Welcome to this week’s Crypto Market Weekly Outlook, post #344, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto market.

Bitcoin (BTCUSD):

Bitcoin has maintained its resilience, closing at $59,112 on Friday. Despite ongoing regulatory challenges and economic uncertainties, Bitcoin’s market dominance remains strong, with consistent support above the $54,000 level. We are closely monitoring key resistance levels at 66,787 and 68,000. Breaking through these levels could pave the way for a potential rally towards $86,500 and beyond. The market’s focus this week will likely be on how Bitcoin responds to macroeconomic data and regulatory news, particularly any updates on the U.S. Federal Reserve’s stance following recent inflation data.

Ethereum (ETHUSD):

Ethereum closed the week at $2,525, showing stability but also facing the same cautious sentiment that is affecting the broader crypto market. The network’s robust activity, particularly in decentralized finance (DeFi) and non-fungible tokens (NFTs), continues to support its price, even as broader market sentiment remains cautious. The upcoming developments in Ethereum’s ecosystem, especially related to layer-2 solutions like Optimism and Arbitrum, could provide the necessary catalyst for Ethereum to break above the $3,139 resistance level, potentially setting up a rally towards $4,600.

Regulatory Landscape and Market Sentiment

Regulation continues to be a significant focus for the crypto market. The U.S. Securities and Exchange Commission (SEC) has delayed its decision on various spot Bitcoin ETF applications, creating uncertainty but also keeping the market in a state of anticipation. This delay has somewhat dampened the bullish momentum, but many market participants remain optimistic about future approvals, which could trigger a wave of institutional investment.

Global regulatory discussions, particularly those emerging from the G20, are also being closely monitored. Any consensus on crypto regulation at this level could have widespread implications for the market, affecting everything from trading volumes to long-term investment strategies.

Blockchain Ecosystem Developments

The blockchain ecosystem continues to evolve, with Ethereum’s layer-2 solutions gaining traction due to their ability to offer lower transaction costs and faster processing times. These advancements are essential for scaling the Ethereum network and maintaining its dominance in the DeFi and NFT sectors.

Solana remains a formidable player in the blockchain space. The network has expanded its developer base and enhanced its infrastructure, which could drive further adoption. However, Solana’s volatility continues to be a concern for traders, and caution is advised when navigating this market. If Solana breaks above the $180 level, it could target $200 and potentially retest its all-time high near $220.

Market Dynamics and Trading Volumes

Trading volumes have seen some fluctuations across both centralized and decentralized exchanges. Centralized exchanges have reported a slight increase in spot trading volumes, likely due to traders capitalizing on the recent market stability. Decentralized exchanges, however, continue to gain ground, particularly with the ongoing popularity of meme coins and new projects that often debut on these platforms.

The crypto derivatives market remains active, with an increase in open interest in Bitcoin futures and options. This indicates that traders are positioning themselves for potential future price movements, either to hedge against risks or to speculate on price directions.

What to Watch This Week

As we move into the new week, several key factors could influence the crypto market:

- Economic Data Releases: The latest U.S. CPI data released last week showed higher-than-expected inflation, which could impact investor sentiment and risk appetite. Keep an eye on how the market reacts to any follow-up data releases.

- Regulatory News: Updates on the SEC’s stance on crypto ETFs and any global regulatory developments will be crucial in shaping market sentiment.

- Technological Developments: Watch for any significant updates or launches in the blockchain space, particularly related to Ethereum’s layer-2 solutions or Solana’s ecosystem, which could drive price action.

The crypto market remains in a state of cautious optimism, with the potential for both upward momentum and downside risks. Traders should stay informed and be prepared to adapt to the rapidly changing market environment.

BTCUSD (Bitcoin)

Outlook: The market sentiment remains cautiously optimistic, with potential catalysts including further institutional adoption and favorable regulatory decisions, particularly around the approval of Bitcoin ETFs. However, if Bitcoin fails to break above these resistance levels, it could retest support around $49,000, with the possibility of dipping lower if broader market conditions worsen.

ETHUSD (Ethereum)

Outlook: Ethereum is facing a critical resistance level at $2,836. Breaking through this could pave the way for a rally towards $4,600. However, this is contingent on several factors, including the successful implementation of its layer-2 solutions and broader market conditions. The potential approval of an Ethereum spot ETF is another factor that could significantly influence price movements, though it could also lead to short-term volatility as the market reacts to any regulatory updates.

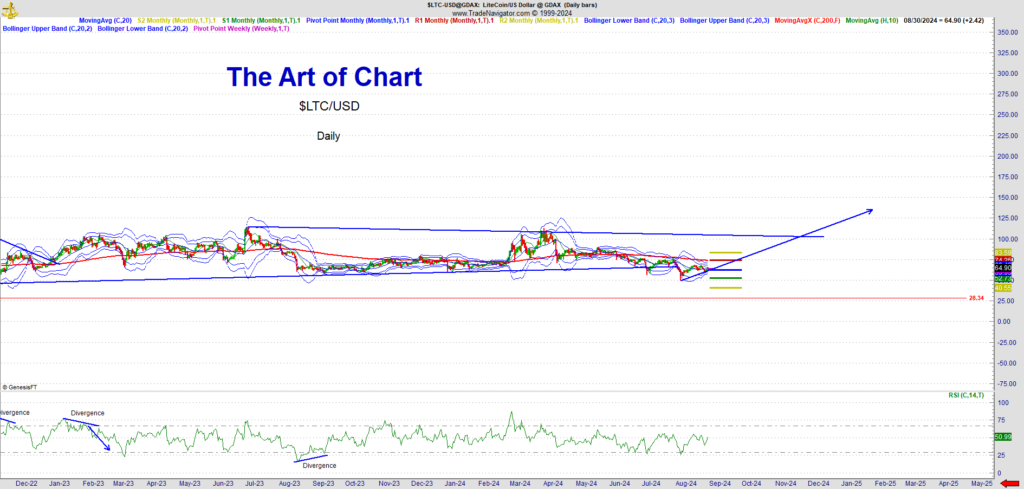

LTCUSD (Litecoin)

Outlook: Litecoin is facing resistance at $73, and a breakout could see it move towards $80 and beyond. The broader market conditions will play a significant role in determining Litecoin’s trajectory, but its relative stability makes it a solid option for long-term holders, especially those looking for consistent performance in a turbulent market.

SOLUSD (Solana):

Solana has been trading around $130, showing signs of stabilization after a period of volatility. The network continues to gain traction, particularly among developers, due to its high transaction speed and low costs, which are critical for the growth of DeFi and NFTs on its platform.

Outlook: Solana is facing resistance at $180. If Solana can break through this level, it could target $200, with the potential to retest its all-time high around $220 if market conditions remain favorable. The key to Solana’s continued success lies in its ability to maintain network stability and scalability, which will be crucial as adoption increases. Traders should be cautious, however, as Solana’s price action has been more volatile compared to Bitcoin and Ethereum, making it susceptible to sharp moves in either direction.

Stay tuned for more updates, and as always, Trade Smart and Trade Safe.

Exploring Advanced Blockchain Investments

This week is the second focus article is on Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns. Here’s an overview of some of the key investment vehicles available today, including vaults, lending coins, yield farming, and more. We’re also excited to announce the upcoming launch of our Crypto Service, designed to help subscribers gain access to these advanced strategies.

1. Staking

Staking is a process where cryptocurrency holders “lock up” their coins to support the operations of a blockchain network. In return, they receive rewards in the form of additional tokens. Staking is commonly associated with Proof-of-Stake (PoS) blockchains like Ethereum 2.0, Cardano, and Polkadot. It provides a way to earn passive income while contributing to the security and efficiency of the network.

- Expected Returns: Staking rewards can vary significantly depending on the network, typically ranging from 4-20% annually.

2. Decentralized Autonomous Organizations (DAOs)

DAOs are organizations run by smart contracts on a blockchain, where decisions are made collectively by the members without centralized control. Investors can buy governance tokens to participate in the decision-making process and potentially benefit from the success of the DAO’s projects. Examples include Uniswap (UNI) and MakerDAO (MKR).

- Expected Returns: Returns vary widely based on the performance of the DAO’s initiatives and the value of its governance tokens.

3. Tokenized Real Estate

Blockchain technology has enabled the fractional ownership of real estate through tokenization. Platforms like RealT and Propy allow investors to buy tokens representing a share of a property, earning rental income proportional to their investment. This approach democratizes real estate investment, making it accessible to a broader audience.

- Expected Returns: Returns typically come from rental income and potential property value appreciation, ranging from 3-10% annually.

4. Non-Fungible Tokens (NFTs)

NFTs are unique digital assets representing ownership of a specific item, such as art, collectibles, or virtual real estate. While NFTs are often associated with digital art, they have broader applications, including gaming and virtual worlds. Investors can buy and trade NFTs, with the potential for significant gains if the asset’s value increases.

- Expected Returns: NFT investments can be highly speculative, with returns ranging from 0% to several hundred percent depending on the asset’s popularity and rarity.

5. Liquidity Mining

Liquidity mining is a strategy where investors provide liquidity to decentralized exchanges (DEXs) in exchange for rewards, typically in the form of governance tokens. Platforms like Uniswap, SushiSwap, and Balancer offer liquidity mining programs that can yield high returns, especially when new tokens are launched.

- Expected Returns: Returns can be substantial, ranging from 10-100% annually, but are subject to market volatility and risks like impermanent loss.

6. Cross-Chain Bridges

As the blockchain ecosystem grows, the ability to move assets across different blockchains becomes crucial. Cross-chain bridges like RenVM and ThorChain facilitate these transfers, and investing in these protocols’ tokens can provide exposure to the growth of interoperability in the blockchain space.

- Expected Returns: Returns depend on the adoption and success of the bridge protocol, with potential for high growth as cross-chain interactions increase.

7. Yield Aggregators

Yield aggregators like Yearn.Finance automate the process of yield farming by pooling funds and optimizing the returns across multiple DeFi protocols. This approach simplifies the yield farming process for investors and can generate higher returns by continuously reallocating assets to the most profitable strategies.

- Expected Returns: Yield aggregators can offer returns from 5-50% or more, depending on the strategies employed and market conditions.

These advances investment strategies are easy to use if you are familiar with using wallets and the security procedures associated with wallets.

01st Sep 2024

01st Sep 2024