In my last post on Tuesday I was talking about ideally seeing a higher high on this rally to set up divergence and we have since seen that on SPX, NDX and IWM. That has set possible daily RSI 5 and hourly RSI 14 sell signals brewing on SPX and brought SPX closer to the ideal IHS area at the June high at 4177.

The distance from the SPX 45dma reached a nosebleed level at 6.19% though that doesn’t mean as much after a strong bear move. Still a very good place to be looking for a retracement though.

SPX daily 45dma chart:

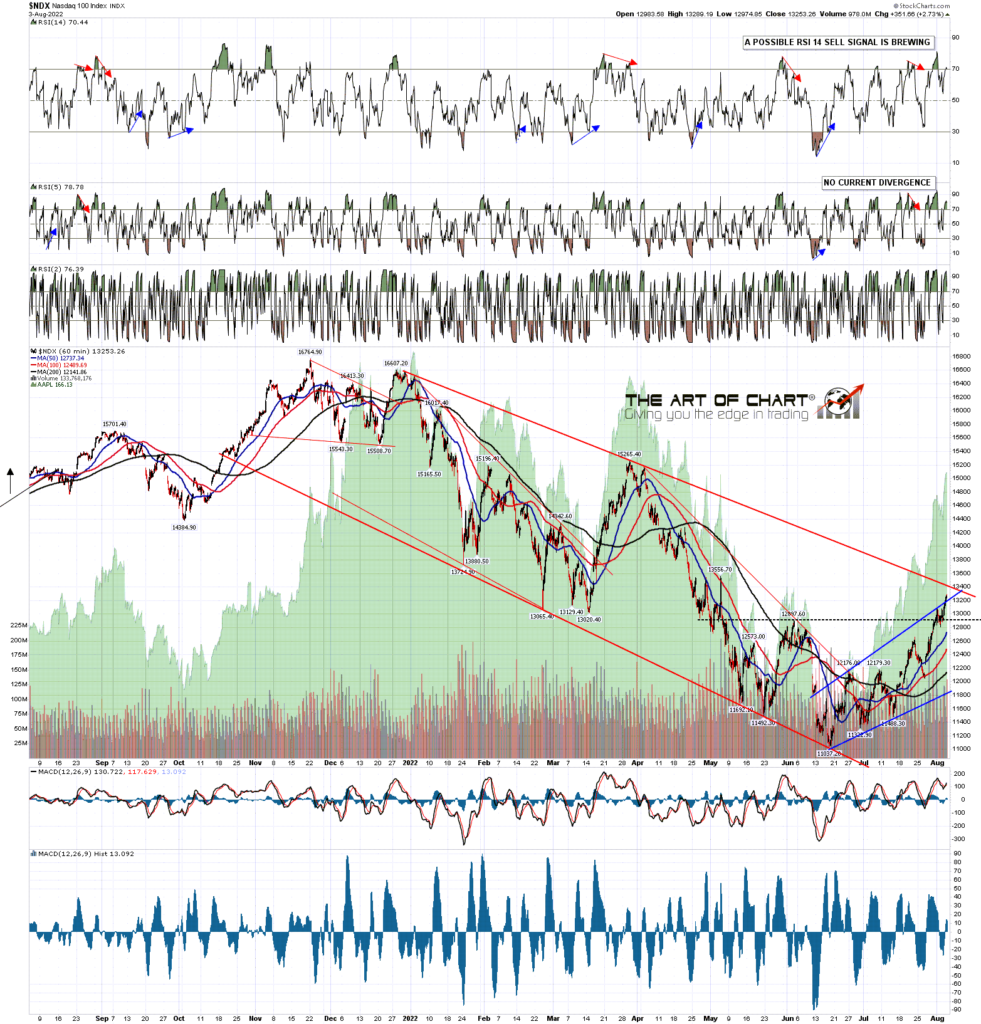

NDX has gone over the short term trendline resistance and may be reaching for the main bull flag megaphone resistance trendline now in the 13400 area. I would prefer not to see a perfect touch of the trendline here, as that would suggest that there might be a move coming next to take NDX down to that megaphone support currently in the 10250 area.

NDX 60min chart:

The obvious inflection point has set up here at the obvious resistance area. Do the equity indices have to turn down here? No, as that isn’t the way things work in this universe, but the prospects for at least a significant retracement from this area look good. We’ll see how that goes.

The historical stats are neutral leaning slightly bullish until mid August, but I’m actively looking for at least short term highs here or slightly higher. Those highs could deliver retests of the 2022 lows. I’m wondering about just a little higher on Dow particularly before a turn just to complete that rally high retest and set up negative divergence there.

I was saying back in June that a difficulty for bulls here was the grim economic backdrop and that remains the case. I have doubts as to whether the bull flag setups that have formed on the US indices so far in 2022 can make target in this environment but I’ve seen a lot of crazy things happen on the markets over the last twenty years, and predicted at least some of those. Retests of the all time highs remain on the table as a possibility here, and the prospects for seeing those from a TA perspective have only improved over the last few weeks.

We are doing our monthly free public Chart Chat at theartofchart.net at 4pm EDT next Sunday 7th August. If you’d like to attend you can register for that here or on our August Free Webinars page. It should be interesting. Be there or be unaware! 🙂

Everyone have a great weekend and my next post will likely be on Tuesday before the open.

04th Aug 2022

04th Aug 2022