incomplete as we have a wave B which should yield a wave C lower into 140. Higher highs expected into 170 once the pull back is complete.

5-30 – Coffee is extended here and the retrace is still incomplete. This week look for a conversion of 157.65, a break of the support trend line and lower into 143-144. Once seen buy Coffee as $170 is still target.

6-6 – The reversal is in and now looking for the rest of the structure lower. Trend line should break and looking for a print in the 145 area. Lower high expected to hold.

6-13 – Consolidation here also and look lower into 152 at a minimum and likely 146-67, Legg C is about to unfold.

6-20 – Legg C unfolding as discussed, and near target. Can make a marginal lower low to set up positive D. Likely we see a reversal this week. $170 is the next upside target.

6-27 – A break up in Coffee this week and as discussed looking for a $170 price target. Watch for a back test of the broken resistance trend line.

7-4 – Retest and look complete as a three back almost retesting the broken trend line resistance. Rally this week expected and higher into 170.

7-11 – Retest almost complete and deeper than expected, may see another legg lower to finish the pattern. Still looking for $170 next.

7-18 – A possible break up here, watch for a retest this week and then higher highs. It is possible to still see lower lows if we convert 155. If 155 is support, look for a move higher directly.

7-25 – Nice squeeze on Coffee and we have made the 210 target previously forecast into November. Weather issues causing crop and transportation issues in Brazil. The structure should see a higher high after we see the gap turn into support at 179.

8-1 – At support as discussed last week. We can see a bounce and lower low for a long setup. The higher should get retested then look for a lower low. While we have already made the 210 November target, higher highs are still expected into November.

8-8 – A lower low here and we have a nice setup for a legg higher. Again, looking for a retest of the high and a consolidation then another rally into November to new highs. Should see 205 on the next rally.

8-15 – Coffee on the way to retest the high. We should see a consolidation into September then higher into November. We have already made the $210 target for November so likely the higher high will be minor in November, look for 230.

8-22 – Coffee consolidating as expected from the weather based squeeze. This consolidation should continue between 205 and 170 until the end of September then look for higher highs into November.

8-29 – Coffee rally as expected and this is still a consolidation between 205 and 170, range trade here likely. Look into end of September for the next major rally into November.

9-5 – The retracement may have started and we can still see a higher high before we see 175. Look for the consolidation to continue as discussed into late September.

9-12 – A channel has formed and we should see prices continue to consolidate between 200 and 175. Look for a $175 print later this month and higher highs are still expected into November.

9-19 – The channel may see a last leg lower and of seen with a positive D setup, look higher as Coffee should make a new high by the end of the year.

9-26 – A break up out of the channel could be the beginning of the next rally. First a retest of either the low or the declining resistance trend line is needed first. Once seen then look long.

10-3 – Flag may be breaking up and the retrace that was expected was shallow. Monthly pivot is now support and expecting the next legg up to new highs by November 1st. Should be the high for the year for Coffee.

10-10 – A classic pattern – flag breaking up, backtesting the channel trend line and rally expected into $230 into early November. This will be the completion of a major degree impulse.

10-17 – Another small flag which should break up this week as we head higher into target at $230. First week of November likely the high for the year.

10-24 – The small flag has not broken up yet but is expected to. Look for higher prices this week and next week the $230 target.

10-31 – Trend line support and higher highs expected into $230. Coffee should be making the high for the year in November.

11-7 – KC consolidating and expecting trend line support and the next legg higher. Higher high puts in a short term top. Looking for $230.

11-14 – Flag has broken up so expecting target this week at 230. Looking for a counter trend move into the 180 area then higher highs. The high for the year should be in this week.

11-21 – KC is topping out and setting up a reversal into 180 into February. This should be the high for the year for Coffee.

11-28 – Coffee still strong and now a 5 up and negative D on RSI , expecting a pull back into February and 180.

12-5 – Coffee retesting the high and a reversal should complete this week. A good rejection from the high is a sign, lower next into February and 180 is target.

12-12 and 19 – The turn for Coffee is in, we have found the neckline area as support and a retest of the broken trend line resistance is likely next.

12-26 – Trend line converted and now expecting monthly pivot next. The declining resistance trend line should hold on the retest.

1-2 – Lower lows still expected on Coffee, 210 is next then 190. Looking for a February low.

Live Cattle

7-25 – Live Cattle has a bull flag that is about to break up – once seen that confirms the 132-34 area as next target. Look for monthly pivot to hold as support.

8-1 – Bull flag now broken and being back tested which is a bullish sign. Looking for support at Monthly Pivot and higher highs into 8-11.

8-8 – Back test of the bull flag appears complete, I am looking this week for continuation higher and eventually the 134 area as target. Bulls need to perform this week.

8-15 – Live Cattle compressed and looking for the expansion this week and higher highs into the 8-24 window. $134 is still the target.

8-22 – Live Cattle very compressed and an expansion move is brewing with a lean higher. Direction is still long and we may be late with the 8-24 window. Daily Chart also very compressed, looking for the expansion move this week.

8-29 – Hit target and cycle date with the squeeze from last week and now watching for the trend line as support. Once seen, the lean is still long into 138 next.

9-5 – Retracement is underway and looking for a move back into 130 as support and then higher highs into 138.

9-12 – Live Cattle has retraced more than expected and has formed a channel. The low here must hold and expected a run into 130 this week with a pull back to confirm the low and higher highs into the end of October. The USD has helped with this retrace, but when USD turns, look higher here into 138 as next target.

9-19 – Cattle as possibly turned and looking for a rally this week. Convert 130 and we should see the next bullish impulse confirm into late October and the 136 area.

9-26 – Consolidation in Live Cattle is expected to break up. Convert 130 confirms the move and higher into late October is expected.

10-3 – On the wrong side of Live Cattle as I expected the consolidation to break up, it broke down. Live Cattle is cheap at these prices and in an inflationary environment I am still expecting the lower low to set up with Positive D on RSI and go higher.

10-10 – Oversold and a rally as expected and looking for the higher around the 20th then pull back and higher into February next year. As inflation rises we should see cattle prices rise also.

10-17 – Breaking up and Live Cattle is heading into the November high window and 135 target. Continuation higher expected.

10-24 – Monthly pivot support and higher highs expected with target at 134. Watching this week with interest as the monthly pivot must hold here as support.

10-31 – Important trend line support test occurring now, this is a must hold and higher highs expected. Target is still 134, looking for a turn Monday.

11-7 -Expansion to the upside and now past the cycle date and waiting for target at $134 this week. Should see weekly pivot and then the next legg higher.

11-14 – Chop and a press higher to target completes the first legg higher. Retest and higher highs into 140 expected. This instrument should track with inflation.

11-21 – LE – new highs and negative D setup on RSI, we may still see higher highs into 139 – looking for a retest of the last support and higher highs into 142 next.

11-28 – Live Cattle has made target and now expecting a pull back into 137 then higher highs expected. Inflation should power this commodity higher.

12-5 – Needs a wave C lower to complete the flag patterns. Expecting higher highs next into 144 and higher into 2022.

12-12 and 19 – Live Cattle is completing wave C and likely will break higher into 144 next. Support is a little lower at 136.50.

12-26 – Live Cattle retested the low at 136.50 as discussed, looking for the rally from here. Convert the broken trend line and higher highs should ensue.

1-2 – No change in forecast. Three back and expecting the next rally into 144. Monthly pivot is expected as support.

Gold

5-9 – Payroll numbers Friday were much weaker than expected which resulted in the USD dropping and GC had a nice rally. We have made the 1850 target as discussed. Next step is a retrace and then a break and conversion of the declining resistance trend line.

5-16 – Gold is now against the 1850 trend line and I am looking for it to convert. We may first see the support tend like at about 1800 before seeing 1850 break. This is another chance to accumulate Gold for the next rally higher as the USD continues it’s devaluation lower.

5-23 – A pull back is still expected on Gold, nothing significant here in terms of a pull back and needs a rest on RSI before the next major step higher occurs. Look for a support test at 50 or 35 this week and higher highs into 1900 next.

5-30 – A small push expected and a long over due pull back into 50. Still bullish Gold and expecting higher highs into 1930 next.

6-6 – Last week we saw DX head higher which cause the retrace into the 50 area. From here DX should drop to new lows and 1930 is next. Current support is 1835, expecting a rally this week.

6-13 – Consolidation last week and should continue in a trading range between 1930 1864. Lean is 1930 next – retest – then higher highs.

6-20 – FOMC and the USD news reaction has pressed Gold lower than expected. We have broken the flag and the trading range as mentioned last week. This a news reaction so price action and the dominate trend is expected to play out next. We can see resistance at the 150 DMA and lower lows, while this is possible, watch DX for clues, as we can break up directly. Fundamental trend is still intact and I am still bullish Metals and Gold.

6-27 – A consolidation last week and also on DX. I am still expecting a move higher into July 20th. 1830 is current resistance and also where the 150 DMA is located. I am expecting a test there and we can still see lower prices to complete this retest. Overall still bullish metals and Gold.

7-4 – A pop in gold is expected into the 1820-30 area and a retest of the 150 DMA. If we convert it, we see higher directly. USD needs to drop which it is set up to do so this week. An important decision on DX at $91 and Gold in the 1820-30 area will decide if we see wave C lower to 1700 on Gold.

7-11 – Close to the 1820 area and we have turned a little early. Broken trend line support being retested. Either we see 20-30 or we see 90 as support and high. If 90 fails we can se a deeper move into 1710 so mind your stops here.

7-18 – Gold in a pull back and watch 90 as support. If it holds we head higher directly. If we convert 90, then a retest of the low should take place. Overall still bullish Gold.

7-25 – Three down flag is holding 1790 and if it continued to hold, look for a higher high to come later this week. DX may see 93.50 or can turn directly lower. USD devaluation should continue.

8-1 – Nice rally and broken resistance trend line, looking for monthly pivot as support. DX has dropped and should continue to do so. Looking for a high around 8-3 and a retest expected before the next major impulsive wave begins.

8-8 – Friday’s Payroll numbers surprised to the upside and metals were impacted which is a temporary pull back. We will likely see a marginal lower low into 1734 and perhaps strong support at 1720. This is a buying opportunity as the USD is currently at resistance and I am expecting another legg lower on DX which means a rally here on GC. Watch for positive D on RSI here on Gold.

8-15 – Gold has converted the 1770 area and is testing resistance at 81. The USD is getting ready to retest the high so watch Gold for support at 1760, if this holds then the turn is in on Gold. If it breaks we likely see a retest of the low and a USD higher high. Decision early this week.

8-22 – Gold is testing support and the 1760-70 area must hold to see higher highs directly. USD is close to making a high and I am expecting a USD turn this week which means higher GC. I like miners long here.

8-29 – Gold testing and possibly will convert the declining resistance trend line this week and if seen, look for a solid rally into January as DX should continue lower.

9-5 – Declining resistance trend line converted as expected and now likely the first 5 up is done as a first impulse. Look for a retracement back into the 1800 area ad the broken trend line.

9-12 – Back test in Gold is close to complete, we can see a retest of the current swing low and as far as the monthly pivot. DX has also retested and looking for DX to start the next legg lower which should power metals higher. This is a spot to accumulate metals.

9-19 – Another legg lower and DX has put in a flag, and GC a three down. Looking for a bullish confirmation this week above 1772. Watch DX as it should give clues given the flag that has just finished forming, if it breaks down, Gold will rally.

9-26 – Still looking for the flag to break up. Needs to convert 1780 this week to open higher highs. Next high window is in January so looking for the rally to begin. DX currently consolidating and forming a flag which should break down this week which will influence GC prices.

10-3 – The USD has broken the flag upward which opens a possible test of $96 and opens a low retest on Gold. Looking for $1680 as a support test as the USD continues higher. There is a chance we break higher directly but this is a lower odds play, Gold should correct with the USD.

10-10 – Waiting on the USD rally and gold is consolidating. Looking for a low retest before we see a major rally as the USD may rally into 95.50.

10-17 – Gold is likely going to see a pull back as DX rises, this week look for a retest of the low then higher highs in Gold. The long term trend is still higher.

10-24 – Gold still looking for a pull back and hit the 100% fib and the resistance trend line of a channel. Looking for a retrace that break the support channel trend line and results in 1745. The trend is up longer term, a chance to accumulate Gold.

10-31 – Gold breaking down and looking for an RSI of 30 and a target of 1765. The trend is still up in Gold and this sip represents a buying opportunity.

11-7 – Gold saw 1765 and has turned. USD still may rally so some weakness short term can occur but the retracement low is likely in. 1780 support and higher highs coming.

11-14 – Gold should see a pull back this week and a higher high. The flag has broken as mentioned last week so higher highs thru Feb are expected.

11-21 – Retest as expected and almost at target. 1835 expected and if support then higher highs into February and 2100 are likely.

11-28 – Retesting the low and a buying opportunity this week with Gold. The USD make have dropped which means that metals could see a reversal and rally this week.

12-5 – Gold at a critical junction here and we either see the drop in the USD this week and a turn in Gold or we see a full retest of the low at 1725. Either way bigger picture Gold is still bullish.

12-12 and 19 – Higher low and a conversion of 1800 and the turn for Gold is in. Higher than expected inflation on the CPI confirms the bullish bias on Gold into next year.

12-26 – Conversion of 1800 may be in progress. This week tends to be bullish for gold so a conversion of 1800 and we open 1855 next. If we cannot hold the retest and convert 1800 we can still see 1725.

1-2 – GC has converted 1800, looking for the trend line at 1855 next. DX has broken the middle band and must stay below middle to support metals to continue to climb short term.

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog. I am currently using 9 lots for the Striker trades which is based on this account being over $225,000. Each lot for auto trading at Striker requires $25,000 per lot. See the videos below for more information.

Track Record January 2020 thru December 2020 Click Here.

Track Record January 2019 thru December 2019 Click Here.

Track Record January 2018 thru December 2018 Click Here.

Track Record October 2016 – December 2017 Click Here.

*** Trading futures contracts and futures options involves substantial risk of loss, and may not be appropriate for all investors. By reading this web site, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced on this web site and associated documents and emails are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas; we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

02nd Jan 2022

02nd Jan 2022